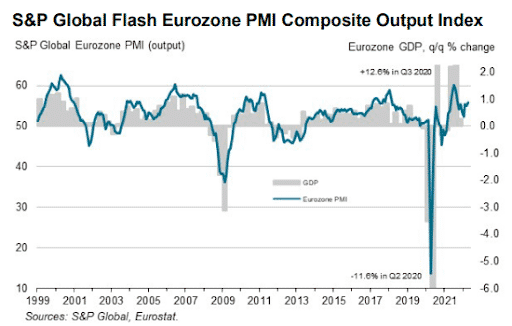

(S&P Global) The Composite Output Index, gauging growth in the Eurozone, reached an index of 55.8 in April, a seven-month high and higher than 54.9 in March.

Growth was mainly driven by the services sector, with the activity index reaching an eight-month high of 57.7 from 55.6 in March.

Manufacturing was a drag in the Eurozone growth, the output index falling to a 22-month low of 50.4, below 53.1 in March. The Manufacturing PMI went to a 15-month low of 55.3, from 56.5 in March.

Employment growth was at the fastest rate in five months, with firms’ hiring constrained by shortages of labor.

Backlogs continued to rise, although the rate was the smallest for nearly one-and-a-half years.

Ongoing supply chain bottlenecks led to higher lead times for the companies, with additional headwinds from the Ukrainian war and the lockdowns in China.

Orders for manufactured goods rose at the slowest pace since June 2020 as risk aversion engulfed the sector due to the Ukrainian war and soaring prices,

Input costs eased slightly, although the rise was the second-largest on record. Output charges rose at a record rate.

Business confidence remained subdued in the eurozone, with rising inflation, pandemic, and the Ukraine war weakening sentiment, especially in the manufacturing sector.

DAX is down by 1.89%, EURUSD is down by 0.26%