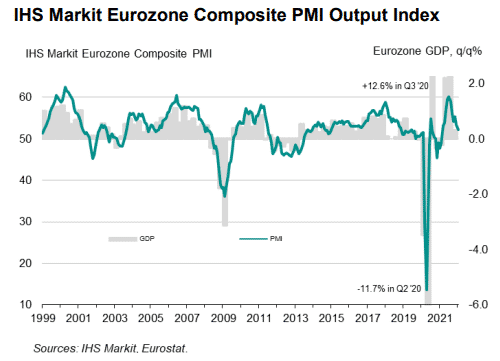

(IHS Markit) The Eurozone posted a Composite Output Index of 52.3, down from the December final reading of 53.3.

The slowdowns in economic activity reflected the outbreak of the Omicron variant. The service sector, the most hit, saw the activity index edge lower to 51.1 from the December reading of 53.1.

The manufacturing sector absorbed some slowdowns on services, with the output rising at the fastest rate since September.

Ireland posted an unchanged growth but had the highest composite PMI of 56.5. Germany came second, with a 4-month high growth of 53.8 index, down from a flash reading of 54.3.

Other major eurozone economies, France, Italy, and Spain, posted a loss of momentum, with the PMI at a 9-month low, 12-month low, and 11-month low, respectively. Spain held a contraction zone, with a PMI of 47.9.

Employment continued to post gains, with acceleration in January, holding above the historical averages. Backlogs remained robust despite easing to a nine-month low.

Eurozone price pressures escalated in January, with output charges rising to a series record among service firms. Input costs rose to the second-quickest on record.

Eurozone businesses still remain optimistic of 2022 fortunes, with the degree rising to the highest since October.

DAX is down -0.61%, EURUSD is down -0.81%.