- The positive outlook by leading financial institutions is a strong case for further gains.

- Ethereum’s efficiency and institutional adoption are likely to influence growth.

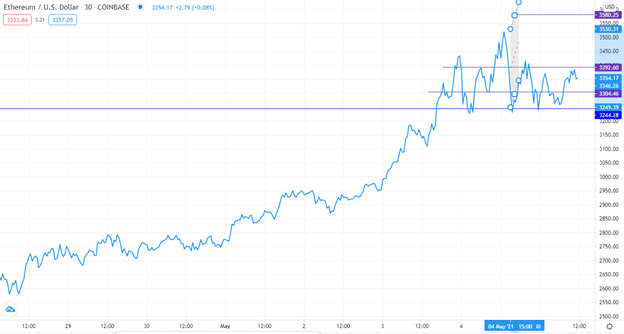

Ether was down 3.3% in 24 hours, trading at $3,357 at the time of writing. Ethereum’s rally looks far from over, with ATH becoming a weekly occurrence in recent times. A few hours earlier, Ether had set another all-time high after rising to $3,530 on Tuesday. Going by its current momentum and barring major sell-offs, May may have new ATHs in store for ETH.

Institutional interest in ETH is getting stronger

Investor confidence in Ethereum is quite high, and debate is now rife as to whether or not Ether prices will surpass BTC prices. JP Morgan issued a bullish view of ETH last week, stating that it was on track to outperform BTC and adding that Ether’s price will rise to $10,500 by the end of the year.

In a related development, the Federal Reserve Bank of St Louis has predicted that DeFi is likely to revolutionize the financial sector in a manner not seen before. Given the dominance of Ethereum in the smart contracts segment on which DeFi is built, this is a big boost to the outlook for Ethereum.

In a paper prepared by Dr. Fabian Schar for the bank, the only significant concerns by the bank are the incidents of insecurity that have often affected DeFi and continue to pose a threat to the platform. Importantly, however, the bank reports that such issues can be addressed. Such a flowery outlook from leading mainstream financial institutions warrants a bullish view of ETH.

Elsewhere, the Ethereum ecosystem has recently had a boost in its scalability. One of the largest cryptocurrency exchange platforms, OKEx has integrated the Arbitrum L2 solution into its operations. This will enable the platform’s users to deposit or withdraw Ethereum directly to its Layer 2, making it the first exchange platform to initiate such a development. Ultimately, the development will enhance efficiency by facilitating faster processing of transactions, reducing congestion and lowering fees. This is likely to increase the adoption of Ethereum.

Significant investments in Ether signifying a confident outlook

As far as adoption goes, Ethereum’s current positioning places it at a great pedestal for more acquisitions. This week, Mogo has revealed that it bought 146 ETH, currently worth about $500K last month.

The Canadian fintech company is seemingly keen on diversifying its balance sheet and benefitting from the upsurge in Ether prices. Coming from a company listed at the Nasdaq, this shows the inbuilt confidence in Ethereum’s price prospects. Stakes are relatively higher for listed companies because a slump in the value of acquired assets can adversely affect the stock prices of those companies.

In another significant outcome in the past week, another Nasdaq-listed corporation, WisdomTree Investments has listed an Ethereum Exchange Traded Product (ETP) on Germany’s Borse Xetra and Switzerland’s Six securities exchanges.

According to the company, the ETP will be physically backed. This will enable investors to trade in the price movements of Ether, without having to own the asset. This is certainly not the first time such an option is being launched for Ethereum, but it is a vote of confidence in Ethereum’s growth prospects.

Technical outlook

ETH/USD is likely to find the first support at $3,304, while the second support is likely to be established at $3,244. Upward momentum will bring the pair to encounter the first resistance at $3,392, while further gains may push prices to test the second resistance level at $3,580.