Limassol-headquartered EasyMarkets Group Limited operates as a market maker brokerage company. It allows its cluster of traders worldwide to access multiple asset classes with competitive spreads and fast order executions. They trade assets as CFDs, options, futures guided by the broker’s dedicated support team 24/5. In addition, EasyMarkets proves to provide legit services under a reputable regulation framework co-led by the CySEC and the ASIC.

Pros

- The minimum deposit is capped at $25 for the standard account traders.

- It does not charge deposit or withdrawal fees.

- It holds regulation licenses from recognized bodies such as the CySEC and ASIC.

- It holds clients’ funds in segregated accounts.

- It provides a negative balance protection mechanism.

- One-click trading, powerful trading tools and EAs.

Cons

- It fails to provide its services to clients from the USA and other countries under the same jurisdiction.

- High fixed spreads on some assets compared to other brokers.

- It is not regulated by a top-tier agency like the FCA.

- No social or copy trading.

- It does not offer the MT5 trading platform.

- No Autochartist.

EasyMarkets Group Limited started in 2001 to bridge financial trading services to everyone. The founders’ goal entailed democratizing trading to allow retail traders to access multiple markets as CFDs, options, and futures. With that vision in mind, EasyMarkets launched under the trademark “EasyForex” and capped the minimum deposit at $25. This made it easy for retail traders to join the broker.

Through time, EasyForex expanded, opening offices around the globe and diversifying its tradable assets. In 2016, the liquidity provider rebranded from EasyForex to EasyMarkets. It serves clients worldwide to provide simple, honest, and transparent trading services.

Its users speculate a wide range of markets with fixed competitive spreads, low latency, and leverage of up to 1:400. The broker also assures users to avoid losing more than invested with a negative balance protection mechanism. Moreover, it holds clients’ funds in segregated accounts. Thus, EasyMarket cannot use the money at any point.

Asset classes include:

- Forex

- Shares

- Crypto

- Metals

- Commodities

- Indices

The broker offers intuitive trading platforms to traders to exploit these asset classes’ tradable instruments. With onboarded innovative features, traders experience ultra-fast order executions with no slippage. The array of platforms includes its proprietary trading platform available on the mobile and web terminal and the MT4 trading platform.

Some of the integrated tools and features include:

- DealCancellation

- FreezeRate

- Stop loss

- Trading charts

- Financial calendar

- Informational tools for market news and live currency rates

The tools help EasyMarkets users make the best out of trading, but they must fund their specific account types before leveraging them to tap into the broker’s markets. It offers a variety of account types best tailored to favor a group of clients. Each trader selects a trading account type depending on their primary objective.

Thus, the accounts have different trading conditions, and as a result, the minimum deposit varies from one account to another. To use the standard account, market participants must fund any amount from $25 while VIPs accepted minimum deposit is capped at $10,000.

However, EasyMarkets levels the playing field for every trader by waiving all deposit and withdrawal fees. It also mitigates all account-related fees allowing clients to trade with zero commissions. In addition, it offers multiple payment options making it easy to transact from anywhere.

Regulation

With offices around the globe, EasyMarkets holds several licenses and registrations. They are as follows:

- EasyMarkets Group Ltd is registered and regulated by the CySEC (079/07).

- In Australia, the broker holds a regulatory license issued by the ASIC (246566).

- Regulated by the financial services of Seychelles (SD056).

- In the British Virgin Islands, it is regulated and authorized by the FSA of BVI (SIBA/L/20/1135).

Account Types

VIP account

- Platforms — Web/App and MT4

- Minimum transaction size — (x)$70 for Web/App and 0.01 lot for the MT4

- Minimum deposit — $10,000

- Max leverage — 1:200 for Web/App and 1:400 for the MT4

- Commission — 0

- Account fees — 0

- Deposit/withdrawal — 0

- Customer support — yes

- Personal Account Manager — yes

- 24/5 phone and lice chat — yes

- No slippage — only for Web/App

- Fixed spreads — only for Web/App and MT4

- Stop loss — only for Web/App

- Negative balance protection — only for Web/App and MT4

Premium account

- Platforms — Web/App and MT4

- Minimum transaction size — (x)$70 for Web/App and 0.01 lot for the MT4

- Minimum deposit — $2,000

- Max leverage — 1:200 for Web/App and 1:400 for the MT4

- Commission — 0

- Account fees — 0

- Deposit/withdrawal — 0

- Customer support — yes

- Personal Account Manager — yes

- 24/5 phone and lice chat — yes

- No slippage — only for Web/App

- Fixed spreads — only for Web/App and MT4

- Stop loss — only for Web/App

- Negative balance protection — only for Web/App and MT4

Standard account

- Platforms — Web/App and MT4

- Minimum transaction size — (x)$70 for Web/App and 0.01 lot for the MT4

- Minimum deposit — $25

- Max leverage — 1:200 on Web/App and 1:400 on the MT4

- Commission — 0

- Account fees — 0

- Deposit/withdrawal — 0

- Customer support — yes

- Personal Account Manager — yes

- 24/5 phone and lice chat — yes

- No slippage — only for Web/App

- Fixed spreads — only for Web/App and MT4

- Stop loss — only for Web/App

- Negative balance protection — only for Web/App and MT4

How to open an EasyMarkets account?

Step 1. Click the “sign up” button on their official website.

Step 2. Fill in your registration details.

Step 3. Verify email and other details.

Step 4. Fund the account.

Step 5. Start trading.

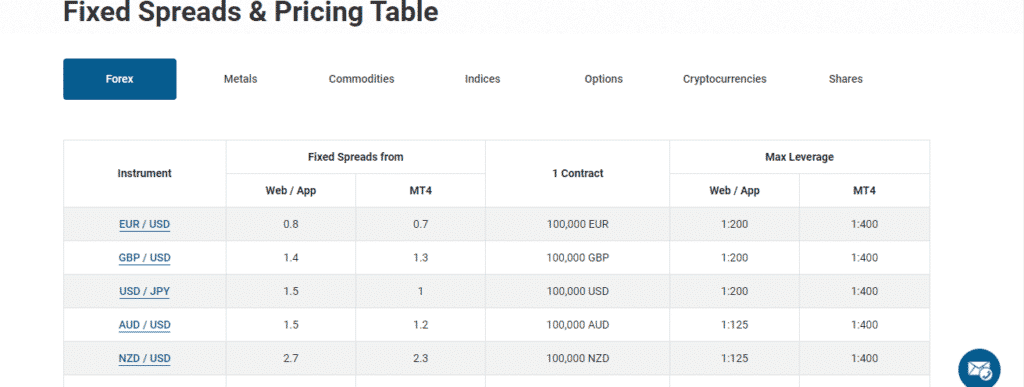

Fees and Commissions

EasyMarkets operates as a market maker. Thus, it charges fees on the spread. Clients do not incur commissions as indicated on the account types. However, the spreads are slightly higher than other brokers and depend on the asset the client trades.

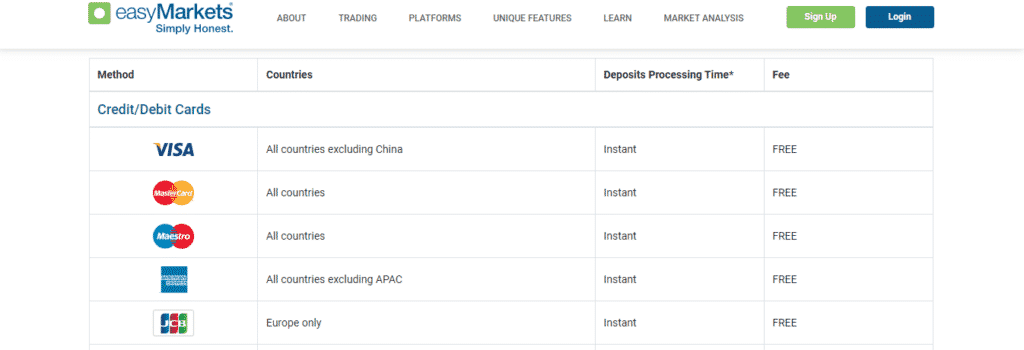

Payment options

The payment options include:

- Credit/debit cards

- Online banking

- E-wallets

- Bank wire transfers

With offices around the globe, the broker offers multiple payment options and waives all fees for its clients. The users choose either credit/debit cards, e-wallets, or bank wire transfers, depending on the method that suits them best.

Pros

- Deposit and withdrawal of funds are free

- Multiple payment options

Cons

- None

Deposit

EasyMarkets accepts deposits from these methods:

- Bank wire transfers

- Bank cards like Visa, MasterCard, Maestro

- Online banking platforms like SOFORT

- E-wallets like Neteller, Skrill, Perfect Money, and many more

Withdrawals

Deposit methods apply to withdrawals.

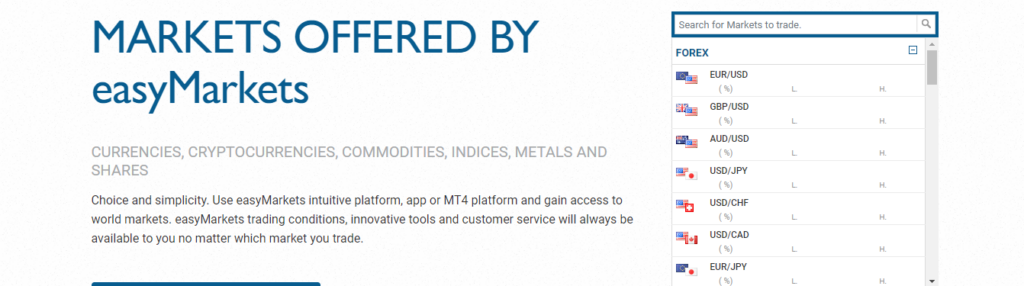

Available Markets

The broker offers a wide range of markets to its clients. They speculate the markets’ products with competitive spreads, fast executions, and leverage of up to 1:400. All markets trade as CFDs, Options, and futures. Therefore, users have the opportunity to diversify and trade in any direction when exploring CFDs.

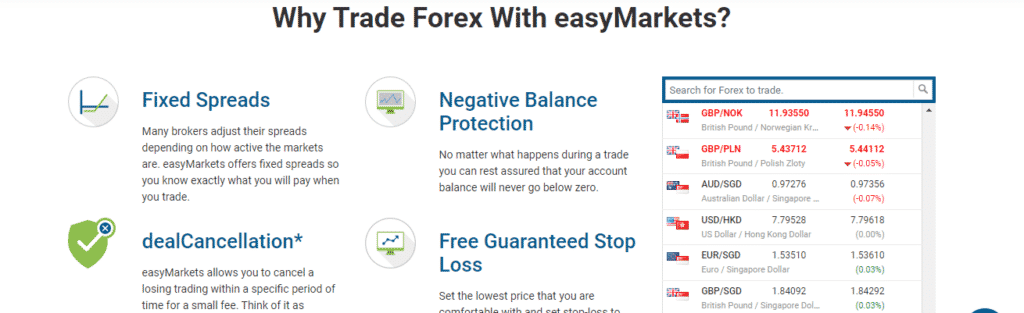

Forex

The broker supports multiple currency pairs involving significant crosses, minors, and many others. It trades 24/5 with fixed spreads negative balance protection, and traders avoid huge losses with a guaranteed stop loss. The pairs are quoted against nine base currencies.

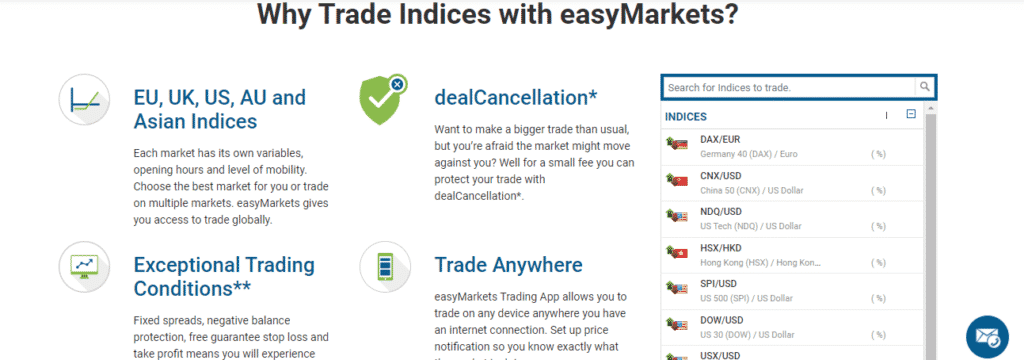

Indices

Dozens of the world’s popular stocks trade at EasyMarkets. They encompass markets such as the EU, UK, US, AU, and others. They trade with fast executions and competitive margins. However, the day each product trades differs per the asset. For example, US 500 opens on Sunday and closes on Friday while UK 100 only trades on weekdays.

Precious metals

Few of the world’s most valuable assets, gold and silver, trade as options at EasyMarkets. The products trade against major fiat currencies like USD, EUR, GBP, etc. This gives traders more choice, and they can trade irrespective of the market direction.

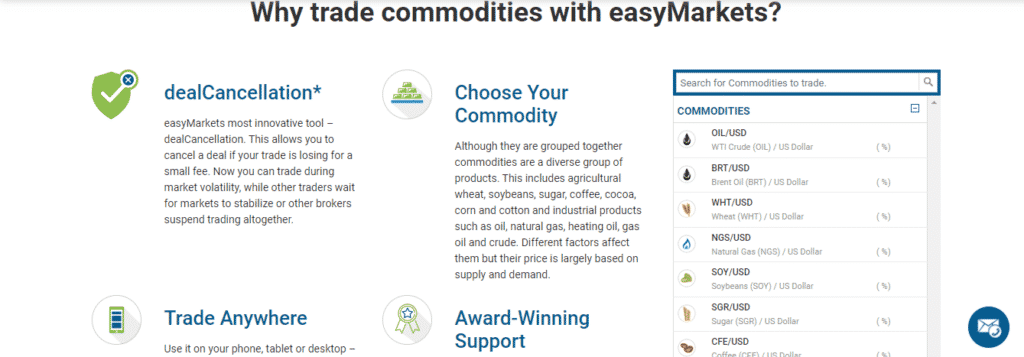

Commodities

The broker’s platform traders to speculate the rising and falling prices of assets such as oil, gas, and metals. The assets trade against the USD with competitive margins and fast executions. Customers also benefit from an award-winning support team.

Shares

Clients have the opportunity to trade the world’s most popular shares leveraging innovative tools and favorable conditions. They trade as CFDs giving traders the ability to diversify their portfolios further and go long or short.

Cryptocurrencies

Several crypto assets trade at EasyMarkets as CFDs. This allows clients to benefit both on the upward and downwards movements of digital assets like BTC, ETH, LTC, and others.

Trading Platforms

EasyMarkets WEB platform

- Simple and user-friendly platform

- Guaranteed stop-loss

- No slippage

- Fixed spreads

- Powerful trading tools like the inside viewer freeze rate

- Other informational tools like trading charts and signals, financial calendar, and market news

- Multiple ways to trade

EasyMarkets Mobile trading APP

- Easy to use and available on android and IOS

- Trade with 0 spread

- Get access to deal cancelation too, inside viewer, and informational tools like live rates graphs

MetaTrader 4

- One-click CFD trading

- Pre-installed indicators and analysis tools

- Ability to test your EAs

- Available on multiple terminals

- 80+ markets

- Tight fixed spreads

Features

EasyMarkets features:

- Include powerful trading tools

- Offers multiple trading instruments

- Provides competitive spreads, leverage, and margins

- Trade with fast executions

Education

The broker cares about the wellbeing of its clients in the trading industry. It offers several educational resources to help boost clients’ skills to capitalize on markets’ benefits and offset its risks. Moreover, traders can register for courses offered by the easyMarkets academy.

Customer Support

The broker prides itself on offering award-winning customer support. Customers use platforms such as the live chat button, email, and phone calls to reach out to the team in case of any issue. The team attends to its cluster of clients 24/5 and is available in multiple languages.

Review Summary

EasyMarkets is a well-established brokerage company that made its foray into the trading industry in 2001. It serves clients worldwide with competitive spreads, margins, and fast executions. They trade the broker’s array of markets as CFDs, options, and forwards using EasyMarkets’ intuitive trading platforms. However, clients may face higher fixed spreads than other brokers, and it may take a while to receive feedback via email.