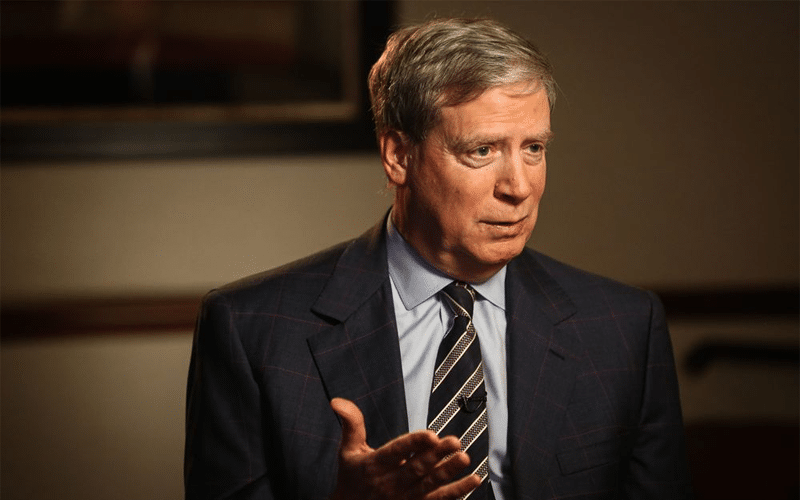

Investing legend Stanley Druckenmiller believes great investors don’t follow the conventional wisdom of diversification, The Hustle reports. They make concentrated bets where they are most convinced to reduce the overall risk exposure.

On current high valuations of equities, Druckenmiller sees them as speculative-led but expects high-growth tech stocks to match the valuations in 3-4 years.

The self-declared life investor expects rotation of investments from growth to value stocks, warning that big tech stocks should not be viewed as growth stocks.

Druckenmiller ranks Apple lower to Amazon and Microsoft and says the iPhone giant lacks the innovation of the latter two to take the company’s valuation to $5 trillion

On equity market risks, Druckenmiller cites Fed’s decision to raise interest rates if inflation keeps rising.

Druckenmiller reckons the force of retail traders and expects them to keep piling into stocks, but in less radioactive names

Druckenmiller considers a multi-disciplinary investing approach that combines fundamentals and technical alike to give an edge in the market.

On crypto wars, Druckenmiller says bitcoin has eclipsed ether as a store of value, and doesn’t take dogecoin seriously. Calls Ether a “myspace or yahoo” that will be replaced by “facebook or google”.

Druckenmiller advises investors to know when to sell a security saying such a decision should be made after invalidation of the reasons for holding it.

Druckenmiller advises 20-year-olds to try different occupations until they find what they are passionate about.