(Bloomberg) Germany’s benchmark stock index DAX is expected to target high-value and fast-growing companies in its move to expand from 30 to 40 stocks.

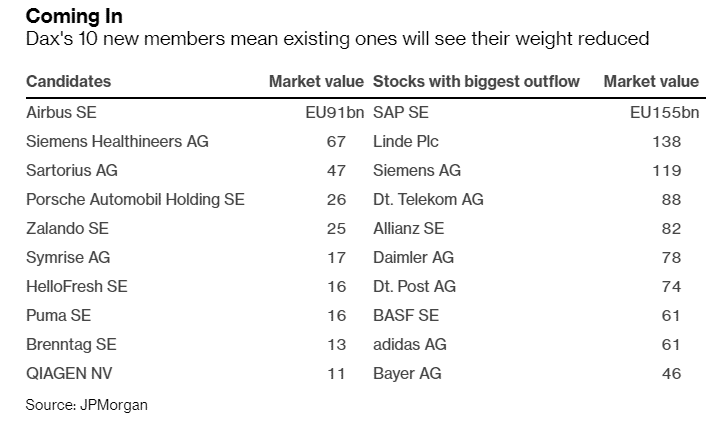

JPMorgan strategists expect online retailers such as Zalando SE and food delivery HelloFresh SE to make the cut into the 40 stocks. Industrial giants that include Airbus SE and Siemens Healthineers AG are also expected to be included.

DAX changes are meant to strengthen the benchmark, with the revision prompted by the Wirecard AG scandal, which filed for bankruptcy last year.

Analysts say the DAX move is a step towards moving from a dividend to a growth index, with the changes expected to kick off on September 20. DAX is expected to gain more attention from international investors after the changes.

Analysts do not expect wild moves after the index revision since this is already factored in the market.

The changes are expected to cause the most significant impact on exchange-traded funds, which have a value of about $19 billion. Small-cap indexes are also expected to lose.

The expected additions will boost DAX by 350 billion euros or $416 billion and dilute stocks of dividend-paying entities such as BASF SE.

DAX is up +0.058%