- DoorDash stock up 24% ahead of the Q3 report.

- Q3 revenue and earnings are expected to top estimates.

- The focus will be on the expansion plans needed to diversify the core business.

DoorDash Inc. (NYSE: DASH) is slated to deliver its Q3 2021 results on November 9, 2021, after the market closes. The company is poised to deliver, having faced significant challenges in the quarter, including worker shortages and supply chain issues. However, expectations are high the results will top estimates given the improvements in the food delivery business.

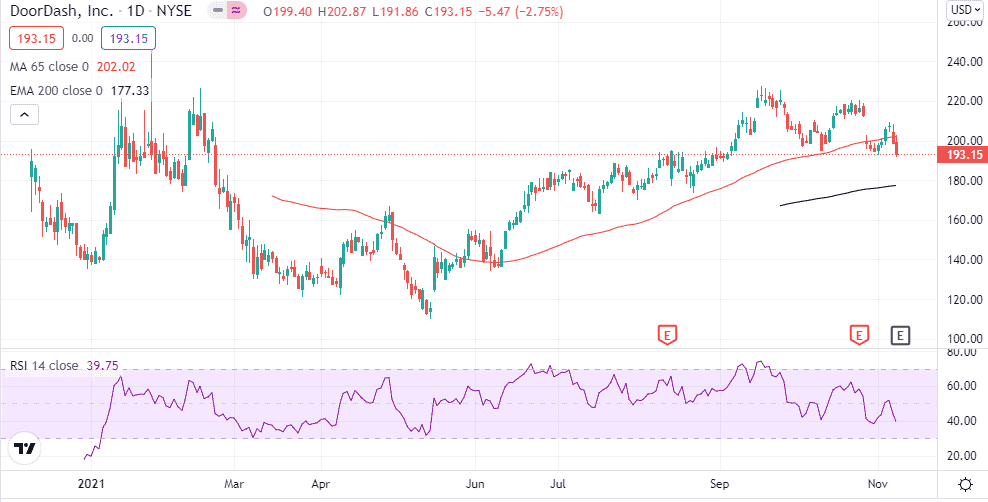

The food delivery company has seen its sentiments improve significantly over the past year. The stock is up by more than 23% for the year, in line with the overall market. However, it has pulled back by about 13% from all-time highs.

DoorDash was one of the biggest beneficiaries in the delivery business amid the pandemic. As dining in the restaurant was suspended, the company recorded booming business as food delivery became the norm.

Fast forward, there have been concerns that the company could face a significant drop-off of orders and revenue with the opening of the economy. The company has sought to shrug off the concerns by expanding to delivering other items apart from food.

While delivering Q2 results, management did warn of a seasonal decline in new consumer acquisition and order rates. The company also projected increased levels of investments in new categories and international markets as well as platforms and services.

Q3 earning expectations

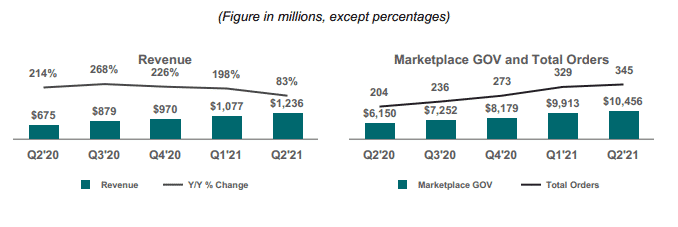

Wall Street expects the food delivery company to deliver $1.18 billion in revenue for Q3. This would be a decline considering the company delivered an 83% year-over-year increase in revenue in Q2 that totaled $1.2 billion.

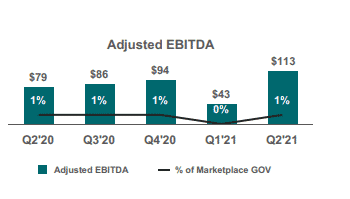

Additionally, analysts expect the company to post an adjusted loss per share of $0.26. Gross profit has been increasing sequentially in recent quarters owing to revenue growth. However, with revenue expected to tank sequentially in Q3 gross profit might take a hit.

While delivering Q2 results, DoorDash projected a gross order value (GOV) of between $9.3 billion and $9.8 billion for the third quarter. Additionally, management guided adjusted EBITDA to be between $0 million and $100 million.

What to look out for when DoorDash reports

When DoorDash reports, the focus will be on whether consumer behavior deviated significantly to affect the company’s bottom line and top line. In the second quarter, total orders were up 69% year-over-year to $345 million, driven by increased average order frequency from customers and new customer growth.

Consequently, a significant change in consumer behavior may have hurt the company’s ability to deliver GOV of between $9.3 and $9.8 billion.

In the recent past, DoorDash has also warned that fragmentation of local commerce would make it difficult to solve emerging problems. Consumer behavioral shifts are one of the headwinds the company is facing in the highly competitive food industry.

In a bid to shrug off potential slowdown due to the headwinds, DoorDash has reiterated plans to improve capabilities in restaurants and expand into new categories. It has also suggested plans to broaden Platform Services and increase the geographic scope.

Consequently, it will be interesting to see the strides the company has made on this front as it enters a period of tough comparison amid concerns of a sequential growth slowdown.

Bottom line

DoorDash has been firing on all angles going by the impressive 23% rally in the market. The stock’s sentiments have improved amid expectations the company has what it takes to shrug off stiff competition in the industry. Consequently, a stellar Q3 report should affirm solid underlying fundamentals likely to strengthen the stock’s sentiments, causing the stock re-rate higher.