Happy Thursday, friends. Today, I want to reflect on opportunity costs and the risks of being spread too thin.

Regarding investing, almost all traditional education preaches the value of a ‘diversified portfolio.’ While that is a fantastic concept, if you’ve already made it with millions in the bank, the actual reality is that most of us are still grinding to get there.

For those of us who haven’t ‘made it,’ diversification can protect wealth, but it will not rapidly grow it. This is also true in trading, but the implications of a ‘diversified approach’ in trading is even more dangerous, particularly in crypto.

The reality is many of us overestimate our capabilities and underestimate the time it will take to do something. Preparing a strategy takes time. Scanning the markets and researching new projects takes time.

And for every different sector in crypto, for every new hype cycle, there is a new meta, a new alpha, new skills to learn, new strategies to develop, and new tools to learn how to use.

A year ago, I had never even heard of GMGN, and didn’t track social metrics as a key part of my memecoin strategy – now it’s something I do every day.

You must guard your time and focus because a million things are vying for your attention daily. The risk of trying to learn too many things is that you become spread too thin, mediocre at many things, but not truly great at one thing that can exponentially increase your wealth.

The same is true for your investments; spread yourself too thin, and you’ll get the average return of the market instead of the punctuated gains you seek. You’ll also drive yourself crazy trying to keep up with all those positions daily.

I find 5-10 active positions are what I can effectively manage. More than that, I start to lose focus, and I see a feeling of anxiety creeping in. I feel most powerful and effective when they’re on the lower end of that range.

In summary, you only have so much time in the day. Don’t underestimate how difficult and time-consuming it can be to get competent in a new skill. Don’t underestimate how much mental effort it takes to manage multiple positions. Keep things simple, limit your number of positions, wait for the right opportunities to come to you, and bet big on them with sound risk management.

Market Update

Stablecoin Dominance

This metric fell by -2.28% today. Not a lower low, but three significant days of moving down, which favors our risk-on assets.

Bitcoin + Stablecoin Dominance

We are putting in a Lower Low today, but we are showing some upside pressure as we move into the Daily Close. Tentatively bullish for a continuation of altcoins.

Altcoin Performance Relative to Bitcoin

Went for a breakout today, but so far, it has failed. Selling pressure on alts is coming this evening as we head into Daily Close. It’s still tentatively bullish for altcoin continuation.

Bitcoin

Trends

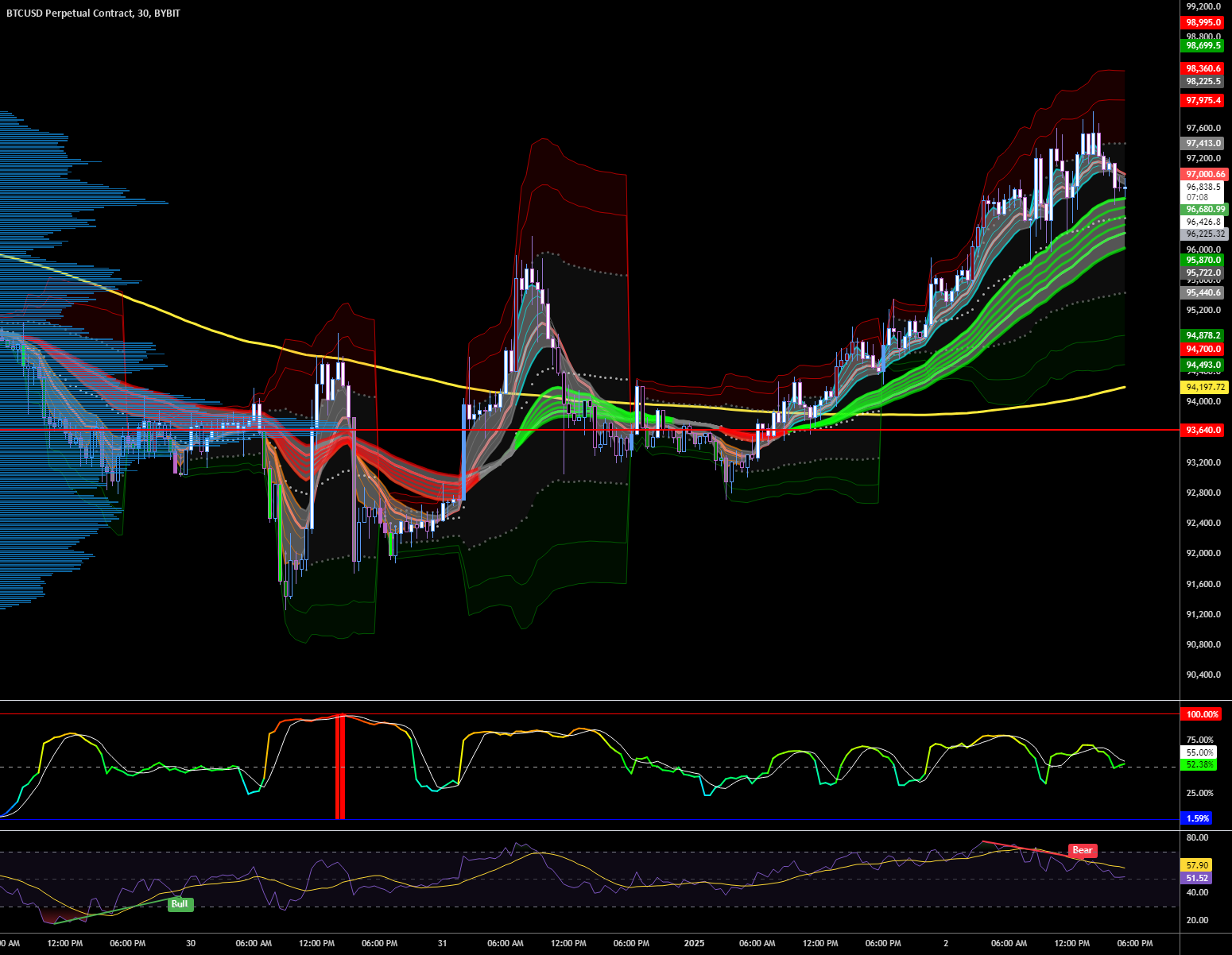

5M: Neutral

30M: Bullish

1H: Bullish

4H: Bearish

D: Bullish

Bitcoin has put in a nice movement off its lows of $92,000, rallying to almost $98,000. While a good start, Bitcoin faces stiff resistance and volatility, which has increased dramatically in the short term. This is the first Bull Trap area, and Bitcoin needs to hold above $94-95K on any pullback, or we risk a movement below $90,000.

Key Levels

POC: $93,640

VWAP: $96,422

Value Area High: $97,412 – $98,995

Value Area Low: $95,433 – $94,482

Strategy

Bitcoin faces its first wave of significant distribution as we approach $98,000. This is the first strong uptrend we’ve seen in Bitcoin for a while, and it has not reversed yet, but it is hinting at it. Strong buys have stepped in between $96,200 to $96,800. If Bitcoin loses short-term momentum overnight, then it is critical that we put in a Higher Low above $93,000. Trading lower than $93,000 marks this as a bull trap and essentially confirms that we will experience a Lower Low in Bitcoin’s price rather than a bullish two weeks.

For now, continue to hold longs opened up below $95,000. For new long positions, I would strictly manage risk at $96,000.