- Crude oil prices rose to a 14-year high earlier in the week.

- Analysts forecast further rallying to $150 per barrel.

- The US has banned crude oil imports from Russia.

Fundamental analysis

Russia’s attack on Ukraine in late February, and the subsequent war that has been ongoing for about two weeks now has boosted energy prices to multi-year highs. Indeed, after the announcement of the invasion, Brent futures rallied past the psychologically crucial level of $100 for the first time since September 2014.

Over a span of two weeks, the crude oil price has surged by close to 35%. At the beginning of the week, Brent futures rose to $138.10, the highest level since July 2008. It has since pulled back to $130.04 as of the time of writing. Similarly, the benchmark for US oil – WTI futures – extended its gains to a 14-year high of $129.50 on Tuesday before easing to $125.82 as at 08:30 AM GMT.

Based on both the fundamentals and technicals, it is in good shape to record another week of gains; marking 12 out of the past 14 weeks in the green. Investors and analysts alike are extremely bullish on the crude oil price as the geopolitical tensions in eastern Europe are expected to continue for a while longer. At the beginning of the week, President Putin stated that he will not back down until Ukraine meets his demands.

With the ongoing rallying in energy prices, various analysts have adjusted their short term forecast to the upside. For instance, Energy Aspects has indicated that Brent oil is set to reach and surpass the $150 mark in the coming weeks. During a recent interview with CNBC Television, the firm’s Director of Research Amrita Sen indicated that demand destruction is the only solution to the current situation.

Interestingly, Goldman Sachs holds a similar opinion. It has raised its short-term forecast for crude oil prices from $98 to $135. JP Morgan also expects Brent futures to surge to $185 by the end of 2022.

In the ensuing sessions, the energy market will likely remain subject to heightened volatility as investors assess the Russia-Ukraine war and subsequent sanctions from the West. On Tuesday, President Biden announced that the United States will ban imports of Russian fuel. At the same time, the UK has indicated that it will phase out Russian products by year-end.

So far, the US and UK are the only two countries that have enacted a direct ban on Russian exports. The move is expected to result in even higher energy prices and subsequently heighten inflationary pressures.

Russia is the leading exporter of oil in the world. Besides, it is ranked second, after Saudi Arabia, in the exportation of crude oil globally. Even with the return of Iranian oil, the removal of Russian oil from global oil will likely boost prices to the predicted $150 per barrel. In addition to the direct bans, the market is self-sanctioning as buyers find it difficult to ship products from the eastern European country.

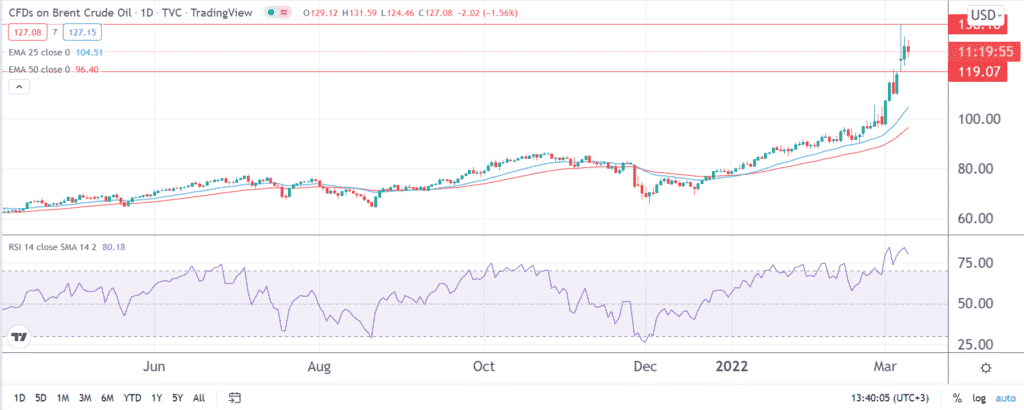

Crude oil price technical analysis

As seen on a daily chart, the crude oil price is still trading above the 25 and 50-day exponential moving averages despite easing from the multi-year high hit earlier in the week. The fundamentals substantiate the technical outlook that the commodity will record further gains in the coming sessions.

At its current level, it remains in the overbought territory with an RSI of 80. Even with the probable price swings, I expect the crude oil price to remain above the psychological level of $100.

In the short term, the horizontal channel between the support level of $119.07 and the week’s high of $138.10 will be one to look out for in the week’s second half. Above the range’s upper border, the bulls may have an opportunity to hit a fresh multi-year high of about $145.