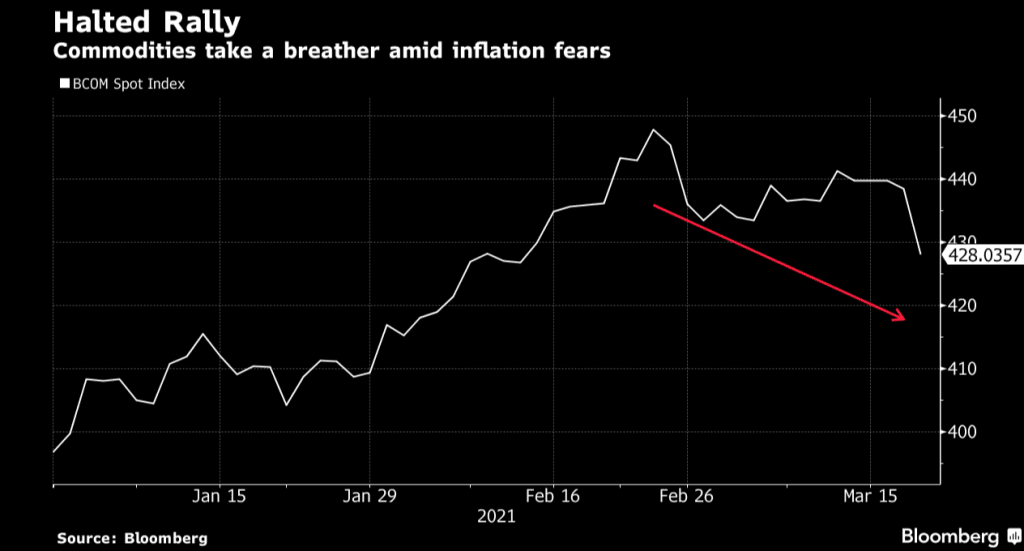

Concerns that the Federal Reserve will let inflation accelerate sparked a selloff in most risk assets on Thursday. The fears are now gripping commodity markets as crude oil plunged 7%, while coffee had the biggest loss in two months, with copper and corn also falling.

Despite the fall in commodities, analysts say markets can sometimes benefit from an inflationary environment since investors think of raw materials as a good place to find yield.

Commodities started the year strongly, which saw a crude surge by more than 30% through Wednesday, while corn, soybeans, and copper reached multi-year highs.

Slow rollouts of vaccines sparked concerns over how long it will take before consumption of energy, metals, and grains returns to pre-pandemic levels.

Arlan Suderman, the chief commodities economist at StoneX, says Treasury yields and the dollar respond to the Fed and are currently having a short-term negative impact on the commodities.

The gains for Treasury yields hurt demand for the assets like gold and silver, which do not bear fixed interest.

Major commodities are currently mixed. CL! is up 0.83%, HG1! is down 1.06%, KC1! is up 0.77%.