CMC Markets operates as an online brokerage company linking traders to a wide range of liquidity markets. The broker claims to offer advanced spread betting and CFDs trading services on over 10,000 instruments through its trading platforms. Its proprietary trading platform holding a portfolio of awards integrates with multiple tools and plugins to offer traders the next generation of trading technology on different interfaces.

Pros

- Award-winning trading technology

- Access to over 10,000 markets

- Tight spreads starting from 0.7 pips

- Free deposits, withdrawals, educational trading tools

- The minimum deposit is 0 euros

- Next-generation trading tools and features

- Leverage of up to 30:1

- Segregation of funds

- Offers a demo account

- Over 30 years operating in the trading industry

- Offers social trading

- Access to expert support 24/5

- Access to rich educational resources like trading guides

- Offers rebates depending on the volume of trades

Cons

- Inactivity fee of ten euros every month after one year of account dormancy

- High CFD fees

- Overnight trading fees

- Spreads vary across different instruments

- Not available to USA residents

CMC Markets prides itself as the leading CFD trading and spread betting provider across Europe. The brokerage company launched in 1989, aiming to revolutionize CFD trading and spread betting for both newbie and veteran traders. The broker allows clients to trade the price movement of over 10,000 assets while also gambling on their spread fluctuations.

With over 30 years of experience, the broker now serves millions of traders around the globe, offering instant trade executions, tight spreads, and 24/5 expert customer support. The company operates several offices in different pockets of the world, such as Australia, Germany, and Singapore, but its head office operates in London, England.

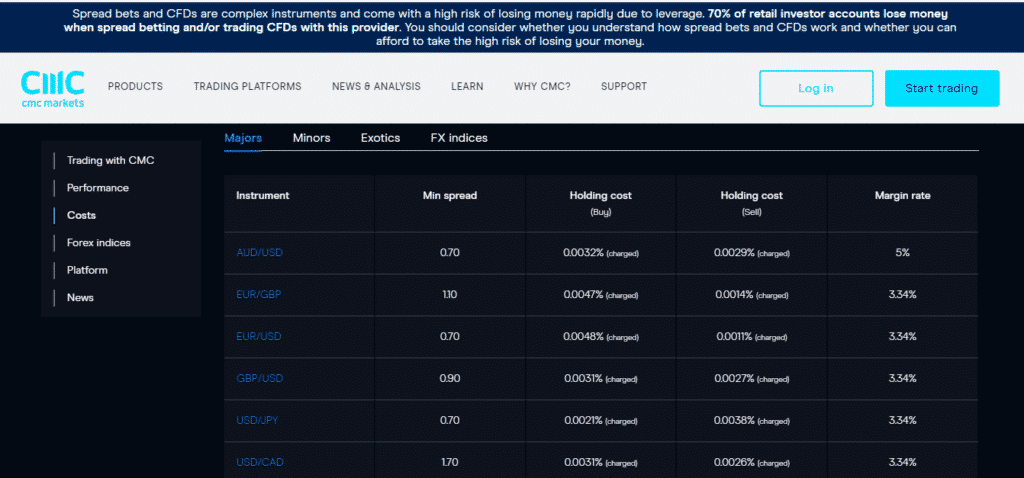

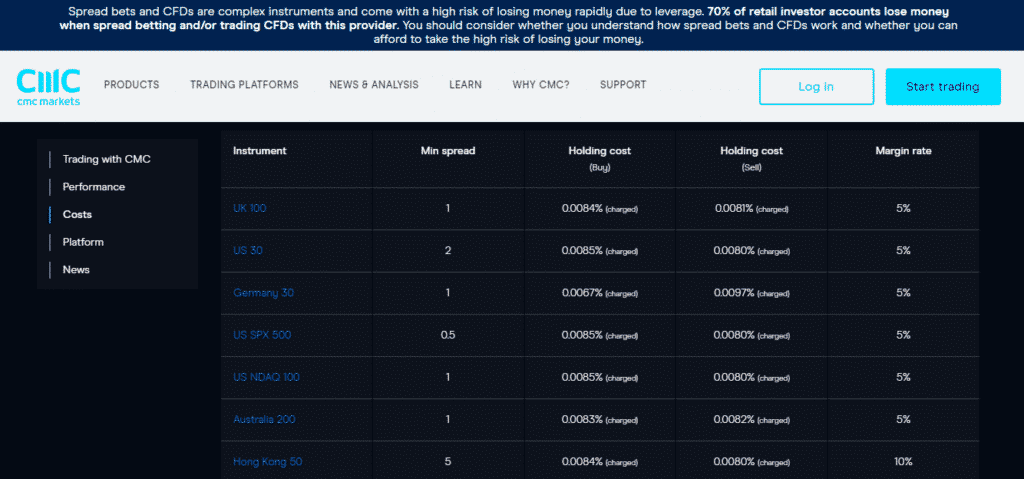

Traders access these trading services on all assets, but the conditions vary depending on the asset class. The minimum spread offered starts from 0.7pips for EUR/USD but fluctuates depending on the currency pair. The points also vary on indices and commodities as the lowest trades at one point for some indices and 0.3 points for gold. The margins fluctuate with forex margin (leverage) trading at 3.3% and 30:1 while indices and commodities trade with a 5% margin.

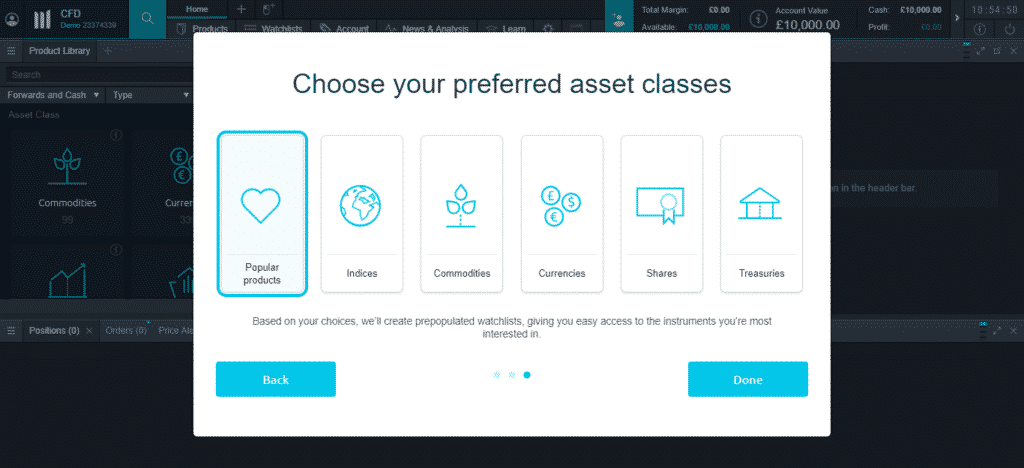

The broker offers the following instruments:

- 300+ forex instruments

- 60+ indices

- 15 cryptocurrencies

- 9000+ shares and ETFs

- 90+ commodities

- 30+ treasuries

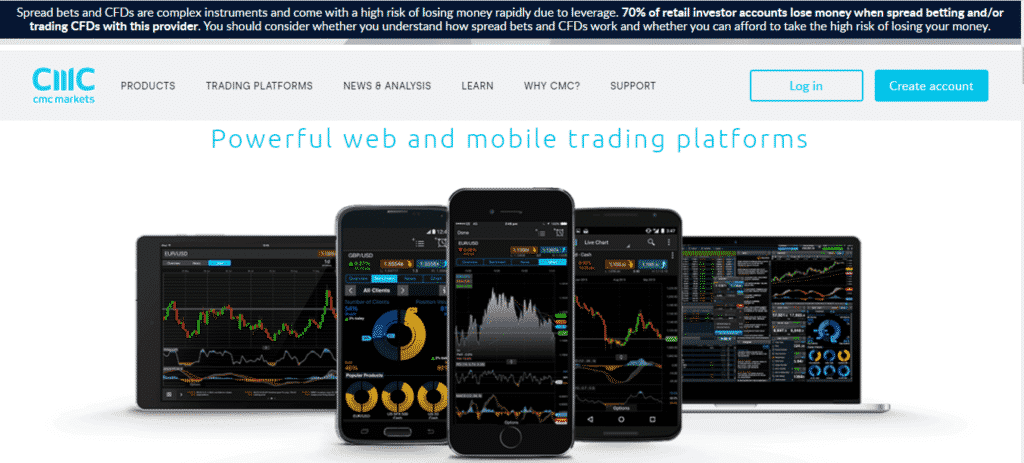

As alluded, the broker notes to provide fast order executions and competitive spreads with advanced trading technology through its platforms. It claims to offer clients the next-generation trading technology via its proprietary trading platform integrated with unique trading tools and features. Clients also access MetaTrader 4 under the broker’s list of platforms.

CMC Markets integrates its platforms with the following tools and features:

- Charting tools

- Trading tools

- News and insights tools

- Technical indicators and drawing tools

- Price projection tool

These tools and features come in handy when trading using CMC Markets’ accounts. The broker allows traders to create either a spread betting account or a CFD trading account. The account type determines the mode of trading applicable to each trader. However, the broker also offers a demo account for practice and skill improvement.

However, the broker provides fewer account funding channels as compared to other brokers. It emphasizes clients to use debit/credit cards or online bank transfers for better security of their funds. The broker rarely accepts third-party payment channels/ deposit methods but waives all the deposit and withdrawal fees to traders. The minimum deposit is capped at 0 (zero). However, traders must fund their accounts with at least $200 for a better trading environment. Generally, payment methods available include:

- Bank transfers

- Credit/ debit cards

- Electronic wallets

Regulation

The broker operates under top-tier and two-tier regulations. The head office located in England holds the trading license number 173730 from the Financial Conduct Authority (FCA). Besides, the brokerage company stock is publicly traded on the London Stock Exchange with the symbol (LSE: CMCX).

In addition, the company’s subsidiaries operate under the surveillance of regulatory bodies based in the same region. CMC Markets Australia abides by the laws imposed by the Australian Securities & Investment Commission (ASIC). Other regulatory bodies regulating different CMC Markets’ subsidiaries include:

- Investment Industry Regulatory Organization of Canada (IIROC)

- Monetary Authority of Singapore (MAS)

- BaFin

Pros

- Highly regulated

- Publicly traded on the London stock exchange

Cons

- Doesn’t offer services to clients in the US

Account Types

The broker provides both a demo account and a live account. The demo accounts act as a learning tool, especially for beginners, while the live account serves both intermediate and professional traders. However, the broker also allows newbies to create a live account directly as it offers social trading.

The live accounts include:

- A spread betting account

- CFDs trading account

- Corporate account

Spread Betting account

- The minimum deposit is 0

- Access to a demo account

- No trading commissions

- Negative balance protection — yes

- Only two base currencies — GBP, EUR

- Market data fees — no

- Inactivity fees — yes (after one year)

- Fast execution

- Access to over 10,000 instruments

- Free deposits and free withdrawals

- 24/5 expert support

- Access to free education, online trading courses, and content

- Access to real-time market trends and advanced trading tools

- Low spreads starting from 0.7 pips

- Leverages of up to 30:1 for forex

CFD account

- The minimum deposit is 0

- Access to a demo account

- A $10 trading commission on shares only

- Negative balance protection — yes

- Ten base currencies

- Market data fees — yes

- Inactivity fees — yes (after one year)

- Trade with points low points starting from as low as 0.3 points

- Leverages of up to 20:1 for stock index CFDs and 5:1 for stock CFDs

- Instant execution

- Access to over 10,000 markets

- Free deposits and withdrawals

- 24/5 expert customer support

- Access to real-time market trends

- Access to free education, online trading courses, and content

N/B: CFD account trading conditions apply to the corporate account.

How to open a CMC markets account?

The broker’s account opening involves a few easy steps. However, verification of the account may take 1-3 working days, depending on the client’s location.

Step 1. Log into their website at https://www.cmcmarkets.com/en/ and click the “create account” button.

Step 2. A form asking for your nationality pops up, fill in, and the following form is asking for your full details.

Step 3. Verify your email address by entering the security code sent to you.

Step 4. Choose the type and preferred currency.

Step 5. Verify your identity using KYC documents and fund your account.

Step 6. Start trading.

Fees and Commissions

Despite waiving fees on deposits and withdrawals, CMC Markets imposes trading fees and commissions depending on the account type and asset. CFD and corporate account traders face a $10 trading commission when trading shares. They also incur fees on market data depending on their subscriptions.

As reiterated in this review, margins, leverage, and spreads fluctuate relative to the asset on trade. However, CMC Markets’ fees include; fees on the markup spread, overnight fees, and fees contributed by trade margins and leverages. Clients also incur a ten euros monthly fee after one year of account dormancy. But, the broker also offers some incentive services like negative balance protection and rebates on the volume of trades.

Payment options

CMC Markets’ array of payment options includes; bank transfers, debit/credit cards, and E-wallets transfers. Due to its security reputation on clients’ funds, the broker implores traders to use credit/debit card deposits mostly.

Pros

- High security on client’s funds

- Deposit and withdrawal is free

- Accepts different currencies for deposit/withdrawal

Cons

- None

Deposit

Deposit channels include the following:

- Bank wire transfers

- E-Wallet transfers

- Credit/ debit cards such as Visa, MasterCard, among others

Withdrawals

Clients receive payments through the same channels offered for deposits.

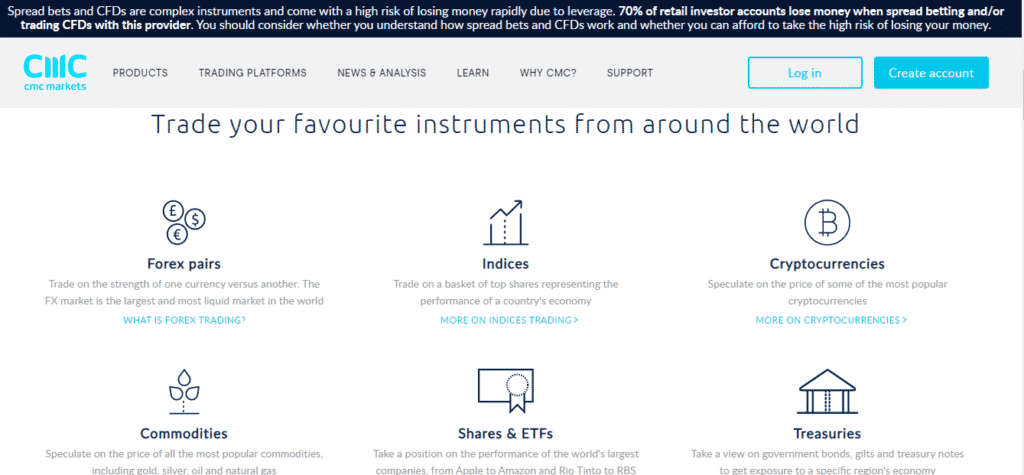

Available Markets

The broker claims to provide clients access to diverse liquidity markets in the financial arena. It asserts to offer more than 10,000 instruments with competitive spreads and margins.

- Forex

At CMC Markets, the FX market trades 24/5 on the broker’s platforms. The broker offers clients over 350 currency pairs made up of both significant pairs and exotics. Some of the major currency pairs include EUR/USD, GBP/USD, AUD/USD, among others.

These assets trade with spreads starting from 0.7 pips, instant executions at 0.0045 seconds, and with no dealer intervention — clients have a 99.7% fill rate.

- Indices

Over 80 indices trade on the broker based on the FTSE 100 and other regional indices. The indices basket holds both popular indices like the UK 100, US 30, among others, at a 24/5 trading schedule. The broker offers accurate bid/ask prices on these assets with no dealer intervention.

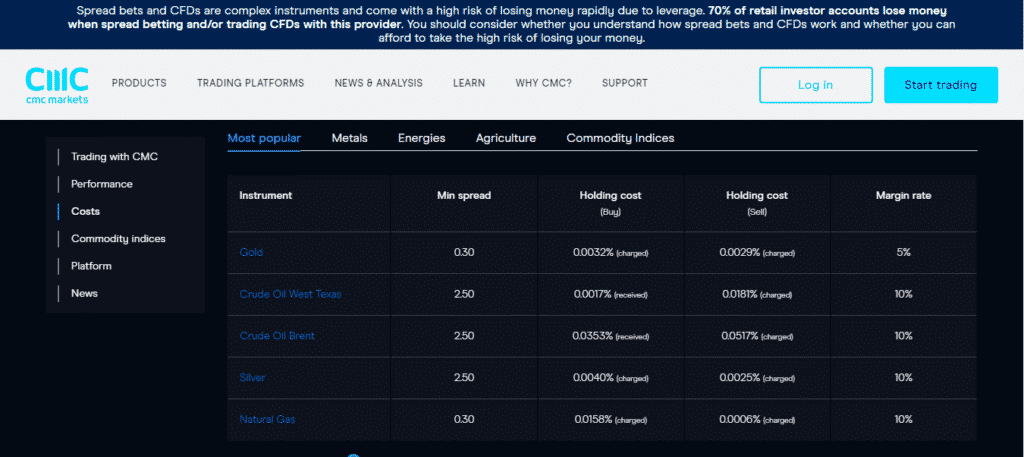

- Commodities

The broker offers an array of commodities to traders. Clients trade over 100 commodity assets, including popular instruments such as Brent and West Texas oil and lesser-traded products like Palladium. Some of these assets trade at a minimum spread of 0.3 points and a margin rate of 5%. The market opens 23 hours from Monday through Friday, allowing clients to trade even when the markets close. Some of the commodities include natural gas, gold, silver, among others.

- Shares & ETFs

CMC Markets claims to offer over 9000 instruments on shares and ETFs. The asset class holds about 250 biggest UK shares and the most popular US shares. They trade with instant execution and automation and 24/5 customer support. The spreads start from as low as 0.1 points but fluctuate depending on the instrument. Some of the shares include; Apple Inc., Tesla Motors Inc., Amazon.com, among others.

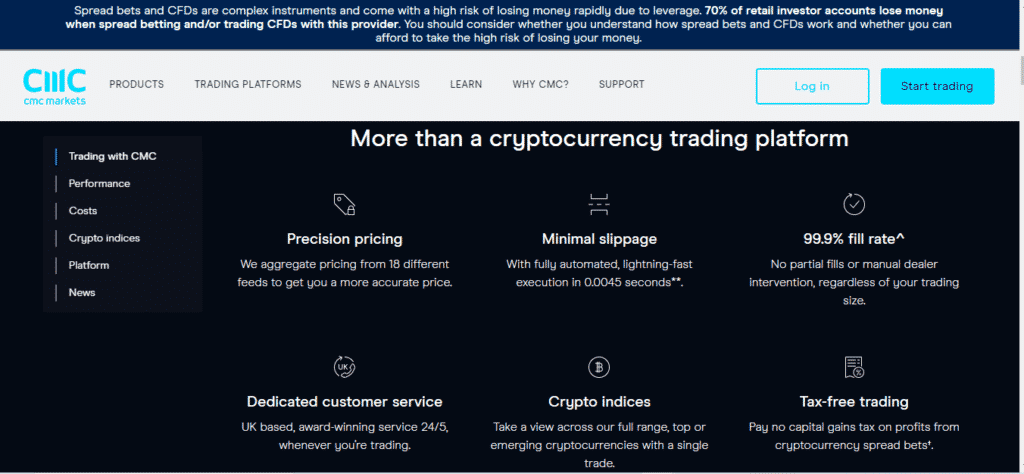

- Cryptocurrencies

The broker sites offer about 14 cryptocurrency assets for trading. The assets trade with instant execution and a 99.9% fill rate. Clients experience limited partial and zero manual dealer interventions. The minimum spreads start from as low as 1.9 points and change relative to the asset. Some of the digital assets include; BTC, Ethereum, and alt-coins such as TRON.

- Treasuries

The broker also diversifies its markets into treasuries such as bonds and global rates. Clients trade over 50 treasuries with full automation, fast executions, and without any dealer intervention. The broker also offers access to 24/5 expert customer support to clients trading these instruments and others, such as the US T-Bond trade up to 23 hours a day. Some of the assets include euro Bund-Cash, UK Gilt-Cash, among others.

Trading Platforms

CMC Markets provides clients with two trading platforms available on different interfaces. Clients choose either its proprietary trading platform dubbed “next-generation” or the MT4 trading platform. The broker’s proprietary platform serves clients with mainstream trading technology and holds several awards due to its customer service.

| Next-generation platform | MT4 |

| This platform serves the broker’s clients on all its accounts. It’s available on the web, desktop, and mobile phones giving clients the ability to trade from anywhere. Its features include: Market watch indicators providing clients with new and market insights Fast order execution and easy to use Advanced features including boundary orders, stop-loss orders, price ladders, among others One-click tradingLive chat and feedback Over 10,000 instruments115 technical indicators Drawing tools 70 chart patterns and 12 chart types | CMC Markets also offers the MetaTrader 4 as a substitute for its main trading platform. The broker offers the MT4 platform as most traders prefer using it to its proprietary platform. MT4 features include: Instant trade executions Tight spreads Automated trading Live chat with customer support One-click through trading Over 10,000 instruments Interactive features |

Features

CMC Markets features generally include:

Trading tools

- Expert advisors on news and insights

- Trading calculator

- Charting tools

- Advanced order options like 1-click trading, price ladders, among others

Analytical tools

- Market watch information tools

- Technical analysis tools

- Indicators

- Signals

Education

CMC Markets provides a wherewithal learning environment to clients. Traders access its learning platform on the broker’s websites and access beneficial tools such as:

- Videos

- Articles

- Webinars and events

- glossaries

These tools offer traders educational tutorials on spread betting, FX, and CFD trading guides, among others.

Customer Support

CMC Markets prides itself on having a portfolio of awards for good customer support. The broker’s trading platforms offer real-time customer support 24/5 and attribute to its elevated reputation of good customer service. In addition, the broker allows clients access to a rich customer support platform via its website.

It offers clients real-time information about trading topics on its “Help topics” sections and answers most raised queries by clients through its “FAQs” section. Nonetheless, CMC Markets provides a “Contact Us” section to receive the most complicated questions from traders. The broker claims to answer 98% of the calls made within 20 seconds.

Review Summary

CMC Markets operates as a spread betting and CFD trading brokerage platform on diverse markets. It offers 10,000+ instruments and prides itself on over 30 years of experience in the financial trading spree. It’s suited for all sorts of traders as it provides a demo account and waives the minimum deposit to 0 (zero).

Meaning newbies access the demo account to up their trading skills while intermediate, and veteran traders open a live account regardless of their pocket size. The broker also holds trading licenses from reputable agencies, making it a safe trading platform. In addition, it offers tight security of client’s money through segregation of funds.