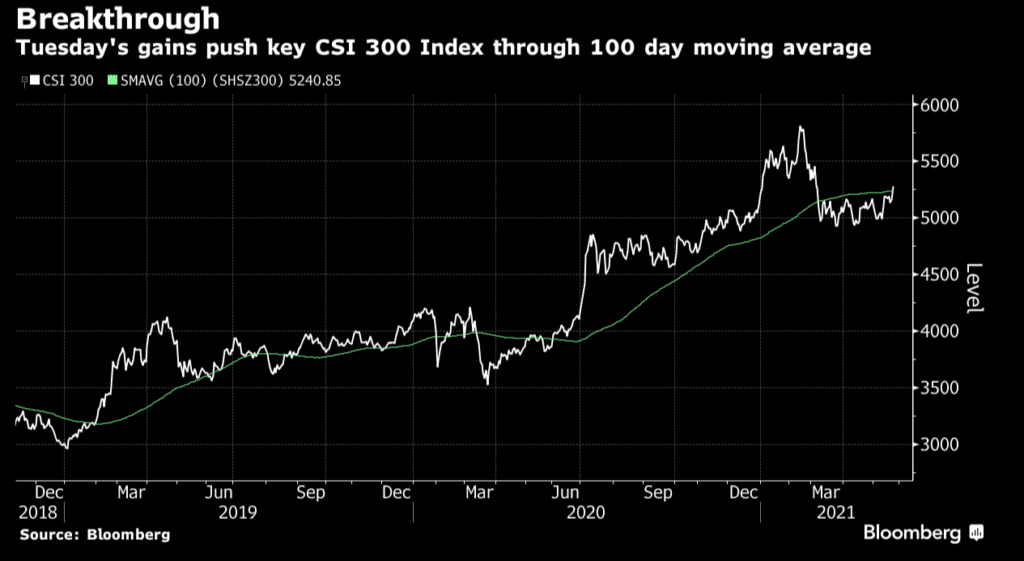

Gains in consumer staples equities saw China’s benchmark index gain the most since July on Tuesday, Bloomberg reports. CSI 300 surged 3.2% closing above the 100-day moving average, the highest since March.

Foreign investors bought record class A shares worth 21.7 billion Yuan or $3.4 billion via Hong Kong links.

The gains in stocks come amid China’s move to crack down rising prices of commodities and control the markets that saw investors flee into consumer stocks seen as more stable.

Gains in Chinese equities were replicated elsewhere as the Yuan rose 0.2% to its strongest in three years, despite moves to control its appreciation.

The Yuan is now up at least 2.5% in the quarter as foreign funds were attracted into the currency for better yields on the robust economy.

Retracted comments by a Chinese central bank official to let the Yuan run to offset rising commodity imports also fueled its gains.

Chinese stocks and the Yuan are currently gaining. CSI 300 is up 3.16%, USDCNY is down 0.22%.