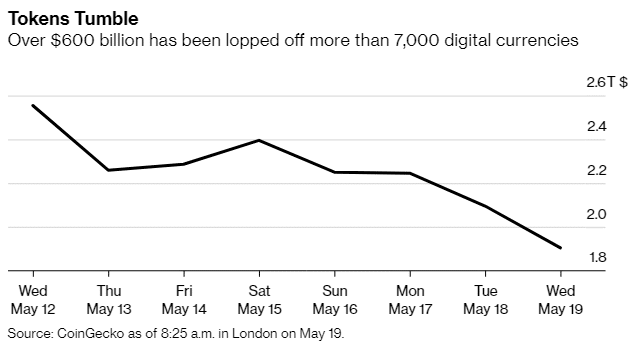

At least $600 billion worth of digital tokens have been wiped out of the cryptocurrency market in the past week. Bitcoin, the world’s largest cryptocurrency, shed 11% on Wednesday to trade below $40,000, wiping out more than $25,000 since its record high in April.

The fall in digital tokens has been attributed to criticism of the environmental impact of Bitcoin’s energy usage by opponent Elon Musk.

Risk of regulatory squeeze has also been highlighted, with China saying it would not accept digital tokens as means of payment.

There are also views that traders are taking profits in crypto markets sending prices down.

Market analyst Jeffrey Halley says a decline of below $30,000 is likely as the $40,000 mark is critical make-or-break pivot level.

Bitcoin chartists see a bearish head-and-shoulders pattern, highlighting more weaknesses ahead.

In April, the value of cryptocurrencies doubled to $2 trillion for the first time as institutional investors joined the digital token boom.

Bitcoin’s price relative to gold has dropped to the lowest since early February, amidst greater caution about speculative assets as well as post-pandemic economic recovery.

Major cryptocurrencies are currently declining. BTCUSD is down 15.59%, ETHUSD is down 24.60%