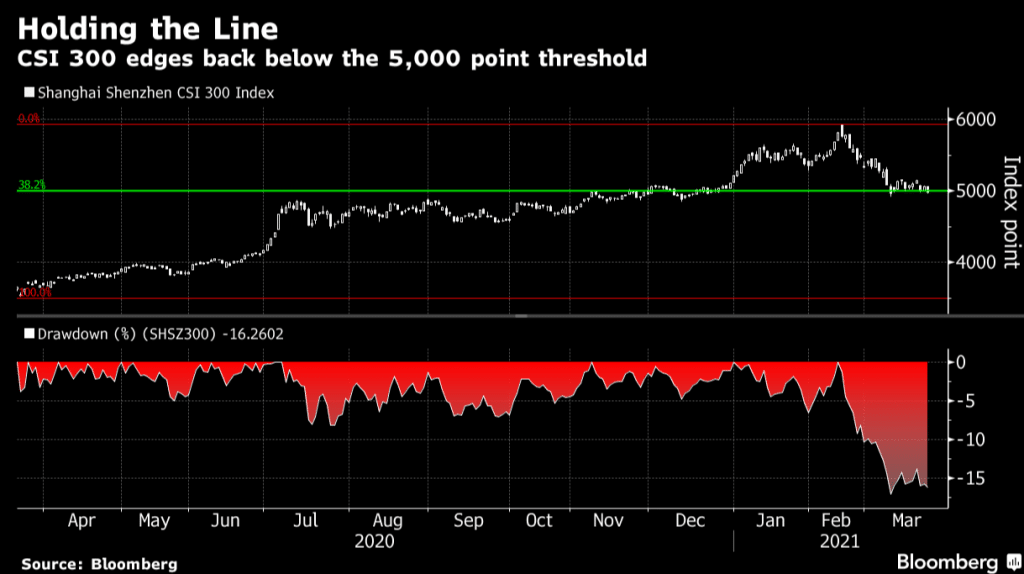

China’s CSI 300 Index plunged 1% to close at 5,009.25 points, extending its decline from this year’s peak to almost 14%. The index briefly pieced through the key support level as traders engaged in massive sell-offs on concerns over earnings and valuations.

Foreign investors sold a net $1.1 billion worth of Chinese mainland stocks through trading links, the most since March 8.

Traders were concerned about earnings growth not living up to the expectations that drove a buying frenzy before the Lunar New Year break.

Credit Suisse Group analysts also contributed to the grim outlook after they downgraded Chinese stocks to underweight from market weight on slower earnings growth and expensive valuations.

Credit Suisse analysts expect China to suffer a bigger payback than most markets from temporary gains the pandemic delivered.

The fall of China stocks highlights how quickly favored stocks can fall when regulators deem the markets as too hot.

Last weekend, China’s securities regulator warned about the risks of the so-called “hot money flows” or capital flows fueled by strong economic recovery and higher interest rates.

Some analysts say the recent slide has upsize and offers an “attractive entry point.”Chinese stocks are currently declining. CSI 300 Index is down 0.95%