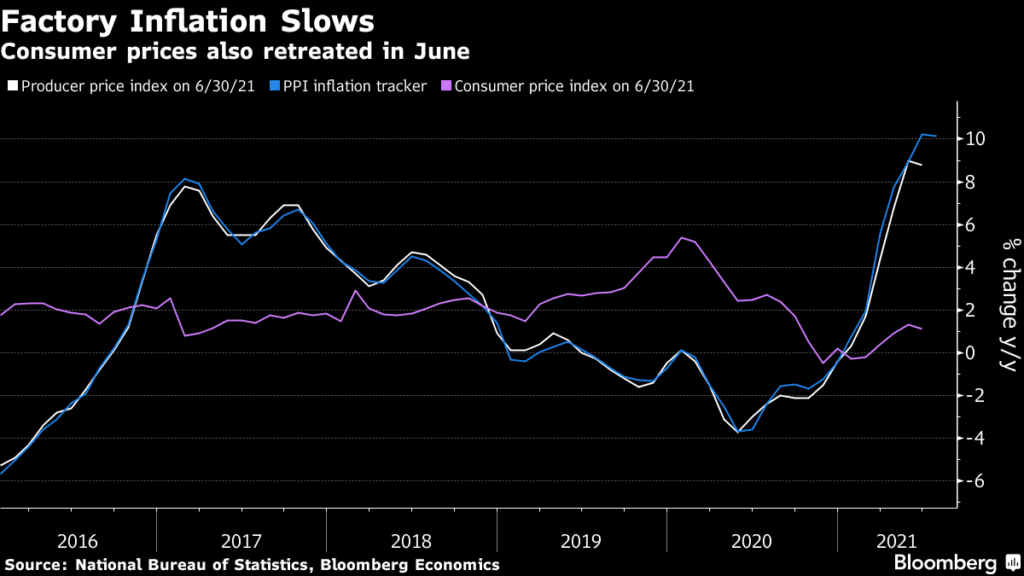

(Bloomberg) China’s producer price index eased to an expansion of 8.8% year over year, after May’s high of 9% on commodity price control measures and stronger dollar.

Consumer prices ticked higher by 1.1% year over year, below the estimated 1.2% but lower than May.

The decline in price pressures reflect China’s subdued growth amid government talks of additional support to the economy.

Input prices for Chinese producers rose by the most since 2008.

Producer prices for consumer goods rose only marginally by 0.3% as manufacturers were unable to pass costs to consumers due to depressed demand and intense competition.

Analysts expect China’s producer prices to slow in Q3 and Q4 of this year up to June 2022, while consumer prices are projected to rise.

CSI 300 is down -0.37%, USDCNY is down -0.13%.