(Bloomberg) China has warned lenders to cash-strapped developer Evergrande Group not to expect interest payments due on September 20 as massive debt restructuring looms.

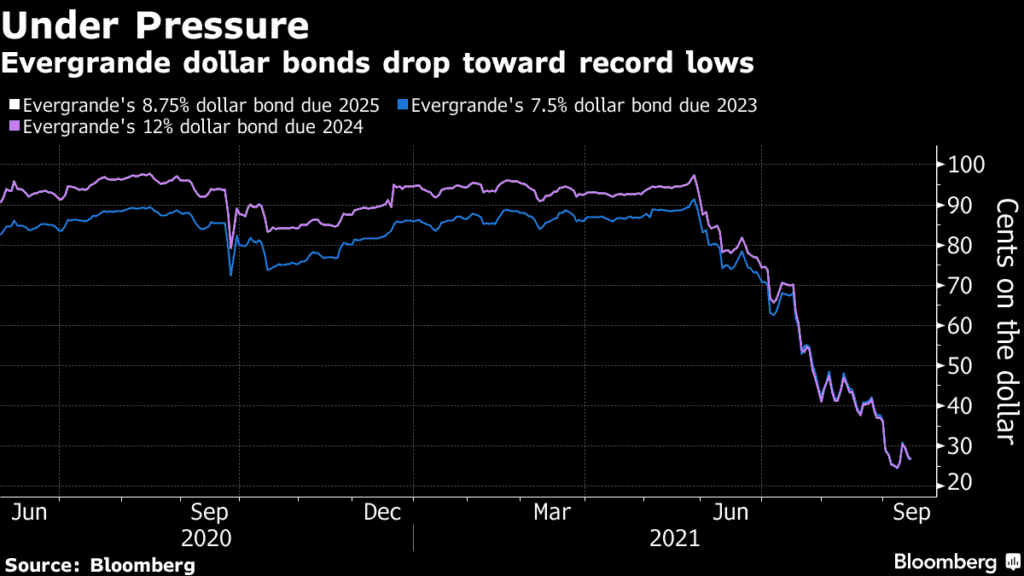

Fig: Evergrande’s Dollar Bonds

The warnings, by the Ministry of Housing and Urban-Rural Development, come as Evergrande discusses loan extensions and roll-overs its lenders.

Evergrande is also expected to skip at least one principal repayment next week.

The loan restructuring happens as Evergrande faces a liquidity crisis, with at least $300 billion of liabilities in its balance sheet. The obligations have posed a major financial risk to China.

China is already assembling accounting and legal experts to scrutinize Evergrande’s finances and help in the debt restructuring task.

Evergrande’s debt fell to its lowest in five years at 571.8 billion yuan or $89 billion as of June 30. Trade and other payables surged 15% in the six months to a record 951.1 billion yuan.

The developer company is sitting on down payments on to-be-completed properties from about 1.5 million homebuyers. Homebuyers, retail investors, and some company staff have protested the company’s failure to meet obligations.

3333: HKG is down -5.39%.