(WSJ) China will release its stockpiles of industrial metals to curb commodity prices which have ticked to a 13-year high.

Economic stimulus across the world and resumption of activity have fueled demand for China’s products, raising the cost of major commodities.

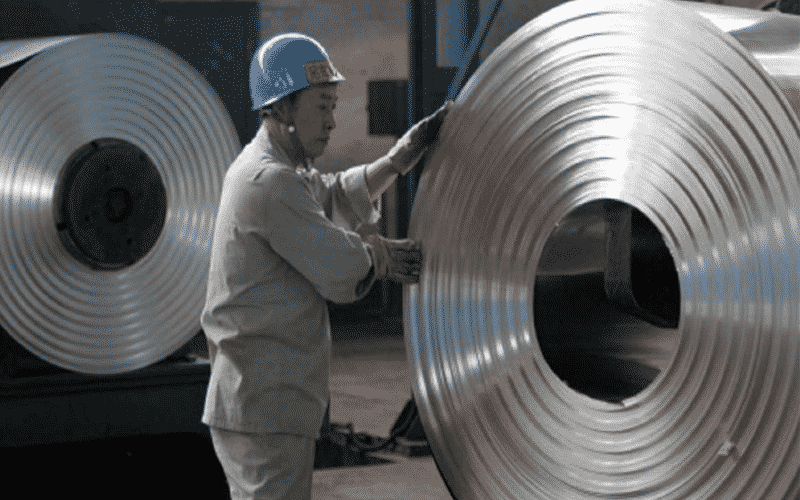

China’s move will target commodities that include copper, zinc, and aluminum.

Although recent moves by China to tame rising commodity prices have shown signs of success, analysts have faulted the country saying the gains are only temporary.

The success of China in curtailing commodity prices is now expected to be pegged to the effectiveness of metal it releases, but analysts are doubtful.

China expects to release the metals in batches to maintain stability in prices and supply, although the time frame is yet to be clarified.

China’s producer price index jumped 6.8% year over year in April and 9% in May to raise further concerns of inflationary pressures.

The strength of the Yuan against the dollar has also been blamed on rising prices of Beijing exports, raising concerns that China could move price pressures elsewhere.

CSI 300 is down -1.67%, USDCNY is down -0.12%