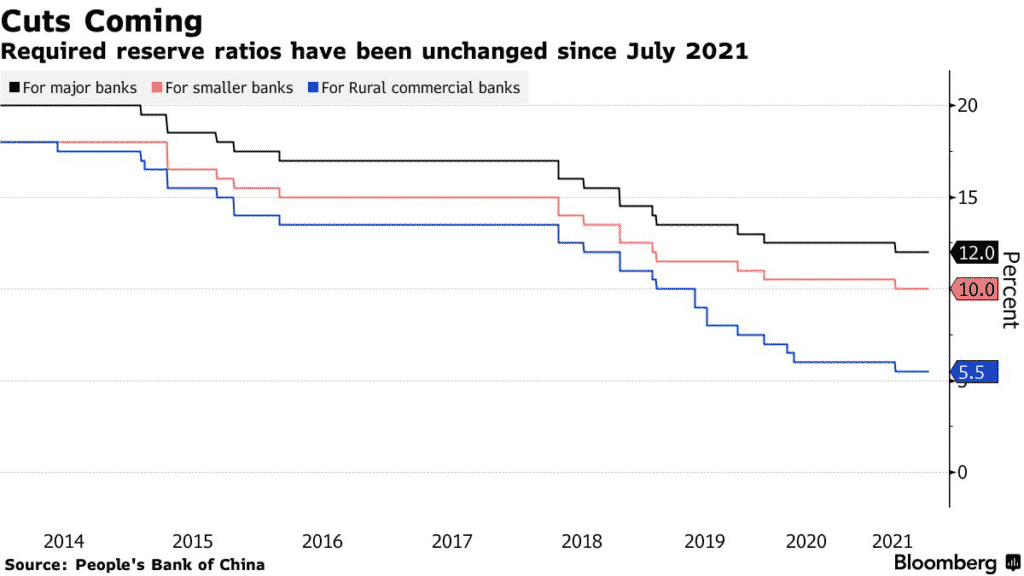

(PBC) The People’s Bank of China has announced a 0.5 percentage point reserve requirement reduction, in a move that will infuse 1.2 trillion yuan or $188 billion into the economy.

China’s central bank move aims to stabilize the economy, which is already facing stagnation amid liquidity challenges that have engulfed the property sector.

PBOC says the reserve ratio cut is a regular monetary policy initiative, insisting that it has not shifted from its path. The central bank says it will maintain a stable and consistent monetary policy, without flooding the economy with excess liquidity.

The move by PBOC is a divergence from other global central banks which are exploring policy tightening.

PBOC’s rate cut will become effective on December 15 and will apply to all banks, most small rural ones, already at the lowest level of 5%. Financial institutions will incur a rate of 8.4%, down from previous 8.9%.

Banks will be expected to use the liquidity boost from the rate cut to pay back the maturing obligations and replenish long-term capital. About 1 trillion yuan of one-year loans will fall due on December 15.

CSI 300 is down -0.17%, USDCNY is up +0.02%.