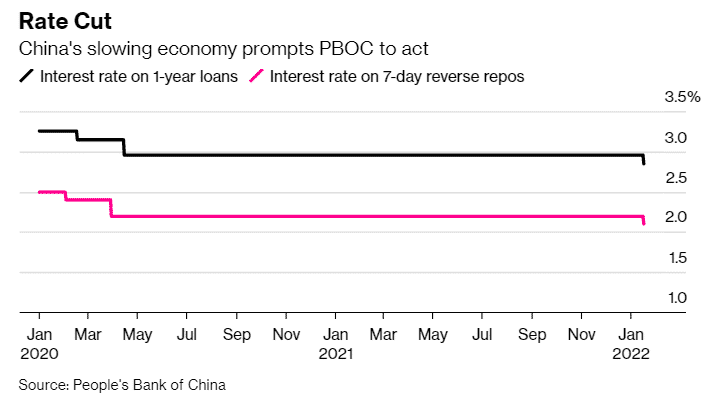

(Bloomberg) China’s 10-year government bond yield fell by two basis points to 2.78% as the central bank cut its interest rate on one-year policy loans by 10 basis points.

The policy cut, which reduced the rate to 2.85%, is the first since April 2020 at the peak of the pandemic and happens when the government seeks to bail out the sluggish economy.

The People’s Bank of China also reduced the rate on the seven-day reverse purchase rate and added 200 billion yuan or $31.5 billion into the economy.

Guosheng Securities Co. analyst Yewei Yang says the move by PBOC suggests that the economy is weak, with the central bank aiming to boost credit supply and guide borrowing costs.

Hao Zhou, an analyst at Commerzbank AG, expects further easing by PBOC, with the latest reduction projected to prompt banks to trim the loan prime rate.

The move by China contradicts those of other global central banks, which are seeking to raise the interest rates to tame rising inflation.

CSI 300 is up +0.85%, USDCNY is down -0.09%.