In this interview on the side-lines of Guaranty Trust Holding Company Plc listing on the main market board of the London Stock Exchange, Chief Executive Officer, Nigerian Exchange Plc, Jude Chiemeka speaks on the significance of GTCO’s successful listing, NGX’s MOU with LSE, why companies with ESG policies are attracting a lot of liquidity and other thorny issues in the economy and capital markets. Eromosele Abiodun presents the excerpts

The listing of Guaranty Trust Holding Company Plcon the London Stock Exchange (LSE) speaks a lot about how far Nigerians companies have come. What does it mean to you as an exchange?

Alright, thank you. So, when you think about what we do at the NGX, we are a platform provider that will enable issuers to raise capital. And at the same time, we have a lot of investors on the retail side and institutional side, both international and domestic, that provide this capital to the issuers.

As a multi-asset exchange, we try to use different asset classes for these issuers, from equities, to fixed income, to ETLs, and more recently now, derivatives.

Now, so, we are also mindful about regulation, as a listing destination, right? So, investors’ protection is key, so that investors can be protected as the issuers undertake these issuances that they do. And from a governance perspective, I think GTB Bank has, or GTCo has demonstrated a strong governance structure.

Even as a listed entity on the NGX, you see that a lot of internationals buy their shares because of the heightened level of corporate governance the company undergoes. And now that they are listed on the London Stock Exchange, we see it as a good thing, in terms of the level of governance that will go through here. But beyond that, we think it will also help create more liquidity for the shares that we have.

As you are aware, we have an MOU with London Stock Exchange, so this is not the first company to undergo this sort of arrangement. We have Seplat, we have Airtel. You can see the level of liquidity those companies continue to enjoy.

So, it’s a good thing. We congratulate GTCO for taking this initiative to list on the London Stock Exchange. We believe that it will help also position them to be able to attract more international capital, which is, at the end of the day, the essence of exchange listing.

We also think it will help improve liquidity, not just for international institutional investors, but being listed on the LSE we expect them to also have access to retail investors on the LSE. You will recall that they had done a GDR that led to the metamorphosis of this initiative. So, we think that from the MOU we have London Stock Exchange, we are beginning to see the benefits of such interaction.

At the end of the day, what we expect is listed corporates should have good corporate governors. And if you think about what is going on now around ESG, we see companies that have ESG policies attracting a lot of liquidity. So, we are really happy that this will also help other institutions to begin to look at emerging trends as they structure and position their companies.

It is not about profits anymore. It has to be a careful environment, it has to be careful governance, and it has to be social impact. GTCO has demonstrated that and we believe that it’s a good thing, not just for the exchange, but for the entire country.

It puts Africa in a good light because it’s a proudly Nigerian company with an international focus. And we do have a lot of companies, even in the banks, who also have international focus. So, we think that this will open up more opportunities in that space.

Now, you talk about ESG governance, what are you doing as an exchange to get more listed companies to abide by this new trend?

So, the exchange is very committed to sustainability. First, we are a member of the UN Sustainable Stock Exchange Initiative. We also have these sustainability guidelines that we have issued for corporates to follow.

It is not compulsory, but for them to see the value in it. And we have seen a lot of corporates, SEPLAT, MTN, go that route, and we can see what it does. A lot of investors are interested in such companies, and they have this sense of market equity.

The other thing to also bear in mind is the Sustainability Standard Board adoption. We have done a lot of trainings, and we will continue to do trainings through our regulatory arm as an exchange, so that corporates understand their obligations, their financing, post-job. We have our ex-academy, which is our learning arm, that has been significantly involved in all these things, working with the UN Sustainability Stock Exchange Institution to provide the required trainings as companies begin to adopt the sustainability standards in their financial reporting.

We will continue to do more of that, because businesses, as you very much know, have since moved from profitability to sustainability, and we encourage listed corporates to do all these things in line with international best practices, all in a bid to get more investors, because international investors are now moving along those lines. You will also recall that we are very much involved in sustainability on its own. Recently we had a sustainability engagement with IFC.

We do have an MOU with International Finance Corporation (IFC), and it’s also trained corporates around the use of sustainable or laboured bonds to raise capital. So we talk about the green bonds, we are working with the Federal Minister of Environment, we are also working with the blue economy to ensure that they are able to raise bonds along their line of interest to be able to meet some of those climate-related issues. Nigeria is in a very position where we think that because of the strong domestic PFA that we have, companies and governments will be able to raise capital along these lines of sustainability – green bonds, blue bonds – and you will see a lot more engagement from this change along those lines.

The stock market is thriving despite the high interest rate, as against the norm where the stock market is bullish when you have lower interest rates. What would you say is responsible for this, and do you think this will continue?

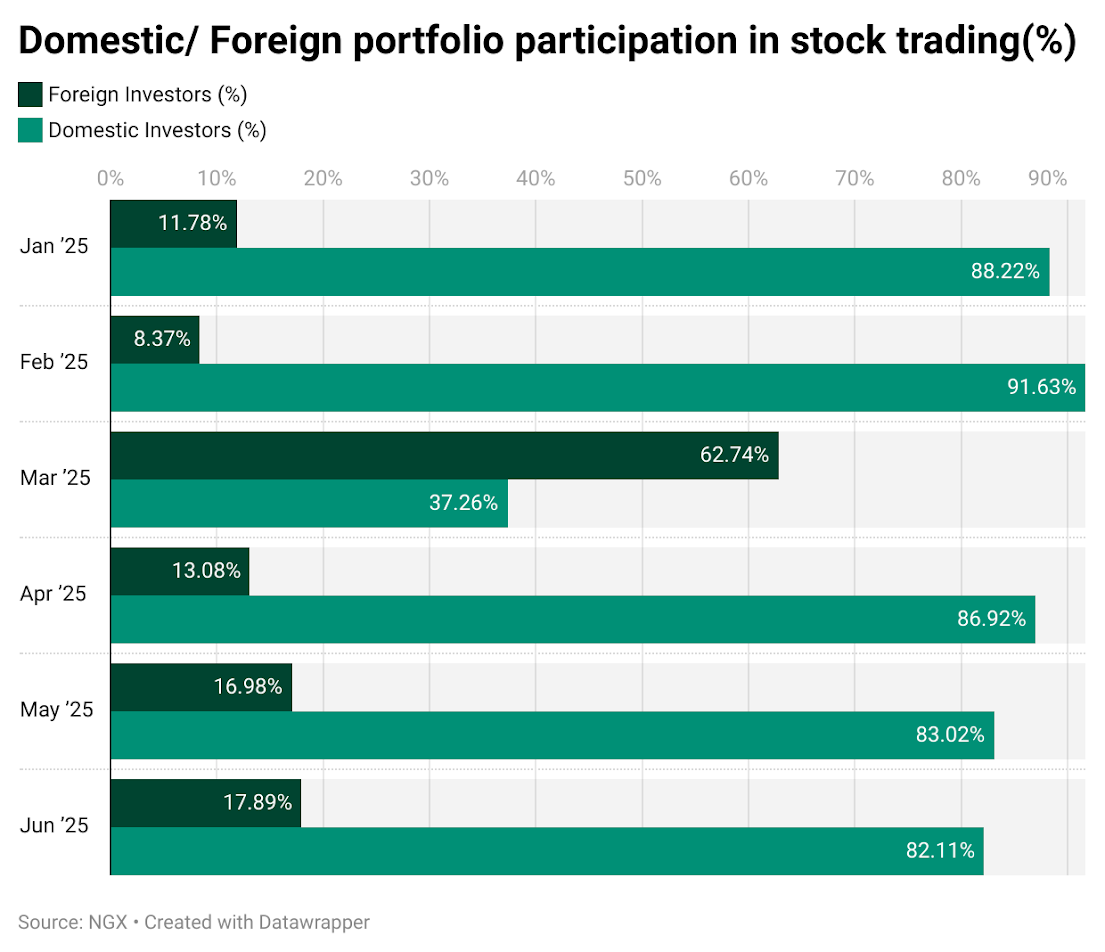

So, when you look at the market, the market is a barometer of the economy, so it’s forward-looking. So all the various reforms that this government has undertaken in the last couple of months is basically what the market is reacting to. Away from the devaluation, assets have been reprised, high inflation, so equities is not an exception, it’s also an asset, and if you see the prices of goods and services, they’ve all gone up, so you expect equity prices to also adjust with that. But what is really driving the interest? If you think about what the percentage of international investors in our market was before the election, it fell to 4%.

Last year, it came to 15%. This is a market, traditionally, where you have 50% international participation in the secondary market and 50% domestic. Falling to 4% was as a result of weak macro and FX illiquidity.

You can see that the FX liquidity issue has improved significantly. So, year to date, international participation in our market is in the region of 30%. So there has been renewed interest, just from a liquidity perspective.

If you think about where we fall as a market, as a frontier market, you look at the dynamics, the PE ratio of our market, the dividend yield of our market, our market is still grossly undervalued. What was hampering it was low demand, orchestrated by these FX challenges. Now that that appears to have been resolved, we can now begin to see the market take form.

And being a barometer of the economy just shows you how the economy is improving, because people are buying it and these are long-term assets that are being bought with a long-term view. So it shows you that there is renewed confidence in the market, because all these internationals are coming back, because they can see the impact of the reforms. And this tax, recent tax bill, just adds more to it, because it will help preserve some form of savings, and we expect to see more retail investor participation. The banking recapitalization and the use of technology to drive participation that we did last year, is also one of the many things that have helped improve participation in our market, from the institutional side, also from the retail investor side. We have a market of 3 to 4 million retail investors. Active number of retail investors two years ago was less than 100,000.

Today that number, because of the digital platform that we use for the bank’s recapitalization, the number is close to a million retail investors. So you will see more investor participation from retail to institutional, domestic and international in our market, as the market plays catch-up to the depression so far as a result of weak macro, which is improving, FX liquidity, which is now a lot better than it was before. Will it continue? As you are aware, the market responds to several things, apart from the performance of the company, there’s a market here, there’s supply and demand.

From the exchange perspective, I think the regulation of the market is also one of the things that builds confidence. The market is well regulated. In the last couple of years, we haven’t had any significant infraction of the market because of heightened regulation the exchange has adopted.

But beyond that, the technological backbone of the market is also critical. In the last six years, we have never had a downtime. There has never been a day where we haven’t been able to trade because we have a robust trading platform, world-class, NASDAQ that we use.

And we think that the call is really for more companies to be listed. So we have engagement with Morphy, which is the Federal Ministry of Finance, incorporated, and their conversation around government listing their parastatals. You are aware of Dangote refinery, he has said he wants to list on the exchange.

He has talked about also listing the fertilizer company. We think that liquidity begets liquidity. From a market of less than $6 million, we currently trade $11 million.

Our plan as an exchange is to use technology to drive more inclusion, help more companies list, relax our listing rules, ensure that more companies list, and that will help improve liquidity, and we can easily move to $100 million a day where we should be as a frontier emerging market, given the size of our economy.

GDP to market cap is significantly low, and that is because governments and a lot of corporates are not utilizing the market fully. But we have spent all this time laying the groundwork to ensure that you have good governance, you have the right technology, you have the right products. We are not just an equities market, but different asset classes that you can use. And we think that that will help corporates to take advantage. Non-interest finance is one area you also have to be mindful about.Government has used it to raise over a trillion naira. Recently, they were looking for $360 billion, and they got a subscription of almost $750 billion. That shows you that there is a buy side. So we are working with Islamic Development Bank to create awareness and trainings for corporates to take advantage of this non-interest. It’s not an Islamic or Islamization of the economy. It is a funding dynamics that talks about Sharia principles. And corporates can use it to raise capital, to finance. Government is using it through Sukuk to refurbish the roads. So we expect all these thematic channels to help companies to raise capital.

So we shouldn’t be too fixated on equity capital raised as an exchange, because we are really a multi-asset exchange. Our market cap, fixed income market cap, is not too divergent from our equity market cap. So we have a very strong fixed income market, and corporates can utilize that to raise capital. High interest rate environment has made it impossible for corporates to use bonds, and they are going to commercial paper, because no corporates want to issue a five-year bond at such high interest rates. But we do believe that the high interest rate was required because of the effects of volatility and liquidity. But you can see that that trend is reversing.

Treasury bills are coming down. We think it will continue to go down as the economy normalizes, and that will force government to start issuing bonds at a much lower rate, and we can now see a more vibrant bonds market. So we are really excited about what the government has done around policy.

I was talking to someone, I said it is like somebody who has a broken bone. There is no way you can fix that without pain. You can’t just go and bandage it and say you don’t want the person to suffer pain.

It’s going to be worse. The bone needs to be put on a cast, and the process is painful. Nigeria is going through a painful period because of the many reforms, but we believe that it’s a good end, and we just need to stick to it. Because one thing about reforms is if you start, you need to complete it, otherwise it causes more problems. So we think that government is really on the right path. It is painful for everybody, but it is to a good cause. We’re beginning to see the FX market. I mean, the volatility in the FX market didn’t allow people to plan, but with the stability we are seeing now, even the interest of international Islam market is a demonstration of the fact that there’s a bit of acceptance of the policy that the government is running. We believe that in the long term, the market will take its rightful place.

Corporates will be able to raise capital, utilizing different asset classes, whether it’s equities they want to do, whether it’s bonds or ETFs. Our role as an exchange is to provide an enabling environment to make sure that investors are well protected and that issuers abide by the right code and the right governance structure. If they have the right technology. The recapitalisation that the banks did, with the mobile phone, people could complete the whole process end-to-end. You can open an account, make your subscription, make your payment. That helped improve the participation of retail investors.

The target is to be at five million. We are working towards that as we utilize technology. Investor education is also critical, right? Because during the financial crisis, a lot of investors got burnt because they didn’t really understand there’s a difference between speculation and long-term investment.

But through our ex-academy, through our secondary market, we have been having a lot of investor education so that people understand and do not mismatch their investment objectives. We don’t expect somebody who is 50 years and over to be speculating actively in the equities market. So that is why we are creating all these products that will allow them to find their objective and ultimately grow their wealth as they preserve value for their portfolios.

And that is one area that we take very seriously. Working with different bodies, ASEA, as you know, is Association of Securities Exchanges in Africa, right? So that has been very helpful because now 22 markets are linked in Africa. And that helps investors through a seamless portal to invest in other markets. It is at the early stage, but ultimately we expect issuers to be able to utilize that platform. So if you are issuing shares in Nigeria, you should have investors across different African markets participating in such issuance in the future.

Alright, now back to this LSE listing of GTCO shares. Are you worried that many Nigerian and African firms are not listed here? And what do you think is the reason in your own view?

So, from a market perspective, you have to understand that it is a prerogative of the issuers where they list. And typically what drives that is several things. It could be visibility, it could be liquidity, and it could be part of their strategic focus.

Because not every company has international aspirations. What we have done as an exchange is to provide our part, through this MOU we have the London Stock Exchange for companies that have such aspirations to be able to undertake it. And we can see GTCO completing their own process. SEPLAT has done it. Oando has done it with Johannesburg Stock Exchange (JSE) because we also have an MOU with Johannesburg Stock Exchange. So, the Nigerian exchange is committed to opening to our markets so that our listed corporates can have access to as many international markets as possible.

Partnership remains one of our cardinal strategic focus. So, even today we are having conversations with Abu Dhabi Exchange, NASDAQ Exchange, because we want to open up our markets so that investors who utilize our markets can have access to capital across different markets. Our involvement with World Federation of Exchanges, our involvement with ASEA, all of this is to ensure that the exchange as a platform is able to cater to the needs and aspirations of domestic companies.

And you have to recall that our ETF market is the second largest ETF market in Africa. And we are quite mindful and intentional about how we position these partnerships. So, are we worried that companies are not taking advantage of the MOU? No, we are not because companies will work according to their own strategic objectives.

But we are happy that we are able to assist companies that have such aspirations to meet those aspirations. And we will continue to work along those lines that will allow corporates to meet their aspirations. Corporates today can raise fixed income, they can raise bonds on our market, they can raise green bonds, they can raise non-interest finance bonds, they can raise ETFs.

All of this is to ensure that we help the corporates achieve their ultimate goal. And we are happy with the MOU we have with the London Stock Exchange because it provides visibility and heightens investor confidence around the governance structure. At the exchange, we will continue to work, bearing in mind that we are also a member of the larger community, which is World Federation of Exchanges, to ensure that our market is international, to be able to cater to the needs and aspirations of companies that come to our exchange to list.

But beyond that, also investors, we invest in our market to have access to products, viable products that will help not only grow their wealth, but also help preserve their wealth along lines of FX-related challenges, which is not peculiar to Nigeria, by the way. That is an emerging global market issue. But we are mindful of that, and that is why we are creating products that will help and provide a path for investors to be able to preserve their wealth.

So we are happy with what we witnessed today, and we believe that it is a testament to our demonstration as an exchange that we are internationally focused. And we believe in partnerships that is progressive, that will allow corporates to meet up with their aspirations and objective institutions.