Low investment and risks with high profits are promises that most automated systems spout to attract traders. This includes signal service providers too. Center Forex is one such signal service that assures low initial investment and consistent profits. The system offers 24/5 customer support and regulated brokers.

Priced at $250 per month this system is considerably expensive when compared to prevailing signal providers in the market. Are you considering using this type of system for your trading? Before you do so, have a look at what our expert reviewers have to say about this service.

Centre Forex Trading Strategy

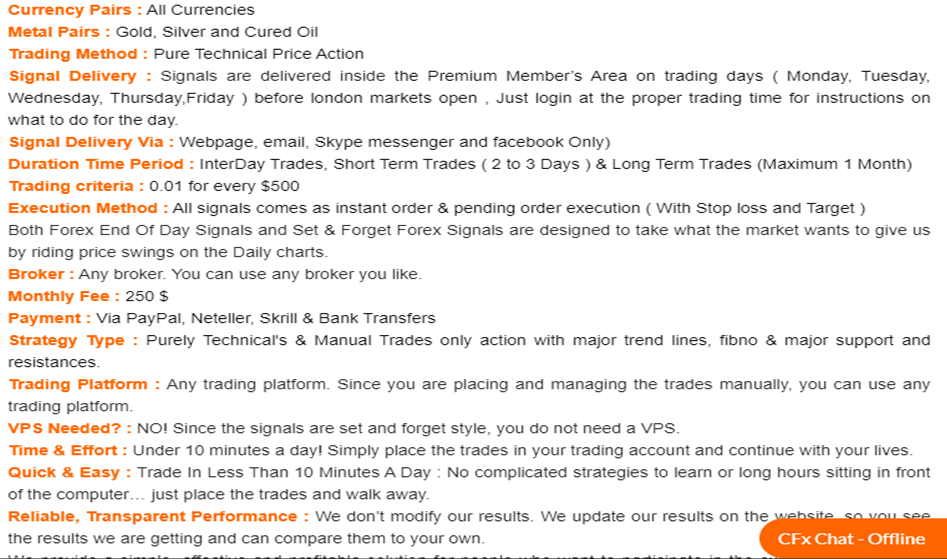

With an assurance of a profit exceeding 50,000 pips, this signal service requires registration and activation of the account after choosing from the basic or the standard packages the system offers. Signals are sent via email, Facebook, and Skype.

Compatibility with MT4 and other platforms is present. Notifications are sent concerning the Stop loss, take profit, and trade settings. The vendor claims to have a target pip of 2500 per month and guarantees users of more than 1000 pips every month.

As for the strategy used, purely technical analysis is performed with the use of trend indicators, key support and resistance, and Fibonacci pointers. No further explanation is provided on the strategy used, which is disappointing as this seems very negligible to form a clear opinion of the system.

Centre Forex Features

This system delivers signals twice daily and focuses on only the signals that provide a risk to reward ratio of 1:1. A predefined take profit and stop loss level are used and this is subject to change according to market conditions.

Besides focusing on all currency pairs, the system also works with metal pairs such as silver, gold, and crude oil. Signals are sent before the opening of the London market and trades used include intraday, short, and long term up to one month. The criterion for trading is 0.01 for every $500.

Besides providing signal alerts, this system also has a signal copier service and runs managed accounts as well as Forex analysis.

Centre Forex Backtesting Results

Strategy test reports of this system are not revealed, which is surprising since the vendor mentions having over 10 years of experience in the field. Backtests reveal details on the performance of the system and the efficacy of the strategy. With no backtests it is difficult to evaluate this service properly.

Centre Forex Live Trading Results

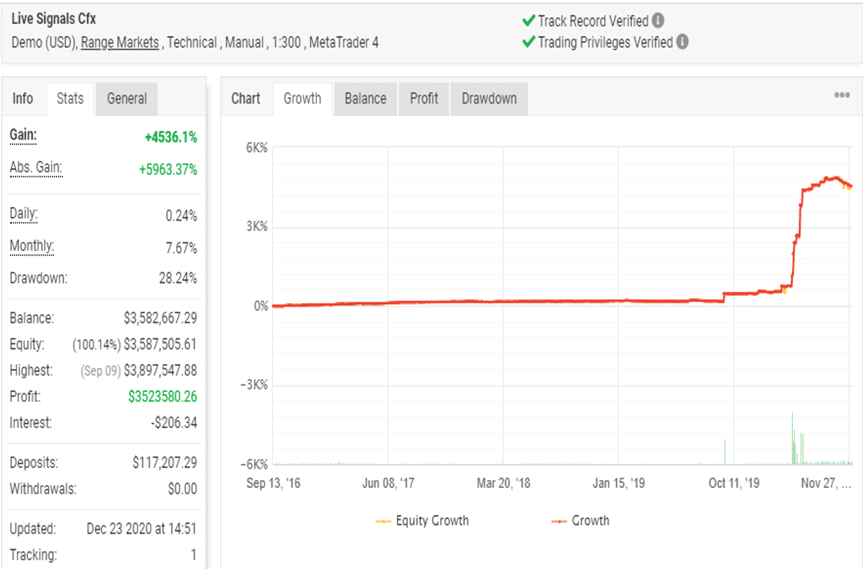

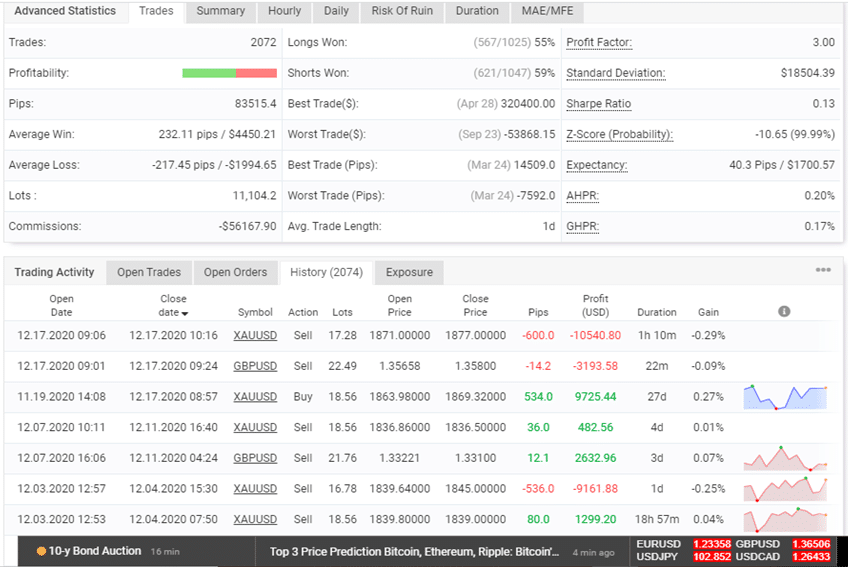

A demo USD account traded using Range Markets broker with leverage of 1:300 on the MetaTrader 4 platform. The manual trading account has its track record and trading privileges verified on the myfxbook site.

From the screenshot of the results shown above, the system reveals a total gain of 4536% and an absolute gain of 5963.37%. We could not glean a reason for the difference in the two values as they should be more or less the same.

Other stats of this trading account include a daily gain of 0.24% and a monthly gain of 7.67%. A 28.24% drawdown is revealed, which is slightly on the higher side.

One day is the average length of trading for this system and the profit factor is 3.0. From the trading history, we could see huge lot sizes, which is not at all a feasible option for most traders. And, this is contrary to the claims of the vendor that only minimal risk is exercised for the trades.

Centre Forex Reputation

From the info provided by the vendor, this provider launched the signal service in 2000. Some of the features of this system include intraday signals and management of PAMM accounts. Additionally, the vendor also operates a managed account service.

However, there are no other products from this vendor. No info is provided on the developer team or the vendor location. Other than a contact form on the official site, the service provider does not offer location or phone contact details. This lack of transparency about the developer and the strategy makes us suspect that this is not a reliable system.

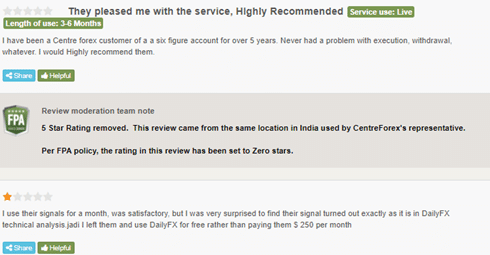

The feedback from users just serves to confirm our doubts about the efficacy of the system. From the screenshot of the user reviews posted on the Forexpeacearmy site, it is clear that the system is an expensive one that resorts to manipulating reviews from users. Furthermore, the efficacy is more on par with the manual trading done by systems like Daily FX, which is a free trading system.

Centre Forex Review Summary

- Strategy – 4/10

- Functionality & Features – 4/10

- Trading Results – 3/10

- Reliability – 3/10

- Pricing – 4/10

Conclusion

Wrapping up our Center Forex review, this system reveals plenty of shortcomings. To begin with, the strategy used in the manual signal generation system is not explained properly. From the trading results verified by the myfxbook site, we could see several discrepancies, such as the absolute gain and the gain percentage showing a large difference, huge lot sizes, and more. The approach used is a high-risk one contrary to what the vendor claims. And, the feedback from users just confirms our assessment of the system not being a trusted one.