The Central Bank of Nigeria’s call for backward integration in the telecom industry comes at a time the real sector is in dire need of sustainable growth, writes Oluchi Chibuzor

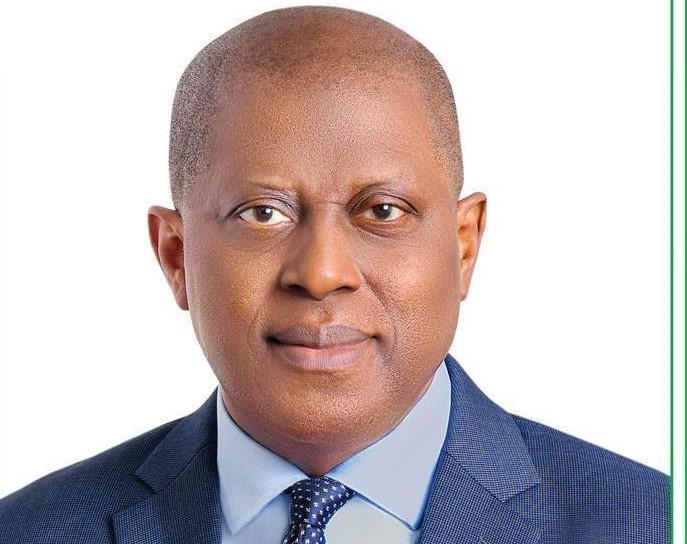

Last week, the Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso advised telecom companies to reduce their dependence on foreign imports by producing key components of their inputs locally. He spoke in Abuja during a visit by Airtel Africa’s management team, led by Group CEO Sunil Taldar. Cardoso stressed that local production would help reduce pressure on the dollar, create jobs, and boost Nigeria’s economy.

The backward integration proposal for the telecom industry comes at a time the real sector is in dire need of sustainable growth. For many analysts, despite challenges facing local manufacturing, it continues to hold long-term benefits for stable and strong naira as well as economic growth. Telecoms sector remains central in achieving these milestones.

Nigeria stands at a crucial juncture where the need to promote local manufacturing has never been more urgent. As the businesses and economy gear towards growth and development, promoting local manufacturing will not only create jobs, earn more forex from exports and support local currency, it can serve as a catalyst for economic and social progress.

This however, requires a delicate balance: ensuring that key players in the economy, including the telecoms embrace backward integration, a strategy where companies source and produce essential materials locally instead of relying on imports. They need to rely less on imported raw materials for their operations.

CBN Governor, Olayemi Cardoso gave insights on what the economy stands to gain from backward integration in the telecoms sector.

He said that massive production of key inputs, that are currently being imported, like SIM cards, cables, and towers is essential.

He noted that over the past 16 months, the CBN has worked to stabilise the foreign exchange (forex) market, strengthen the Naira, and attract investors. With these improvements, he urged telecom firms to embrace backward integration.

Beyond industry reforms, Cardoso noted the CBN’s broader goal of making financial services more accessible to Nigerians, especially in rural areas. He announced plans for a high-level summit where the CBN and industry leaders will discuss ways to improve digital payments and financial inclusion.

“The CBN is committed to ensuring that financial services reach more Nigerians, especially in rural and underserved communities. We aim to build a more inclusive and digitally-driven financial system,” he said.

He also assured Airtel and other stakeholders that the CBN would continue to create a business-friendly environment that encourages competition, innovation, and wider access to financial services.

In response, Airtel Africa’s CEO, Sunil Taldar, praised the CBN’s reforms and expressed support for local production, saying it would benefit telecom companies in the long run. He also reaffirmed Airtel’s commitment to expanding financial inclusion through technology.

Taldar was accompanied by Airtel Nigeria CEO, Dinesh Balsingh; Group CFO, Jaideep Paul; and Director of Corporate Communications and CSR, Femi Adeniran.

Naira upbeat against all odds

Meanwhile, the naira closed last week at N1,509/$1 at the official market, following key policy changes at the CBN.

The naira has sustained rally at both official and parallel markets since the launch of the FX Code, with the local currency, reaching its strongest level in nearly eight months, closing at N1,555 to dollar at the parallel market.

Analysts from Cordros Securities, said the sharp increase is attributed to the policies implemented by the CBN, especially the FX code, which have influenced market dynamics and contributed to the currency’s strengthening.

This latest movement marks a return to that range, reflecting the impact of recent monetary and foreign exchange measures introduced by the CBN to stabilise the currency and improve market confidence.

Managing Director, Afrinvest West Africa Limited, Ike Chioke, projected a sustained positive naira performance this month, supported by CBN’s efforts at entrenching transparency in market operations. “In the new month, we expect the naira to remain on a positive trajectory bolstered by CBN’s effort at currency stability,” he said in emailed note to investors.

The naira rally was also driven by inflows from Foreign Portfolio Investors (FPIs), substantial contributions from International Oil Companies (IOCs), and the CBN’s $18.40 million intervention to authorised dealers.

Other analysts also mentioned the renewed interest of Foreign Portfolio Investors (FPIs) in the FX market — driven by improved market confidence, a more efficient FX framework, and strengthening macroeconomic conditions — alongside the CBN’s sustained market interventions, is expected to continually support naira stability.

Beyond Backward Integration

The CBN under Cardoso has carried out several efforts to improve the functioning of the FX market.

This has led to good results with average daily turnover in the Nigerian Autonomous Foreign Exchange Market increased by 226 per cent in the first half of last year when compared to the same period in 2023.

Foreign portfolio inflows have increased by over 72 per cent during this period, while foreign exchange reserves have risen from $32 billion in May 2023 to over $40 billion.

This represents the equivalent of eight months’ import cover and marks the highest reserve level in nearly three years.

The market has also supported over $9bn in capital outflows over the past year as investors were able to freely repatriate capital and dividends without the need to wait for several months as experienced in the past.

These results, Cardoso said, reflect improved confidence in the reforms he embarked on.

“In addition, we witnessed a $6 billion current account surplus in the first half of 2024 as a result of the impact of these reforms. Reduction in petroleum product imports supported by improved domestic refining capacity, a growing focus on non-oil exports and higher remittance inflows helped to support the positive current account balance,” he said.

Also, an enabling policy environment has led to a doubling of monthly remittances from an average of $300 million in 2023 to nearly $600 million in August 2024.

“We are committed to further integrating the Nigerian diaspora into our financial system, exemplified by the introduction of the non-resident Bank Verification Number registration. We expect our financial institutions to develop products that not only enable the diaspora to support their families but also provide opportunities for savings and investment in Nigeria,” he said.

Views from stakeholders

Executive Secretary of the Association of Licensed Telecommunication Operators of Nigeria (ALTON), Gbolahan Awonuga, said that aside telecom operators, other key business owners and entrepreneurs can also invest in the local manufacturing of key components in telecoms operations.

He said: “We have to look inwards and get Nigerian companies to produce these key components in telecom operations locally. Government also has a role to play, by ensuring that key infrastructure especially power is available. We do not want a situation where locally produced inputs, will become more expensive than imported versions.”

Awonuga said that telecom sector plays key roles in banking services, including enabling digital payments and ensuring security of transactions.

He said banking and telecom sectors have more to gain if backward integration thrives in the country adding that government has significant role to play to make the move a success.

Research Head, Cowry Asset Management Limited, Charles Abuede, said the CBN governor’s call was to discourage the importation of foreign services into Nigeria, especially when efforts can be made to develop such services locally.

“The high demand for foreign exchange by telecom operators has further pressured the naira due to increased demand for the dollar. However, with adequate infrastructure development and a conducive operating environment facilitated by regulators, these challenges can be mitigated,” he said.

According to Abuede, “given Nigeria’s FX policies, illiquidity in the foreign exchange market, and infrastructure deficits, I think increased investment in the telecom sector would enable operators to embrace backward integration. This would allow them to manufacture key components, such as SIM cards, locally. As a result, production costs could decline — provided the operating environment remains stable. This will improve profit margins and enhance both top-line and bottom-line growth in the long run.”

Understanding Telecoms Sector

According to the Nigerian Communications Commission (NCC), the total active telephony subscribers increased by 3.2 per cent month/month to 164.93 million in December 2024.

The increase reflects the gradual recovery in the subscriber base following the conclusion of the NIN-SIM linkage program by mobile service providers in September.

Analysing the market share by operators, MTN Nigeria led by 51.4 per cent with 84.61 million subscribers, Airtel Nigeria followed with 34.4 per cent (56.62 million subscribers), Globacom with 12.2 per cent (20.14 million subscribers) and 9mobile with 2.0 per cent (3.28 million subscribers).

At the same time, the total number of internet subscribers rose by two per cent month/month to 139.28 million in December.

Looking ahead, analysts at Cordros Securities, said they expect subscriber base recovery through SIM reactivation initiatives, especially from market leaders – MTN Nigeria and Airtel Nigeria.

According to the National Bureau of Statistics (NBS) third quarter 2024 Gross Domestic Product (GDP) report, the Information and Communication sector, is made up of Telecommunications (telecoms) and Information Services; Publishing; Motion Picture, Sound Recording and Music Production; and Broadcasting.

The sector recorded 14.51 per cent (year-on-year) growth, which was 2.65 per cent points higher than the rate recorded in the preceding quarter.

The sector contributed 16.35 per cent to the total real GDP, higher than in the same quarter of the previous year in which it represented 15.97 per cent and lower than the preceding quarter in which it represented 19.78 per cent.

The reforms embarked on the telecoms sector by the NCC -led were meant to align the sectoral guidelines with international best practices and accommodate the rapidly changing technological landscape.

According to capital importation data from the NBS, the telecom sector attracted $191.5 million in Foreign Direct Investments (FDIs), indicating renewed confidence among foreign investors.

The data indicated that the Q1 2024 figure surpasses the total FDI of $134.75 million recorded in 2023. Compared to Q1 2023, the sector saw a 769 per cent year-on-year increase in capital importation, rising from $22.05 million to $191.5 million.

The transformation within the telecommunications sector was not just limited to a comparison with the previous year. Comparing the Q1 2024 figure of $191.5 million to the $22.84 million recorded in the preceding quarter, Q4 2023, the sector demonstrated a 738 percent growth rate.

This remarkable rebound in FDIs has been attributed to a series of strategic measures implemented by the Nigerian government, which aimed to enhance the sector’s appeal to foreign investors.

Analysts said the CBN’s proposal will further put the sector on the path of growth and support for the domestic economy.

They however, advised that a positive investment climate characterized by clear, fair, and well-enforced regulations should be entrenched for optimal results.

Quote

“Nigeria stands at a crucial juncture where the need to promote local manufacturing has never been more urgent. As the businesses and economy gear towards growth and development, promoting local manufacturing will not only create jobs, earn more forex from exports and support local currency, it can serve as a catalyst for economic and social progress. This however, requires a delicate balance: ensuring that key players in the economy, including the telecoms embrace backward integration, a strategy where companies source and produce essential materials locally instead of relying on imports. They need to rely less on imported raw materials for their operations.”