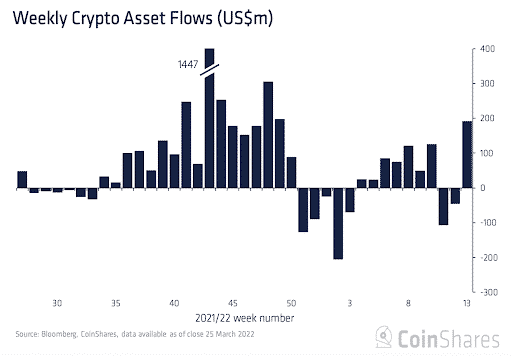

(CoinShares) The total inflows of digital assets into institutional investments were $193 million last week, the highest level since early December last year.

The sharp rise in inflows is a quick turnaround after institutional funds saw a total of $47 million outflows the previous week.

Slightly over 50% of the capital was allocated to Bitcoin related products, with around $98 million of fund flows.

Solana saw $87 million worth of inflows, its largest weekly on record, while ETH-based funds posted inflows of $10.2 million.

Around $147 million of the digital asset inflows were from Europe, with optimism in the region growing following the news that a measure seeking to ban proof-of-work mining was overthrown.

The rising inflows, especially into BTC related products, has coincided with the overall crypto surge, with the price of Bitcoin surpassing $48,000, while Ether rose past $3,400.

BTCUSD is up +0.97%, ETHUSD is up +2.45%.