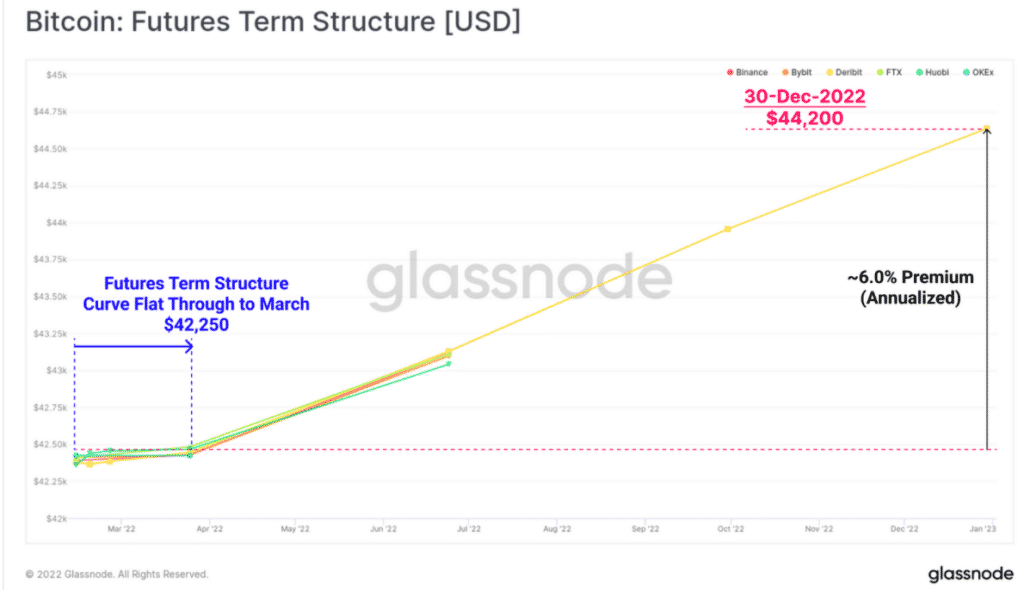

(Glassnode) Bitcoin’s futures term structure curve is flat through March as investors take steps to protect from the downside of higher interest rates.

Glassnode reports that amid the flattening of the term structure curve, futures premiums are relatively low to the end of 2022, with the market preferring protective put options.

On-chain supply dynamics are still reported to be stable, a situation Glassnode says indicates that investors are prepared to ride on the potential storm ahead and are utilizing derivatives to reduce risks.

Glassnode says the ongoing dynamics are indicators of the maturing Bitcoin market, with comprehensive risk management instruments becoming available amid deepening liquidity.

Amid the hedging moves, spot holdings and on-chain flows are said to be stable, with no indications of mass exit caused by panic or fear.

The annualized premium on futures premiums is said to hover around 6% suggesting a lower risk appetite even as investors remain cautious and do not expect a significant bullish run through the end of the year.

Total futures open interest has also fallen to 1.76% of the total crypto market cap, from 2%, attributed to de-risking moves by investors.

BTCUSD is up +3.94%.