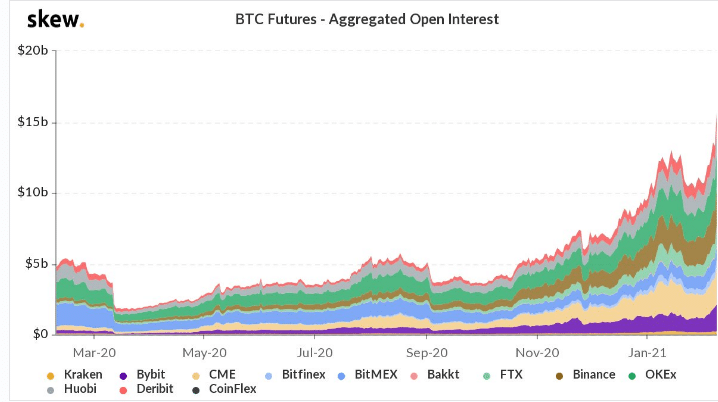

Bitcoin futures open interest hit a new all-time high above $15 billion on Tuesday, according to Bitcoin.com. Recently launched ETH-based futures on Chicago Mercantile Exchange also recorded $33 million contracts on the first day.

- Tesla’s $1.5 billion worth of investment in bitcoin caused the massive demand for BTC futures

- Analysts believe that “short positions are being unwound by leveraged funds on CME bitcoin futures.”

- ETH rose to a 2021 high at over $1,800 per token following the introduction of ether futures on CME

- Genesis Global Trading CEO Michael Moro considers the CME launch as a bolster to digital currencies and has been critical in the recent rally.

Bitcoin and Ethereum futures are currently declining, BTC1! is down 5.97%, ETH1! is down 2.77%