Bank of America sees an imminent correction in steel prices after surging to a record high of around $1,500 a ton, according to CNN Business. Analyst Timna Tanners has called the recent surge a short-term bubble.

Steel prices bottomed out at $460 last year and the current price is nearly a triple of the 20-year average.

Steel has now surged 200% in only 12 months and analysts warn it is a matter of time it crashes.

Recent steel prices have been linked to scarcity and speculation and Tanners sees a reversal once supply catches up.

U.S steel production which was idled by the coronavirus pandemic is believed to have returned, which could end shortage and cause prices to fall.

Steel prices are also likely to be weighed down if the Biden administration rolls back import tariffs imposed by Trump in 2018.

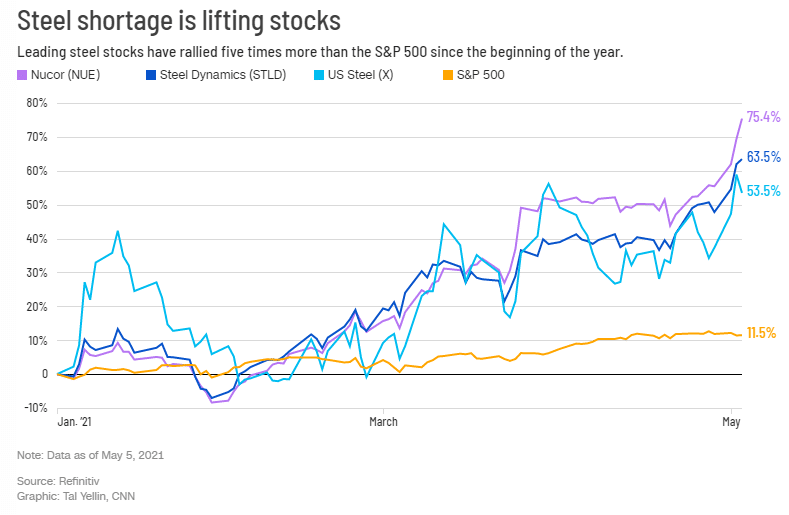

Steel scarcity is believed to be behind the recent uptick in stocks, with the Fed previously warning of the risk of overspeculation.

U.S Steel is currently gaining. X is up 3.04%.