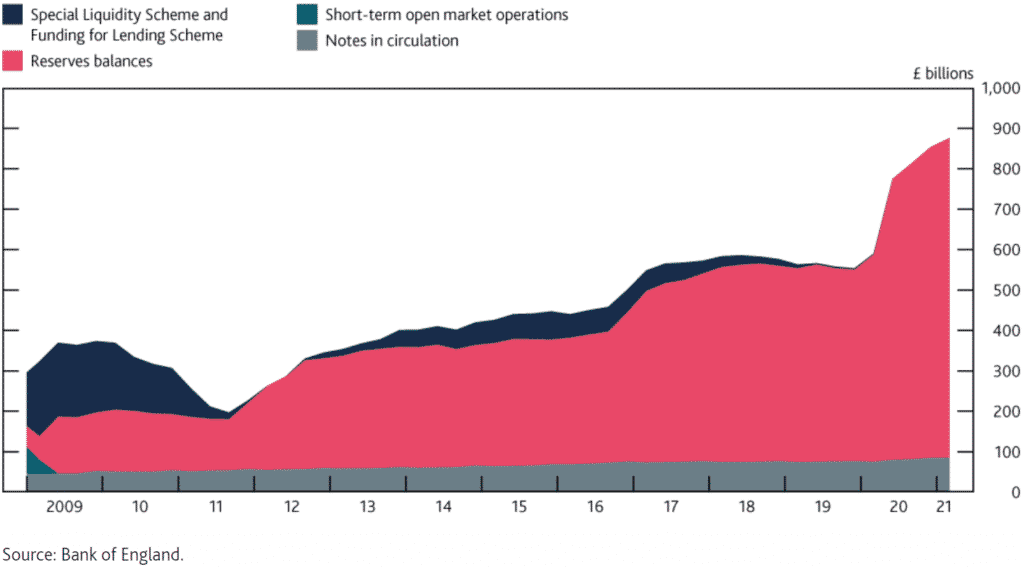

(BoE) The Bank of England boosted the reserve balances on the balance sheet to a record of almost 900 billion pounds following the asset purchase program launched in March 2019 in response to the Covid-19 pandemic.

BoE estimates that by the end of the fourth quarter of 2021, the target stock of asset purchases will reach £895 billion.

APF gilt purchases comprise the majority of assets held in BoE’s balance sheet. Other assets included Funding for Lending Scheme, Covid Corporate Financing Facility, Term Funding Scheme, Corporate Bond Purchase Scheme, and Indexed Long-term Repo Facility and Contingent Term Repo Facility.

To deliver on the record reserves on the balance sheet, BoE initiated about nine times the number of market operations every month by May 2020.

BoE reduced the bank rate from 0.75% to 0.25% on March 10, 2020, before lowering it to a record low of 0.10% on March 19, 2020.

GBPUSD is up +0.35%, FTSE 100 is up +0.059%.