(Bloomberg) Beijing market regulators plan to thwart foreign listings of Chinese companies by introducing rules that mandate firms to seek approval.

The revised rules mandate companies operating under the Variable Interest Entity model to seek approval even when selling additional shares in the offshore market.

Targeted firms include units selling shares even if they are incorporated outside China.

The proposed change revises 1994 rules on overseas listings, in a move that closes long-used loopholes by tech giants to go public in foreign lands.

The proposed rule change could be a blow to companies such as ByteDance which is contemplating going public outside China’s mainland.

If China succeeds in the move, it could threaten business relations for Wall Street’s top banks and add to the growing tensions between Beijing and Washington.

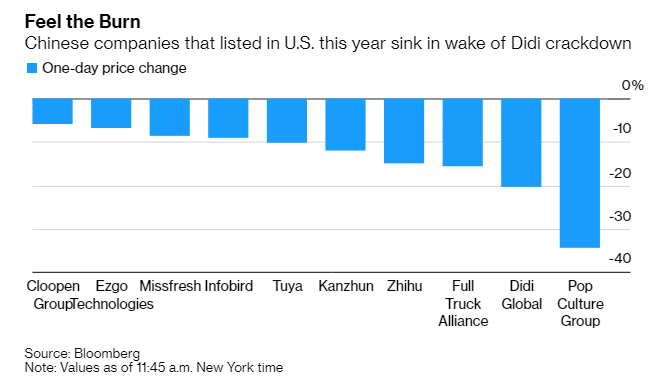

Beijing’s move reflects the continuing crackdown on the tech sector, with 37 Chinese companies already listed in the US this year, generating about $12.9 billion.

CSI 300 is up +1.13%, USDCNY is down -0.11%