(Financial Times) BlackRock and HSBC increased their holdings in Evergrande bonds a few months before the liquidity crisis hit the Chinese developer.

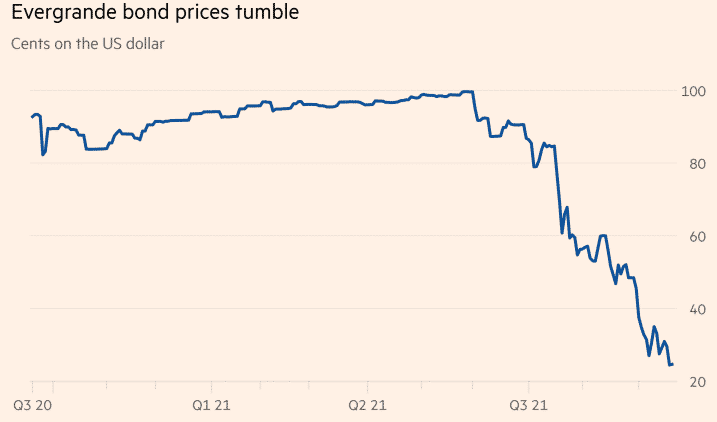

Fig: Evergrande Bond Prices

BlackRock, through its high-yield fund, which had an $18 million stake in Evergrande at the time, purchased five different dollar bonds from the group to raise its exposure to $400 million.

HSBC’s high yield fund increased its bond holdings by 38% from February and had an initial value of $31 million before a decline of Evergrande.

Analysts expect that many investors will have some exposure to the developer since its bonds are a big part of the indices tracking dollar-denominated Asian Company debt.

Evergrande bonds have traded at distressed levels as the group tries to avoid a default of maturing obligations.

The developer has been under scrutiny for its position as the most indebted property developer in the world.

3333: HKG is down -0.44%.