Analysts are least worried of massive Bitcoin sell-offs by miners, saying that the miner’s net position change has entered the neutral zone.

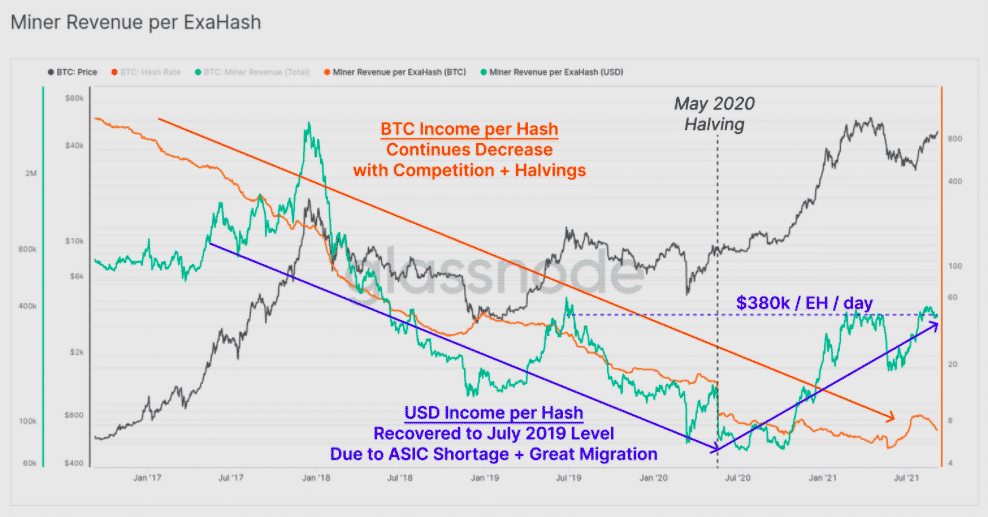

Fig: Miner Revenue per ExaHash

Panic gripped Bitcoin markets after a restriction on mining by China pushed miners out of the market, with the hash rate now at 128 EH/s, which is 29% below its all-time high.

Analysts are now optimistic, saying that with the reduction in miners, few are competing to generate the same number of coins, pushing the US revenue per hash back to July 2019’s $380k per exahash.

There is also the expectation that a fair portion of revenues withdrawn by miners from Bitcoin has been set aside for hardware acquisition and facility expansion that could boost prices.

Analysts now say an equilibrium has been established between miner accumulation and their spending, which will support prices. The sell-side pressure has been taken care of by the market, and Bitcoin would be least affected unless a substantial number of miners liquidate their BTC Holdings.

BTCUSD is down -10.47%