The Bitcoin price relief rally experienced on Tuesday faded after a joint statement by Chinese regulators. The BTC has dropped by more than 5% to $40,462. The currency is almost 40% below its all-time high of $65,000 while its market capitalization has dropped from more than $1 trillion to the current $764 billion.

Chinese regulators warn against crypto

China has emerged as a leading player in the cryptocurrency industry in the past few years. This is despite the fact that the country’s regulators have put in place measures to curtail its spread. They were among the first ones to ban Initial Coin Offerings (ICO).

In a report yesterday, the Beijing National Internet Finance Association of China and the China Banking Association warned about the recent volatility in crypto prices. They were accompanied by the Payment and Clearing Association of China. They weaned that this price action has led many people to lose money. Most importantly, they have moved to ban financial companies that offer these transactions.

China is not the only country critical of the currencies. India, its neighboring country, is said to be drafting laws that will effectively ban the digital currencies. Other countries that have been skeptical of the currencies are the United Kingdom and Turkey.

The statement by the Chinese institutions comes at a tough time for Bitcoin and its peers. In the past few weeks, the prices of most cryptocurrencies have dropped by more than 30% from their year-to-date highs. Also, there are concerns about whether Tesla will continue holding its BTCs because of the Environmental, Social, and Governance (ESG) concerns. Last week, the company decided to stop accepting the currency in its stores.

Interest rates and Bitcoin

The Bitcoin price has also struggled recently because of the rising fear of inflation and rising interest rates. This is after data by the United States government showed that consumer and producer prices jumped in April. The increase was mostly because of the recent stimulus package and rising commodity prices.

Higher interest rates and a tightening labor market tends to be signs that the Federal Reserve will start tightening its monetary policy. This is because low interest rates and unlimited quantitative easing policies have contributed to the recent rally.

However, in statements this week, some Fed members said that the bank will not hike interest rates or taper its asset purchases in the near term. Richard Kaplan and Raphael Bostic termed the current inflationary pressures as temporary.

Still, there is a possibility that the Fed will listen to voices of reason and start tightening. In April, Janet Yellen, the Treasury Secretary, said that it was necessary for the Fed to start raising rates gradually. In another statement, Lawrence Summers, former Treasury Secretary, rebuked the Fed for dangerous complacency. Other prominent people who have warned the Fed are Blackrock’s Rick Rieder and Allianz’s Mohammed El Erian.

The general view is that tightening by the Federal Reserve will push investors from speculative assets to value and push Bitcoin prices lower.

Bitcoin price technical outlook

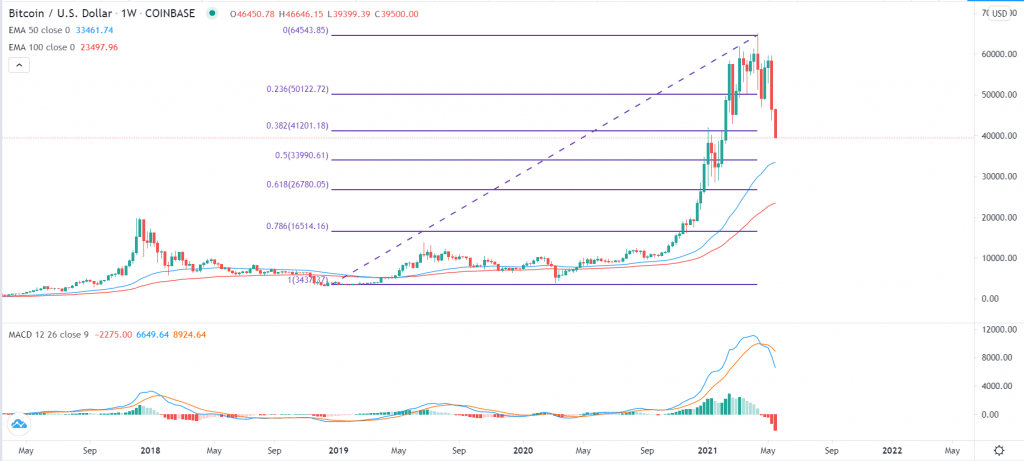

The weekly chart shows that the BTC price rose to an all-time high of about $65,000 in April. Since then, it has struggled to move above $60,000. Instead, the currency has dropped below the 23.6% Fibonacci retracement level. On Wednesday, it also moved below the 38.2% retracement. The price is above the 50-day and 100-day exponential moving averages (EMA). Therefore, by moving below the 38.2% retracement, it opens the probability that bears will start targeting the 50% retracement at $33,990.