Bitcoin mining isn’t what it used to be. It’s evolved into a sophisticated strategic game, and recent data confirms it. With mining difficulty hitting all-time highs, miners are finding innovative ways to maximize profits. Let’s dive into what’s happening and why it matters for the future of Bitcoin.## The Rise of Strategic Mining

Simply put, Bitcoin mining is now a strategic game. It’s no longer just about raw computing power; it’s about efficiency, cost management, and capitalizing on every available opportunity.

With difficulty at all-time highs, miners are squeezing profits through other means. The hashrate surge tells the story: new-generation hardware is online, driving better efficiency at lower cost. This isn’t just an incremental improvement – it’s a essential shift in how miners operate.

## Fee Income and Bitcoin’s Rally: A Powerful Combination

Throw in elevated fee income and Bitcoin’s remarkable 10% rally in July,and you have a recipe for increased miner profitability. The combination of these factors is creating a very favorable environment for those involved in Bitcoin mining.

But how notable is this profitability? Let’s break it down.

### The Value of a Bitcoin Block Reward

At the current price, the 3.125 BTC block reward alone nets miners over $384,000 per block. And that’s *before* counting transaction fees! This makes it very much worth playing the game, even with the increased difficulty.

Consider this: higher fees mean more revenue per block, incentivizing miners to prioritize transactions and maintain the network’s security. It’s a win-win situation for everyone involved.

## Understanding the Fee Landscape

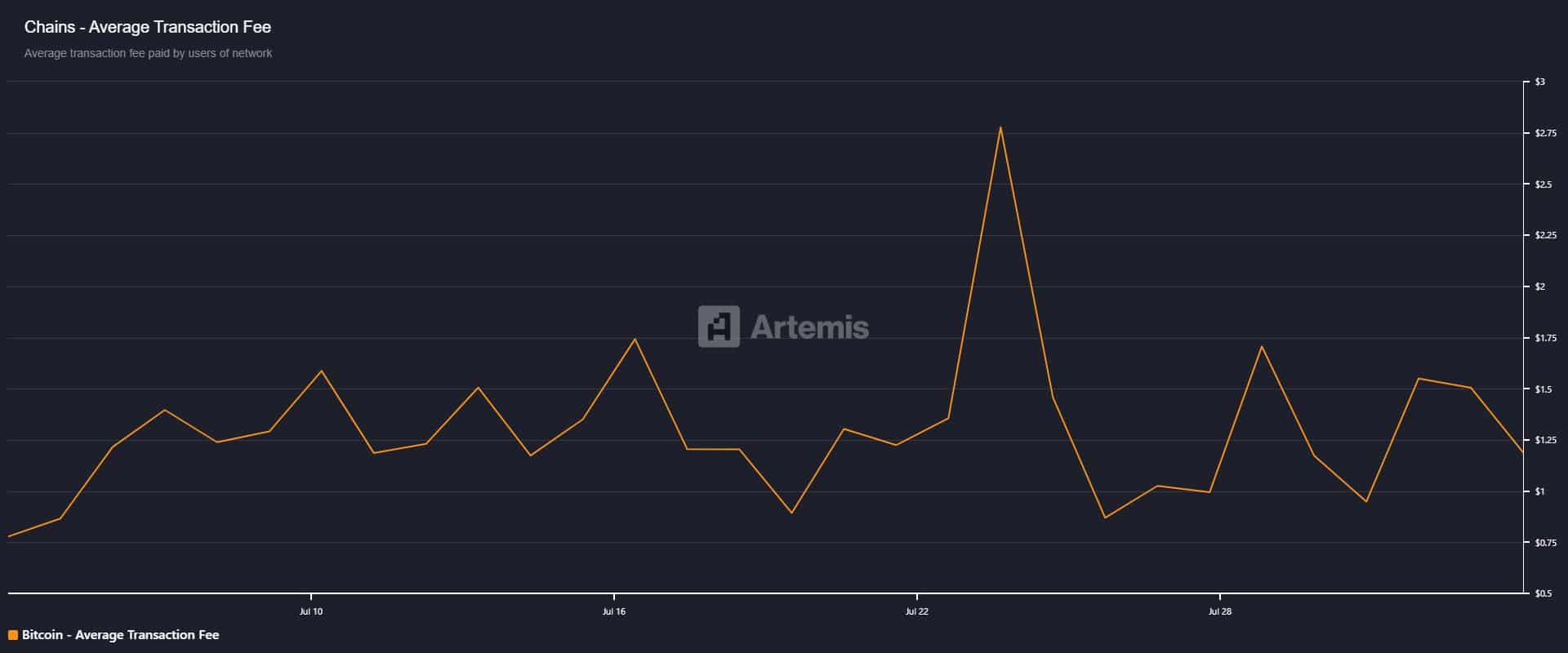

Looking at the data from Artemis Terminal (see image below), we can see a clear trend in average transaction fees across diffrent blockchains.

As you can see, Bitcoin’s fees are currently competitive, and the potential for further increases exists as network activity grows