Bitcoin Eyes Further Gains as Ethereum Struggles With Declining Demand and Bitcoin Hashprice Hits One-Month Highs, A Bullish Signal for Miners

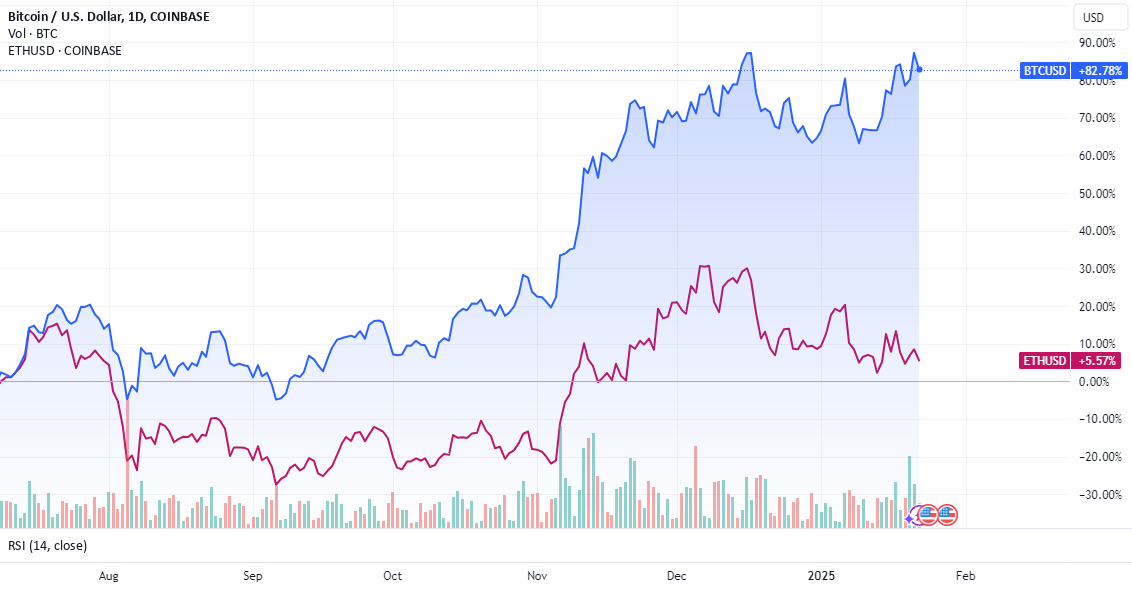

The cryptocurrency market is a dynamic and ever-shifting landscape, with different assets experiencing varying fortunes. While Ethereum grapples with declining demand and network activity, Bitcoin is showing signs of renewed strength, buoyed by positive on-chain metrics and a resurgence in miner profitability.1 This article delves into the factors contributing to Bitcoin’s current momentum, contrasting it with Ethereum’s struggles and highlighting the significance of rising hashprice for Bitcoin miners.

Bitcoin’s Resurgence: A Confluence of Positive Factors

Several factors are contributing to Bitcoin’s current positive trajectory:

* Renewed Institutional Interest: Despite the bear market of 2022, institutional interest in Bitcoin remains significant. Many institutional investors view Bitcoin as a long-term store of value and a hedge against inflation.2 Recent reports suggest renewed inflows into Bitcoin investment products, indicating a resurgence of institutional confidence.

* Positive On-Chain Metrics: On-chain metrics, such as the number of active addresses, transaction volume, and long-term holder accumulation, provide valuable insights into the health of the Bitcoin network. Several key on-chain indicators are currently flashing bullish signals, suggesting increasing network activity and strong holding behavior.

* Growing Adoption: While still early, Bitcoin adoption continues to grow globally. More businesses are accepting Bitcoin as payment, and more individuals are using it as a store of value. This growing adoption contributes to Bitcoin’s long-term value proposition.

* Hashprice Surge: One of the most significant indicators of Bitcoin’s current strength is the resurgence of hashprice. This metric, which represents the estimated revenue a miner earns per unit of hashing power, has hit one-month highs. This increase is a direct result of both rising Bitcoin prices and increased transaction fees, providing much-needed relief to miners.

Ethereum’s Struggles: Declining Demand and Network Activity

In contrast to Bitcoin’s positive momentum, Ethereum is facing challenges related to declining demand and network activity. Several factors contribute to this downturn:

* Competition from Layer-2 Solutions: The rise of layer-2 scaling solutions on other blockchains has diverted some activity away from the Ethereum mainnet. These solutions offer faster and cheaper transactions, making them attractive alternatives for certain use cases.

* Decreased DeFi Activity: The decentralized finance (DeFi) sector, which was a major driver of Ethereum’s growth in 2020 and 2021, has seen a significant decline in activity. This decline has reduced demand for Ethereum block space and contributed to lower transaction fees.

* NFT Market Cool-Down: The non-fungible token (NFT) market, another significant driver of Ethereum network activity, has also experienced a cooling-off period. This has further reduced demand for Ethereum transactions.

Bitcoin Hashprice: A Bullish Signal for Miners

The recent surge in Bitcoin hashprice is a crucial development for the Bitcoin ecosystem. Hashprice is calculated by dividing the total revenue earned by miners (from both block rewards and transaction fees) by the total network hash rate. A higher hashprice indicates increased profitability for miners.

The combination of rising Bitcoin prices and increasing transaction fees has driven the recent increase in hashprice. This is particularly important because miner profitability is crucial for the security and stability of the Bitcoin network. When miners are profitable, they are incentivized to continue securing the network, ensuring its resilience against attacks.

The Significance of Transaction Fees

Transaction fees play a vital role in the Bitcoin network. They incentivize miners to include transactions in blocks and contribute to the network’s long-term sustainability. As the block reward (the amount of Bitcoin awarded to miners for each block they mine) continues to halve approximately every four years, transaction fees will become an increasingly important source of revenue for miners.

The recent increase in transaction fees is a positive sign for the Bitcoin network’s long-term health. It demonstrates that users are willing to pay for block space, indicating continued demand for Bitcoin transactions.

Conclusion

While Ethereum faces challenges related to declining demand and network activity, Bitcoin is showing signs of renewed strength, driven by positive on-chain metrics, renewed institutional interest, and a resurgence in miner profitability. The recent surge in hashprice, fueled by rising Bitcoin prices and increasing transaction fees, is a particularly bullish signal for the Bitcoin ecosystem. This combination of factors suggests that Bitcoin is well-positioned for further gains in the near future.

It’s important to remember that the cryptocurrency market is highly volatile, and past performance is not indicative of future results. However, the current3 trends suggest that Bitcoin is entering a period of renewed strength, while Ethereum faces headwinds that could impact its short-term performance. The dynamic nature of the crypto market necessitates continuous monitoring and adaptation to new information.