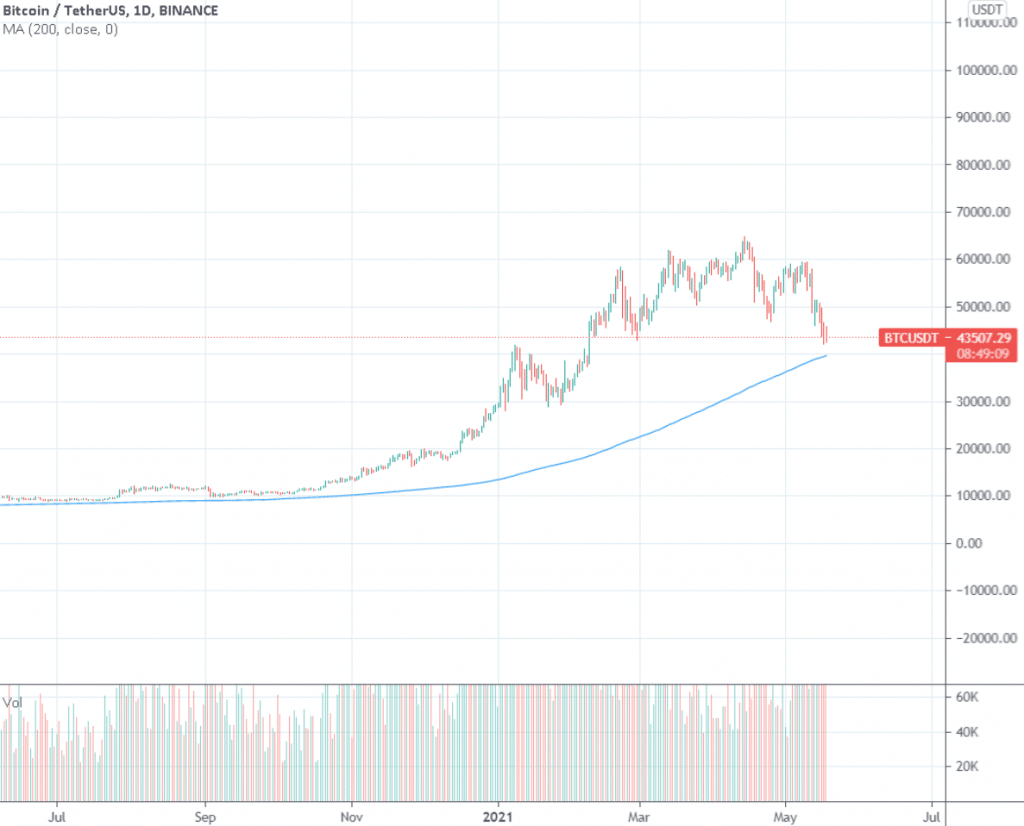

Bitcoin chartists predict big selloffs of the world’s largest cryptocurrency. Evercore ISI’s Rich Ross expects prices to fall to the 200-day moving average or at about $40,000 price level.

Analysts see a pattern of “lower highs and lower lows,” an indication of a bearish momentum.

Elon Musk’s recent tweets about bitcoin are also seen to keep away traditional investors from the digital token.

Analysts also see gold starting to attract money away from crypto, which could open up further weaknesses in bitcoin.

Tallbacken Capital CEO Michael Purves expects any break below $42,000 to open further downsides on bitcoin but if prices hold, it could open another bullish rally.

Some analysts including Fundstrat Global Advisors believe bitcoin prices are likely to bounce due to factors such as high levels of short interest and see the recent slump as healthy.

The bitcoin plunge is seen as an opportunity for new entry by some investors even as others turn to ETFs to gauge the direction of cryptos.

Bitcoin prices have shed about 30% since the intraday high of $64,000 reached in April.

Bitcoin is currently declining. BTCUSD is down 1.69%.