Polygon is a leading blockchain project whose goal is to supercharge applications built-in Ethereum’s blockchain. Its goal is to ensure that these apps execute at a faster pace and save money in transaction costs. As a result, it is the biggest layer-2 blockchain in the world, with a market cap of over $9 billion. Its Decentralized Finance (DeFi) applications have a total value locked (TVL) of over $4 billion. In this article, we will look at the best Polygon DeFi projects.

AAVE

AAVE is a leading Decentralized Finance project that offers a platform where people can earn interest, borrow assets, and even build applications. Its primary product allows people to borrow money by providing their tokens as collateral.

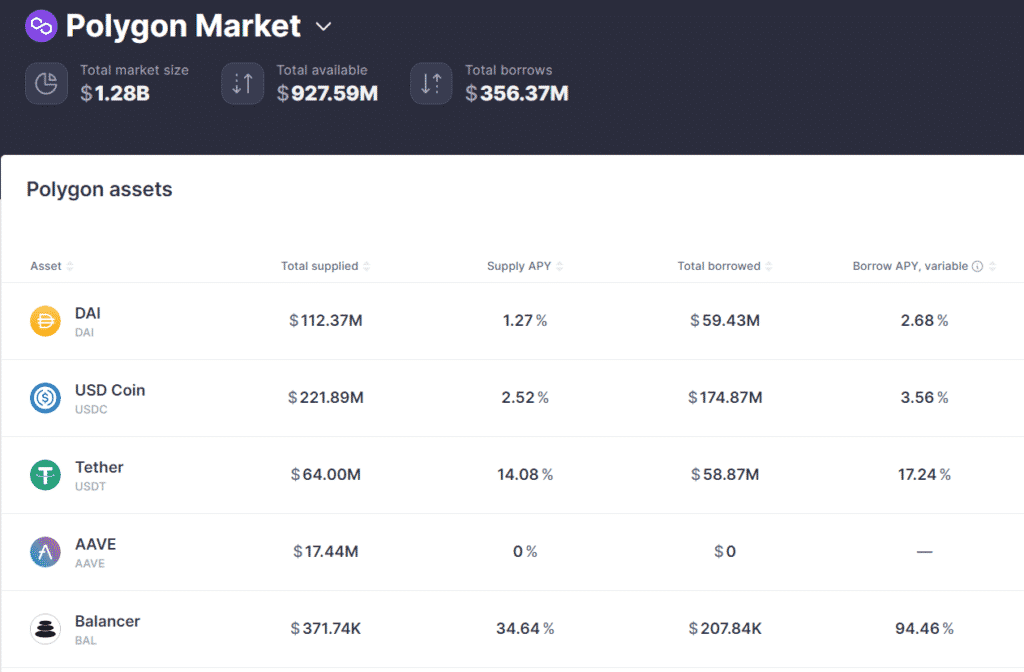

For example, according to its website, people have supplied Dai worth over $1.3 billion while others have borrowed Dai worth $938 million. In this case, the supply APY is 2.34%, while the borrow APY is 3.55%.

Aave was originally built using Ethereum, but it has since then moved to other networks like Arbitrum, Avalanche, Fantom, Harmony, Optimism, and Polygon. Its Polygon version has a total market size of $1.29 billion, making it the biggest DeFi project in Polygon.

AAVE has a native token that has a market cap of over $2 billion.

QuickSwap

QuickSwap is another popular DeFi project in Polygon’s network. It is a DEX that enables people to swap their coins at a significantly lower price than in Ethereum. One can swap most ERC tokens for pennies, which is a better option than in Ethereum’s network.

At the same time, QuickSwap offers other services like liquidity provision. This is where they provide their crypto assets and then earn a 0.25% fee on all charges. QuickSwap has a total value locked of over $743 million, making it the second biggest DefFi project in Polygon.

QuickSwap has a native token known as QUICK that is worth $67 million.

Curve

Curve Finance is one of the biggest DeFi projects in the world, with a TVL of over $20 billion. It was originally created in Ethereum a few years ago. It then expanded to other chains in a bid to give its users a choice for the platform use. Some of these chains are Avalanche, Polygon, Fantom, Optimism, and Arbitrum. Its Polygon version has a TVL of over $383 million.

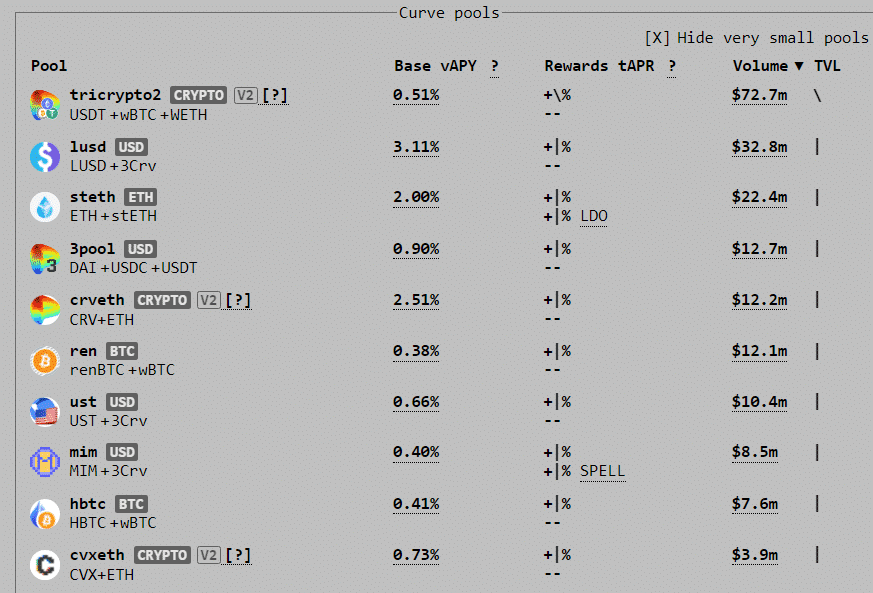

Curve Finance has a number of features. First, it lets users trade stablecoins at the lowest fee. For example, one can exchange Dai for USDC for less than a dollar. Second, Curve also has a number of Curve Pools where anyone can deposit and earn a return. The chart below shows some of these Curve pools. Further, it has a staking platform that lets people earn a return for holding coins.

Curve Finance has a native token known as CRV that has a market cap of over $814 million.

Balancer

Balancer is another leading DeFi project that has used Polygon to scale its network. It is a leading platform for investing and trading. Its flagship project allows people to invest in automated portfolios that generate a return regularly.

Traders can take advantage of its cheaper pricing to execute stablecoin trades. Additionally, its protocol has features that let people build decentralized applications. Balancer also has liquidity provision features.

At the time of writing, Balancer had executed trades worth over $716 million in the previous 7 days. The network generated fees worth about $72 million. These fees are then distributed to BAL token holders.

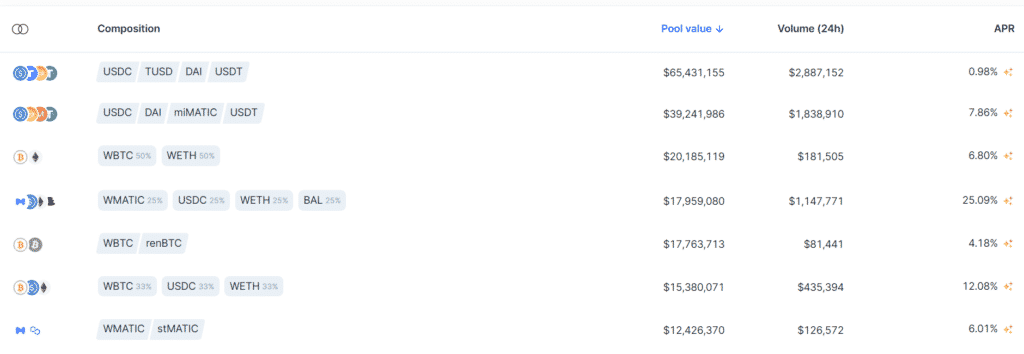

Balancer has a combined TVL of over $3.5 billion, mostly in its Ethereum platform. Its Polygon app has a TVL of about $153 million. The chart below shows some of the assets in its Polygon ecosystem.

Uniswap

Uniswap is a pioneering DeFi network that has become one of the largest players in the industry. Its protocol has features that enable people to earn, swap, and build other financial applications. In addition to Ethereum, Uniswap has expanded to other platforms like Polygon, Optimism, and Arbitrum.

Uniswap is known for its liquidity pools that let people make money by just providing their coins to the network. Also, its swapping feature provides people with an easy platform for swapping their ERC tokens for a small fee.

Uniswap has a total value locked of over $7.5 billion, making it the seventh biggest network in the world. Most of this liquidity is in its flagship Ethereum chain, while only $124 million of it is in the Polygon network.

Some of the top apps built in the Uniswap ecosystem are TrustWallet, Rotki, Burner Wallet, and Gearbox. The chart below shows the performance of the UNI token.

SushiSwap

SushiSwap is a leading decentralized finance platform that offers features similar to Uniswap. Its platform has features that let people earn, swap, stack yields, borrow, and use leverage. Sushi has total liquidity of $3.2 billion and has helped in transactions worth over $192 billion.

Like other DeFi platforms, Sushi has expanded from Ethereum to other networks like Polygon, Fantom, Harmony, Avalanche, Optimism, and Arbitrum. Its Polygon network has a TVL of over $233 million.

Beefy Finance

Beefy Finance is another decentralized finance project in Polygon. It provides differentiated services than the other applications. For one, its goal is to optimize returns across multiple chains. The developers have launched on a number of platforms like Ethereum, Fuse, Polygon, Harmony, Cronos, Moonriver, and Moonbeam. Its Polygon app has a TVL of over $$119 million.

Summary

The Polygon ecosystem has expanded widely in the past few years. As a result, the ecosystem has attracted over 2,000 developers who are seeking to supercharge their Ethereum applications. However, there are signs that the network is slowing ahead of the Beacon Chain and Ethereum merger. Analysts believe that most developers will stick with Ethereum, which provides a faster ecosystem.