Best FX Networks promises to help you to trounce the market using neural networks. The vendor says that all types of traders can apply it gainfully. The robot was created in 2020 and tested at the global currency market using the devs’ own fund. We are led to believe that the resulting outcomes were good. Let’s see through this review if these claims are true.

Best FX Networks provides different lifetime licenses that can allow you to trade both real and demo accounts. The business pack costs $129, while the standard one asks traders to pay $149. You can get the premium plan at $169.

Best FX Networks trading strategy

The EA works with neural works, which are essentially trading algorithms that attempt to imitate certain aspects of the human brain. So, it analyzes trading data to identify unexamined patterns and then uses the results to predict how the market will behave. Buy and sell orders are then placed based on those predictions. The grid strategy is used as well, but the vendor doesn’t mention this.

Best FX Networks features

The robot has the following features:

- It has an inbuilt magic number.

- There is no need to disconnect the system during the news release.

- It’s easy to set up and provides full time support.

- The EA works with all brokers, including cent, micro, ECN, and STP accounts.

- Its live trading results are 100% verified.

- It comes with a money management system.

Best FX Networks backtesting results

The backtesting results for this robot are not supplied. For that reason, its past performance data, such as trading frequency, profits, drawdown, recovery factor, consecutive wins and losses, etc., are unknown.

Best FX Networks live trading results

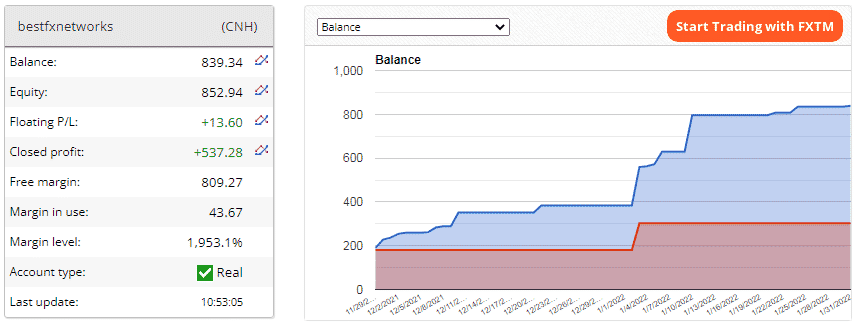

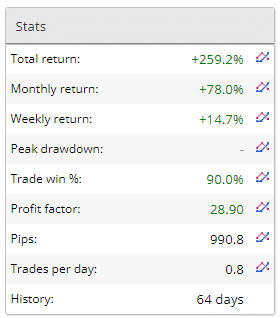

As you can see above, the live trading stats of the robot are available on FXBlue. For the 64 days the system has been operating this account, it has made a profit of $537.28. So, the balance has increased to $839.34, but the amount currently available for trading is $809.27.

Out of all the trades completed to date, 90% have been successful. The monthly and weekly profitability rates are 78% and 14.7%, respectively. The 990.8 pips made have contributed to a total return rate of 259.2%. There’s no info on the peak drawdown.

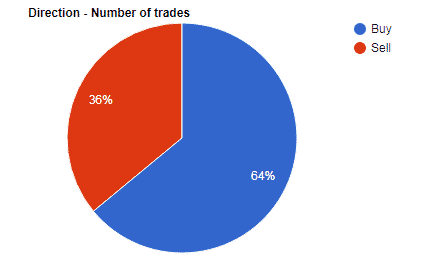

The system placed more buy orders than sell ones.

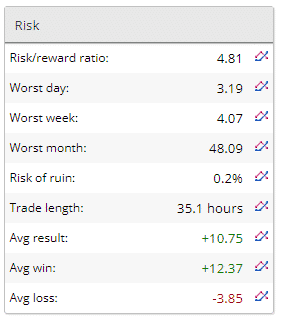

There’s a risk/reward ratio of 4.81, which shows us that the account wins more than it loses. This explains why the average win ($12.37) is higher than the average loss (-$3.85). So, the risk of ruin is low — 0.2%. During its worst month, the EA only made $48.09 for the account. The trade length is 35.1 hours.

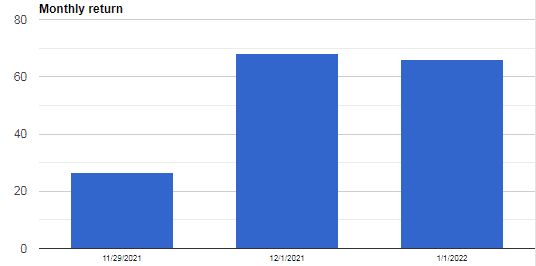

For the three months the account has been active, the robot has brought in profits throughout.

The EURJPY is the main trading currency pair used. Almost all trades have closed in profits. The grid approach is present.

Best FX Networks reputation

This trading algorithm was written by a team of programmers who purport to have many years of trading experience. They have also been researching and creating Forex trading softwares like EAs, utilities, and indicators for years as well. That is all the company reveals about its staff.

The robot doesn’t have any customer reviews yet. Our search for testimonials on platforms like Trustpilot and Forex Peace Army didn’t yield results.

Best FX Networks review summary

- Strategy – 4/10

- Functionality & features – 5/10

- Trading results – 6/10

- Reliability – 5/10

- Pricing – 5/10

The performance of Best FX Networks on FXBlue is undoubtedly splendid. It seems that the market conditions have favored the system to date. We are not sure how long this trend will continue, given that the grid trading plan is present. For this reason, it is paramount to track the live performance of the robot a little longer before making any purchase decisions.