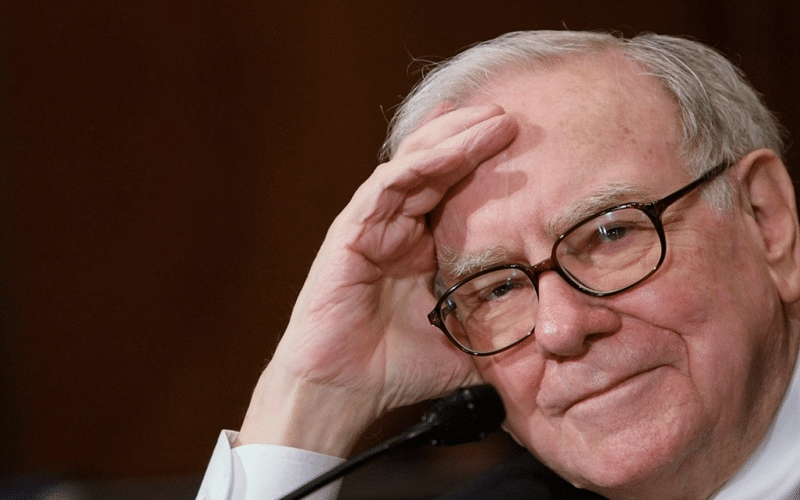

(Bloomberg) Warren Buffet repurchased only $6 billion of Berkshire Hathaway stock in the second quarter despite having $144 billion at his disposal.

The sale happens when Berkshire’s stock has been having a liquidity challenge, while the stock markets are becoming more expensive with the S&P index reporting new highs.

Berkshire disposed of just $1.1 billion worth of other stocks in the quarter, the lowest in the last three quarters, with sales coming from falling stocks.

The conglomerate’s operating earnings jumped by 21% to $6.7 billion in the second quarter, buoyed by the economic recovery from the pandemic.

The conglomerate’s $6 billion repurchases is the fourth highest since the investment giant started its repurchase program in 2018 but the lowest since the middle of 2020.

BRK.A: NYSE is up +2.10%.