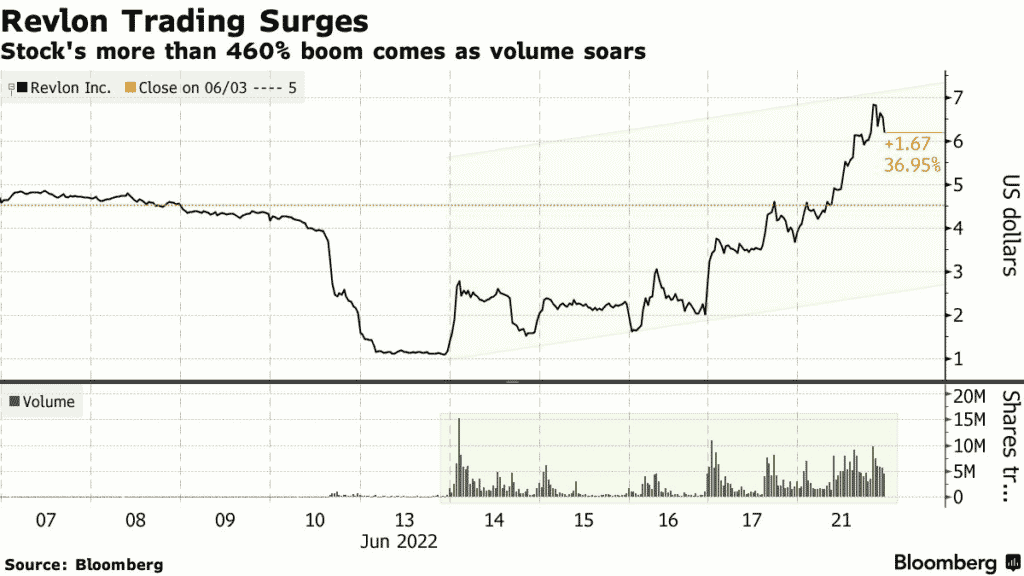

(Bloomberg) Shares of Revlon rose 21% in premarket on Wednesday, extending gains after closing up 62% the previous day amid a social media-driven retail frenzy.

In just five days, Revlon has gained by more than 293%, reflecting an increased appetite for risk assets.

The cosmetics giant, which filed for bankruptcy on June 15, attracted more than 183 million shares trading on Tuesday. The volume is an increase of at least 31 times the average over the past three months.

On the Fidelity platform, Revlon was among the top ten most traded assets on Tuesday as buy orders almost matched sells.

Revlon has now risen by more than 461% since hitting an all-time low on June 13, with the gains fueled by retail traders. The stock has also attracted almost $10 million in retail trader cash in the last seven days.

The circling of Revlon by retail traders comes in total defiance of the ongoing bankruptcy filing. The company’s shareholders risk earning nothing should the assets of the company be disposed of from the current bankruptcy proceeding as the lenders, creditors, and bondholders come first in repayments.

REV:NYSE is up 21.45% in premarket.