Aura Pro uses a special grid method that is derived from deep machine learning and a hyperparameter search technology. This trading tool works on multiple currency pairs. It also uses the Martingale method which many traders consider a dangerous approach. To buy this FX EA, you need to pay $595. A rental option is present for using the package which costs $395 per year. The developer offers a free demo account. To keep the product exclusive, only 100 copies are available on the MQL5 site. There are no further details present on the package like the features included. We could not find a refund policy which makes us suspect the reliability of the system.

Aura Pro trading strategy

The developer Stanislav Tomilov mentions that the FX robot uses the grid and the Martingale methods. It is a well-known fact that these two methods are considered high-risk and avoided by traders. However, the developer explains that the grid method uses machine learning and a search method based on hyperparameter optimization. By using the advanced technology, the developer claims that it is possible to reduce the predefined loss function of given data ensuring better accuracy and high returns.

Aura Pro features

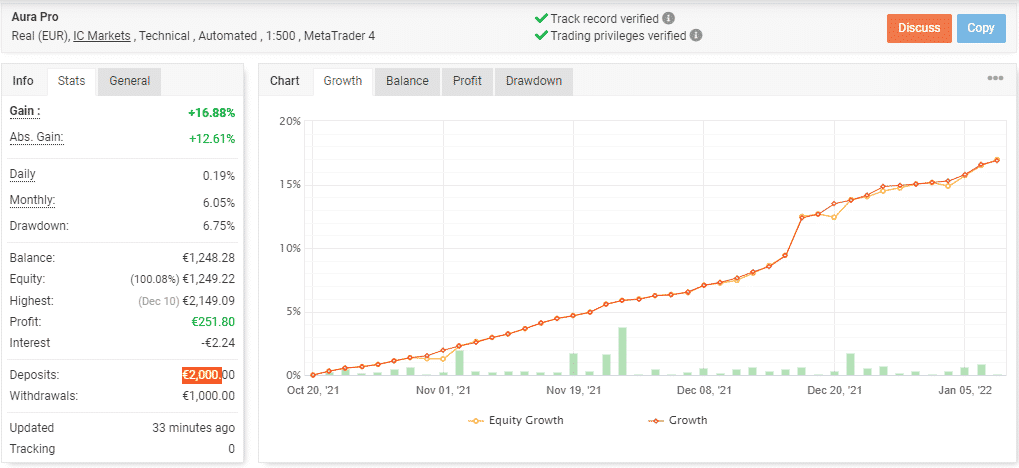

Some of the key features that the developer highlights for this FX robot are:

- It works on the H1 timeframe.

- The EA supports the EURUSD, EURGBP, GBPUSD, USDCAD, EURCAD, GBPCAD, and EURCHF pairs.

- Leverage of 1:500 is needed .

- The minimum recommended deposit is $1000.

- It uses the Martingale and the grid methods for trading.

- No settings files are required as the values are present in the code.

- The system has plenty of optimization and customization features.

- It is not affected by broker conditions like slippage and spread.

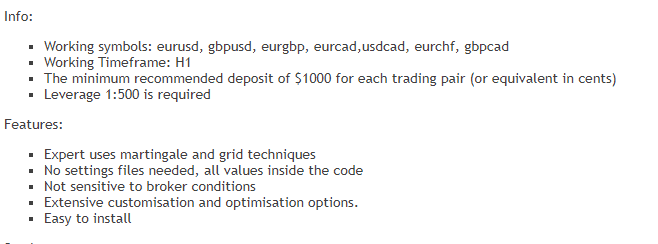

Aura Pro backtesting results

A few backtesting results are present on the MQL5 site. Shown above is one of the tests with default risk settings done from 2010 up to 2021. A total net profit of 26939.76 was generated from an initial deposit of $1000. The percentage of profit trades was 79.68% out of a total of 2195 trades with a profit factor of 5.08. A drawdown of 12.94% was present. From the results, we can see that the profit was good and the drawdown low despite the use of risky methods like the grid and the Martingale approaches. However, the backtesting performance cannot guarantee a similar result in future performance as it is based on historical data.

Aura Pro live trading results

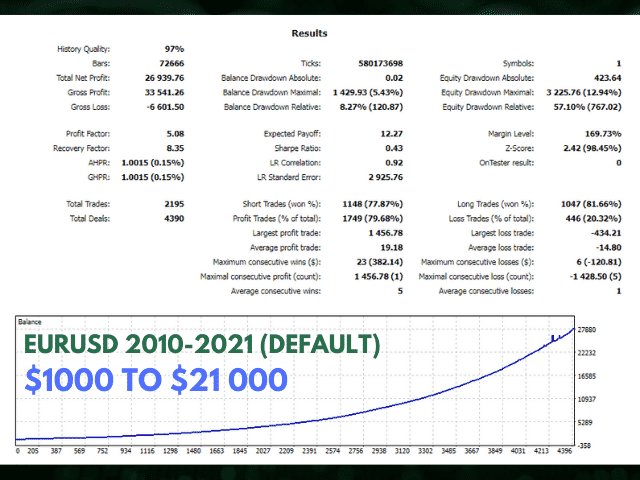

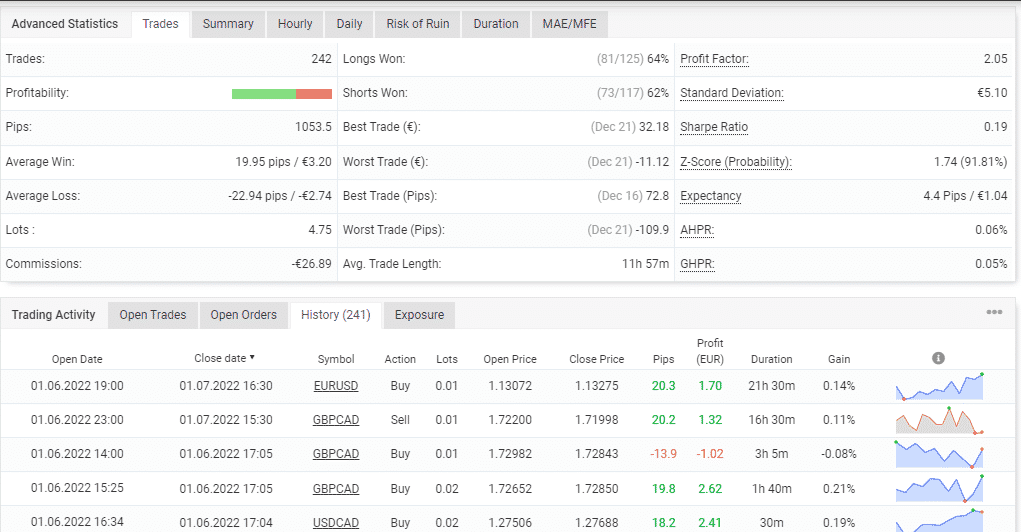

A live real EUR account verified by the myfxbook site is present for this FX robot. The account uses the leverage of 1:500 on the MT4 platform. Here are a few screenshots of the trading stats.

From the above stats, we can see a total profit of 16.88% is present for the account that began in October 2021. The absolute profit is 12.61% for a deposit of €2,000 and a withdrawal of €1,000. The difference in the absolute and total profits can be due to the withdrawal or it can also reflect the risky approach used.

A drawdown of 6.75% is present indicating the approach used is not of the high-risk category. But the profit of €251 is very low which indicates that the strategy used is not effective resulting in a below-average performance.

The growth curve proves this with a slow rise up to December and increasing only for the past couple of weeks. Profitability of 64% and a profit factor of 2.05 are other important values to note. The lot sizes used range from 0.01 to 0.04 which is high denoting a higher level of risk used by the ATS.

Aura Pro reputation

Stanislav Tomilov is the creator of this FX robot. He is located in Russia and has more than 6 years of experience in the field with 12 products and 18 signals to his credit. He provides a Telegram channel link and a Gmail address for contact. His other products include Aura Turbo, Aura Gold, Aura Black, etc.

Unfortunately, we could not find user reviews for this FX EA on reputed review sites like FPA, Trustpilot, etc.

Aura Pro review summary

- Strategy – 4/10

- Functionality & Features – 5/10

- Trading Results – 4/10

- Reliability – 5/10

- Pricing – 3/10

Aura Pro claims to use the Martingale and grid methods which are dangerous. The developer provides backtesting results that prove the efficacy of the approach. From the live trading stats, we find that while the drawdown is not high, the profits are not sufficient. Furthermore, you need to consider the shortcomings in the system like the expensive pricing package, the lack of a refund offer, and the absence of user reviews.