(Reuters) Strategists are optimistic that the US Treasuries, which rose to the highest levels since mid-June, could reach 1.9% in 12 months, 40 basis points from the current level.

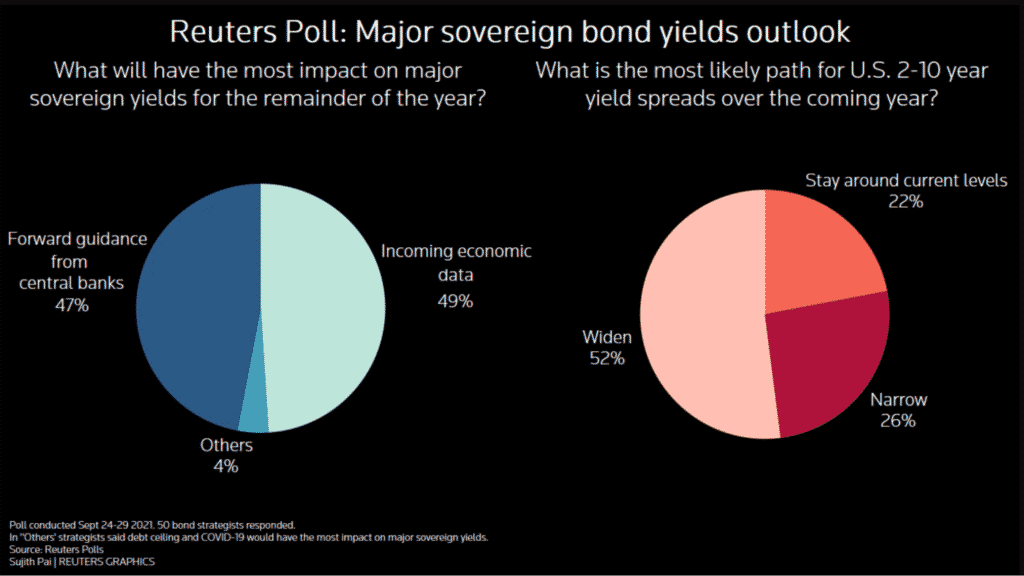

Fig: Survey on Major Sovereign Bond Yields Outlook

The analysts believe US Treasuries have entered an inflection point, in line with the recent stances of Fed and other central banks and the only way is to go higher.

Germany, Britain, and Japan’s benchmark yields are also expected to rise by about 10 to 20 basis points in the next 12 months.

The shift away from the economic policy during the pandemic and rising concerns of inflation is already supporting bond yields.

The analysts now project a widening gap between short-term and long-term dated bonds, pegged on the rate of rate hikes by the Fed and other central banks. Fed’s asset purchases are expected to have minimal impact on yields.

US 10-Year Treasury Note Yield is currently 1.516%.