(Bloomberg) Aluminum year-to-date performance outshined copper, with a 21% gain compared to copper’s 18%.

Both aluminum and copper have been struck by attempts by China to suppress price inflation in commodity markets over the last month.

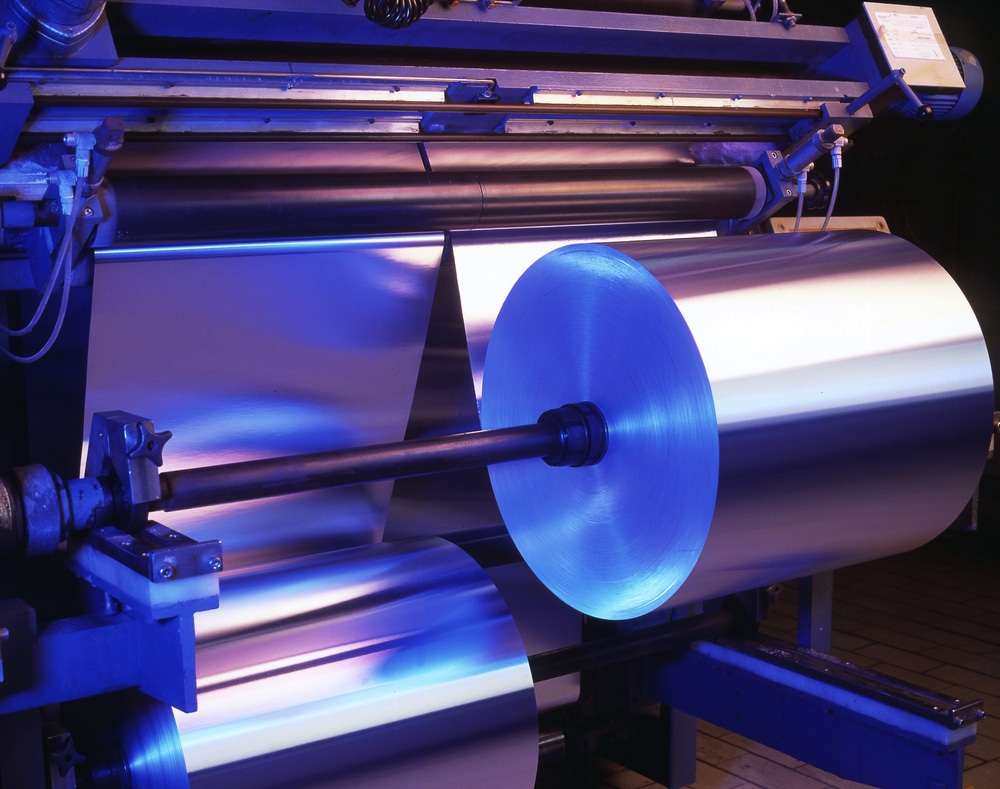

Prices for the metals used in cans and cars have increased by 21% compared to copper which recorded an 18% and tin which had a 48% gain.

Since 2015, aluminum consumers in Japan have been paying the largest surcharges while Chinese customers have been enjoying lowest copper premiums since 2017.

The demand for aluminum was significantly affected by the pandemic but it has snapped back edges while pollution restraints in China changed supply outlook.

On LME today, Aluminum traded less at $2,406 per ton, which is a 8% decline from its peak experienced in mid-May this year.

HG! Is up 1.04%, Aluminum Futures is up 0.99%.