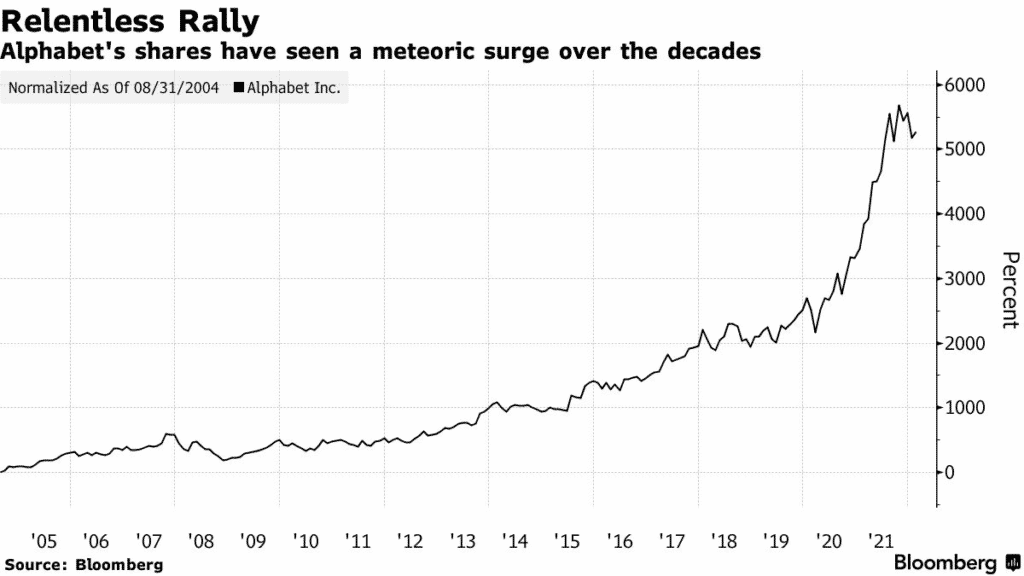

(Alphabet) Google parent Alphabet announced a 20-to-1 stock split on Tuesday as it released its fourth quarter of 2021 results that showed a 32% jump in revenue from the prior year.

The split, which would see Alphabet trade at $140 from the almost $3,000 current level, is intended to make the stock available to the masses, especially to small investors. CFO Ruth Porat says the split would make the shares more accessible.

Chief market strategist at Jonestrading Michael O’Rourke says Alphabet’s stock split is also expected to boost its inclusion into the Dow Industrial Average. He says the four-figure price of Google stock has been a barrier to the inclusion into the index.

The stock split happened when Google’s net income jumped to $20.643 billion in the fourth quarter of 2021, up from $15.227 billion in the prior year. The income was earned from a revenue of $75.325 billion, up 32% from the prior year.

Dow’s weighting system allows stock inclusion based on their price rather than market cap, with the Alphabet’s shares before the split too big for the gauge.

GOOGL: NASDAQ is up +10.10% on premarket.