Adyen NV shares continued their downward spiral as another analyst joins the bear camp. Morgan Stanley’s Adam Wood expressed concerns about the Dutch payment-processing stock, stating that investors may need to wait for at least 12 months before any improvement. As a result, Wood downgraded his rating on the Amsterdam-listed shares and adjusted his price target.

Adyen’s Decline in Value

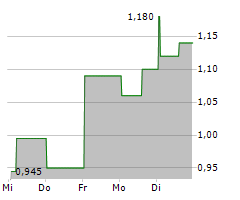

Over the past seven sessions, Adyen shares have plummeted, resulting in the worst seven-day period since June 2018. On Thursday, the Netherlands-listed shares experienced a significant one-day decline of 39% following the release of Adyen’s latest earnings report. The report highlighted increased competitive pressures in the United States, where the corresponding stock also experienced a decline.

Debating Adyen’s Growth Equation

The primary debate surrounding Adyen centers on the company’s growth potential. Wood emphasizes the need to assess if and when Adyen can return to growth within the mid-term guidance range of mid-20s to low 30s net revenue growth. While optimistic investors believe that pricing pressure in the U.S. is temporary and anticipate positive outcomes from Adyen’s investments over the next 18 months, skeptics have a more skeptical view. They see Adyen’s recent commentary as an indication of a highly commoditized U.S. payments landscape, creating additional challenges for the company.

Potential Challenges Ahead

Wood highlights that once pricing has been lowered, it is typically difficult for the industry to raise prices again. This poses an additional headwind for Adyen. According to Wood, the most likely scenario lies between the bull and bear cases. However, without a reacceleration in Adyen’s business, the bearish view is likely to prevail.

Conclusion

Adyen NV shares are facing significant challenges as another analyst downgrades his rating on the stock. With Adyen’s recent decline in value and concerns about growth, investors are closely monitoring the company’s performance in the highly competitive payments landscape.