Millions of Americans invest in stocks. Indeed, according to Gallup, more than 55% of Americans purchased stocks. Others have invested in equities indirectly through their 401k and pension plans. In this article, we will look at five alternative assets that you should consider investing in. These assets can help diversify your investments and boost your returns.

Bitcoin (BTC)

Launched in 2009, Bitcoin has become the biggest digital currency in the world. As of this writing, it has a market cap of more than $286 billion. That makes it bigger than all US banks except JP Morgan, which has a market value of more than $300 billion.

Bitcoin was started with the goal of decentralizing the currencies market. Unlike other currencies, such as the US dollar and euro, it is not controlled by anyone. Instead, it is created only by solving complex mathematical calculations. Also, unlike fiat currencies, Bitcoin transactions cannot be traced, which makes it useful as a privacy-focused tool.

Bitcoin has also become a leading financial asset that is traded by millions every day. On average, Bitcoin worth more than $33 billion is traded every day.

At the same time, this cryptocurrency has helped pioneer a large digital assets industry. In total, all cryptocurrencies are valued at more than $448 billion.

Most investors believe that Bitcoin is a good hedge against risk and inflation. They also view it as a rare currency because there is a limit on the number of Bitcoins that can be mined. In fact, as Bitcoin mining gets more difficult, most investors believe that it will get more valuable over time.

As an investment, Bitcoin has outperformed other traditional assets like stocks, as shown below.

Bitcoin has outperformed traditional assets.

Gold (XAU)

Gold is a precious metal that has been valued for centuries. You can find stories written about the metal in some of the world’s oldest books, like the Bible and Koran. In the 20th century, the US dollar and most currencies were backed by gold. That ended in the 1970s when President Richard Nixon ended the so-called gold standard.

Today, gold is viewed as an excellent financial asset that is mostly used to hedge against risk and inflation. Indeed, unlike other commodities, gold does not have meaningful use. Instead, most gold that is mined is bought by central banks and asset managers.

As a result, gold is usually seen as the anti-dollar. In most cases, when the US dollar falls, gold price tends to rise and vice versa. That happens because a weaker dollar tends to lead to higher inflation in the US, and gold has a role as a hedge against inflation.

There are several benefits of investing in gold:

- Its price has been on an upward trend for centuries. It has risen from $35 in the 1970s to more than $1,975 in 2020.

- The amount of gold available for mining is getting depleted, which will only increase its value.

- Interest rates will remain low for a long period, which will be positive for gold prices.

- Gold has completed a test of time.

In addition to gold, other precious metals you can invest in are silver, platinum, and palladium.

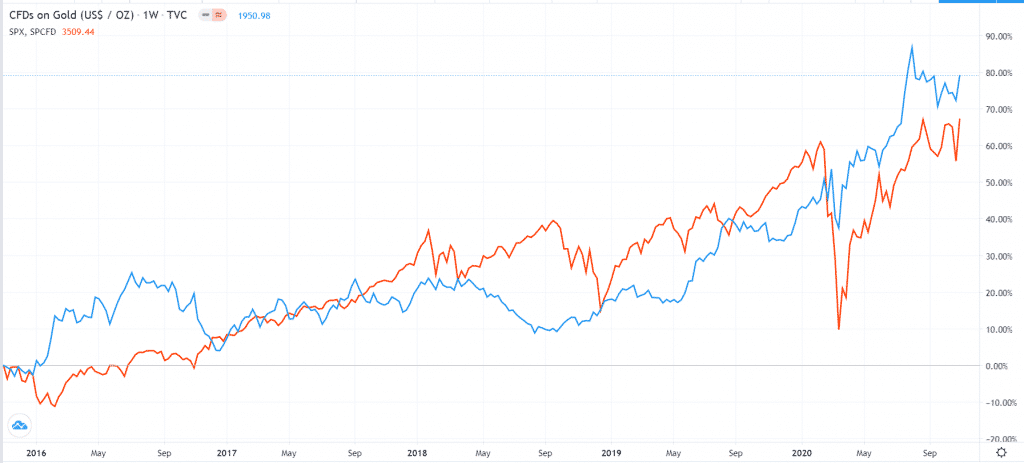

Gold relationship with the S&P 500

Real estate

Real estate is the process of investing in property, land, and other types of buildings. The industry tends to be an excellent place to park your money, especially when you have a long-term horizon.

Real estate investment takes different forms.

House flipping

You can decide to be a house flipper, where you buy houses, remodel them, and then sell them at a profit. The process can make you good money, especially when you are good at remodeling and marketing. Indeed, the industry of flipping has been adopted by fast-growing real estate marketing portals like Zillow and Redfin.

Reselling

You can decide to just buy land and leave it there. The idea is to buy a piece of land at a strategic location, wait for its price to appreciate, and then sell it. This process can take a few months and even a few years. For example, an average acre of land in rural Texas sells for more than $3,000. That is substantially higher than where they were a decade ago.

Building and leasing

Third, you can invest in real estate by building property and leasing or selling it to customers. The idea is relatively simple. Find a good piece of land, get approvals, build, and monetize the project.

A simpler approach is where you use an online portal that crowdsources real estate investments. Examples of these portals are Realty Mogul and Fundraise. Their benefit is that they make investing in property affordable since investing in property tends to be quite expensive.

Another approach is to invest in real estate companies that are already public. That includes Real Estate Investment Trusts (REITs) like VICI Properties, Getty Realty Corp, CubeSmart, and STAG Industrial, among others.

Peer to Peer Lending

The peer to peer lending industry was created to decentralize the lending industry by creating a solution that is win-win for lenders and borrowers. Ideally, the industry allows people to lend money to other people in need through the Internet. The borrowers are usually pre-screened by the companies that provide the service.

In this case, the borrowers receive the funds they need while investors make a return. This is particularly useful now that we are in a low-interest rate environment.

To get started, you need to check out whether your state allows such investments. Then, you need to find a good company that offers the service. The most notable firms are LendingClub and Prosper. After this, you need to deposit your funds and make your investments.

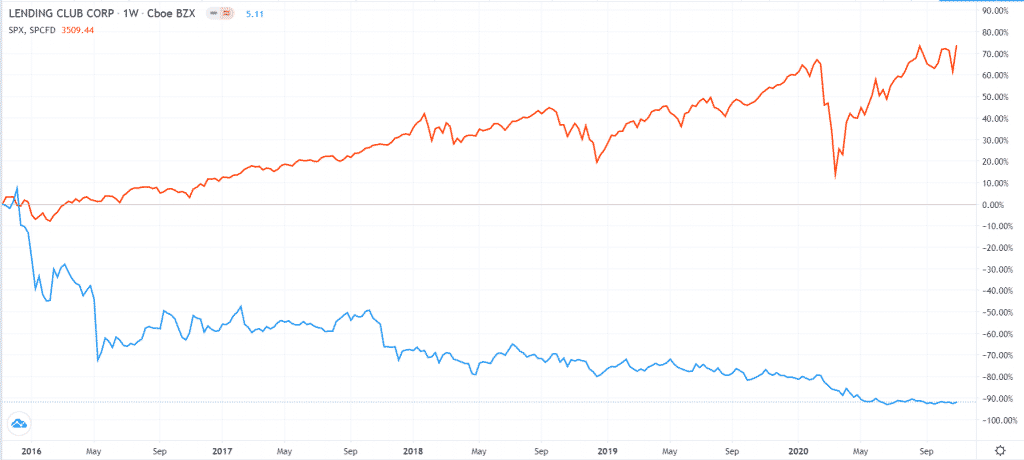

While P2P lending is a good alternative asset to invest in, it is also risky. Indeed, you can see how risky it is by looking at the performance of Lending Club stock price. Therefore, you should only allocate a small portion of your funds to the industry.

Lending Club vs. S&P 500

Private Equity

Private Equity (PE) is one of the biggest industries in the United States. According to McKinsey’s Private Markets Annual Review, private equity total assets under management crossed the $4 trillion milestones in February.

For starters, the PE industry invests in companies that are not listed in exchanges. In most cases, the investors look and identify quality private companies and invest in them. They then hold their investments for a few years and then sell the companies or take them public.

Some of the US biggest private equity firms are KKR, Carlyle Group, Apollo Global Management, and Blackstone.

Most Americans have invested in these PE firms indirectly through their pension funds. However, it is often very difficult for an individual to invest in PE firms since most of them don’t accept funds from anyone. So, the best way to take advantage of the industry is to invest in public-private equity firms like Blackstone and KKR.

Final thoughts

Alternative assets are an excellent way to invest because of their excellent and often uncorrelated returns. The assets we have mentioned here are not the only ones. Others that you can consider are watches, wines, and art.