Investment concerns:

- Is 401k the safest retirement plan with long term benefits when compared to other individual retirement plan options?

- Know what the contribution limits and total contributions for 2021 are so you can save up the maximum possible amount and improve your long-term returns.

- How much risk can you take with your 401k funds?

The Market Condition Now And Its Background

The coronavirus pandemic triggered a financial crisis in March 2020, which has since reduced in impact but has not fully resolved. Other influencing factors include the trade tensions between the US and China and the decline in oil prices. The US market is now in a bearish phase. This is due to three factors, namely:

- Perception of market changes by investors

- Psychology of investors

- Market sentiment

Due to the bearish phase, a negative sentiment prevails, and investors prefer shifting their funds from equities to securities that offer fixed income. This is because investor confidence is affected by the fall in prices, and they retaliate by removing their money from the market. This results in increased outflow and declining prices.

That being said, the recovery of Wall Street with the S&P 500 and Nasdaq showing a phenomenal surge since the previous lows in March indicate a bullish trend as investors have started showing more interest in stocks compared to the overvalued bonds. There are two factors for this scenario:

- The reduction of interest rates by the Federal Reserve Bank.

- The news of a successful vaccine to combat the coronavirus infection.

The Idea Behind 401k

401K ranks high in the list of effective plans that are ideal for employed individuals looking at long term savings and returns. If you are eligible for an employer-sponsored plan, the 401K covers your basic needs. There are regular changes made to this plan annually. Let us see more about what 401K entails and how you can get maximum returns from it.

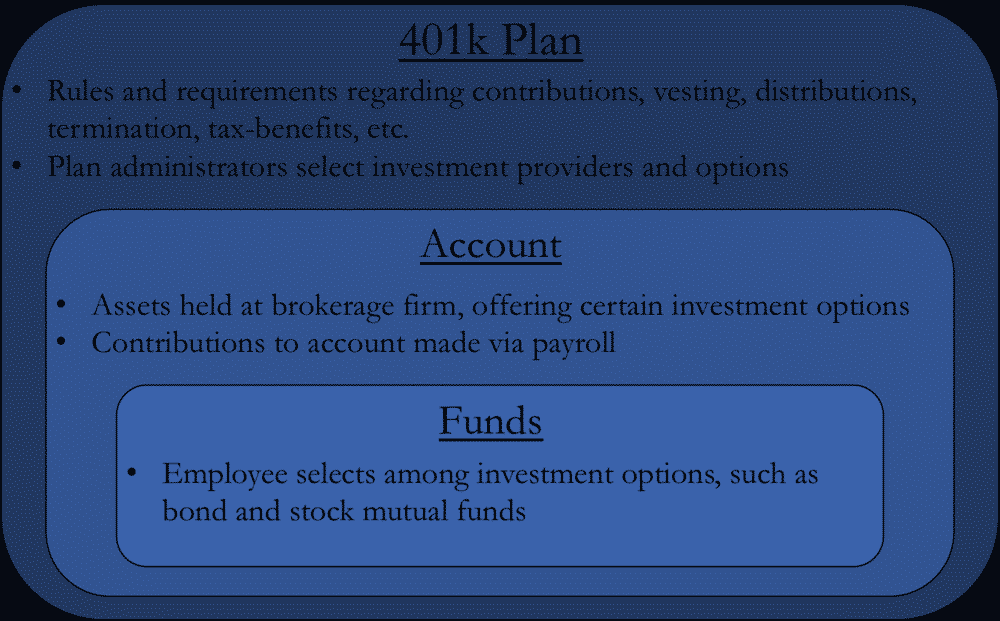

How do you get a 401(k)?

It is common for employers to offer 401K for their employees. They sponsor this retirement account to which a percentage of the employee’s salary before tax is allocated. Some employers also add their own contribution additionally up to a specific limit. The funds in this account are invested in various instruments such as mutual funds, bonds, etc. Here are some important facts about this plan:

- It is a qualified retirement plan with tax benefits that employers offer.

- The limit per year for 2020-2021 for 401k contributions is $19,500, and it is higher up to $26,000 for those aged 50 years or older.

- You can shift the funds in your 401k to your IRA funds when you retire or quit your job.

- Investment options are few, while fees for the funds management are high.

401K Investment Benefits

The advantages you get with a 401k investment plan are aplenty.

- Your employer can match some portion of the amount you contribute towards the investment. For instance, there is the popular dollar match for a dollar or 50 cents match for a dollar for 6% of your contribution. This addition will increase your savings and returns in the long-term considerably.

- The 401k contributions are taken from your pay before a tax cut. This increases the funds you get to save. Taxes generally include anywhere around 20 cents for every dollar you earn.

- The contribution you make can reduce the tax your pay on your income.

- In addition to enhancing your savings, the contributions lower your income value, so the taxes on the sum are also lower.

- Unhampered growth of your investment is possible as you need not pay taxes on the returns you make, including interest, dividends, and gains.

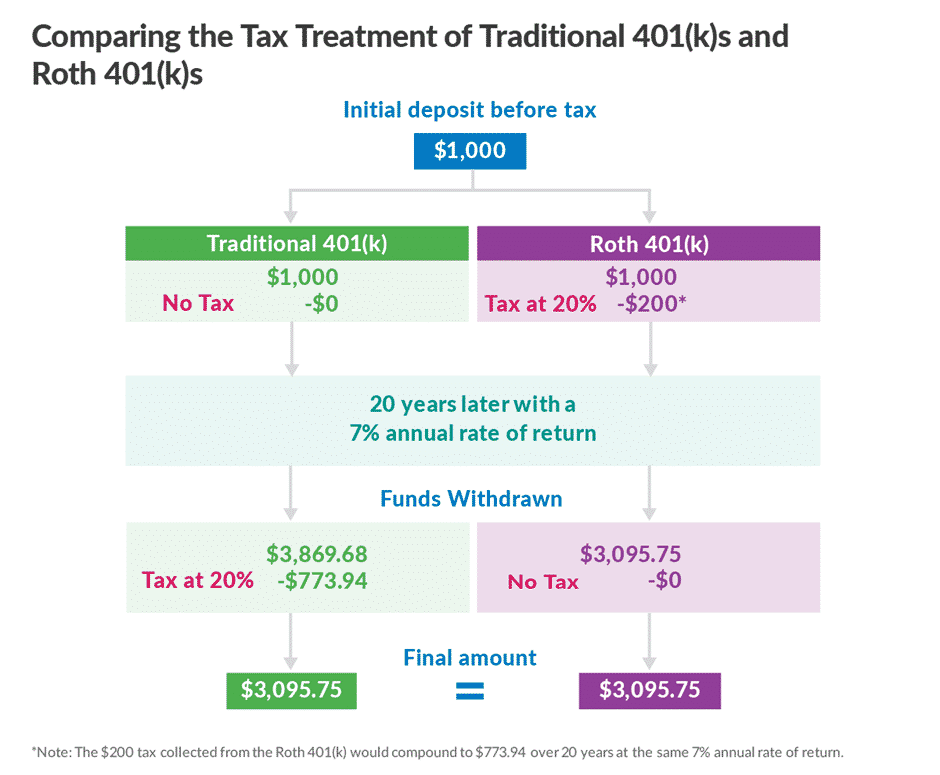

However, the benefits you get are only until you withdraw the amount on retirement, upon which you will have to pay tax for the income. But with Roth 401K, where you make contributions on post-tax money, there is no need for paying taxes on the withdrawal.

Fundamental View

Some common 401k investments that result in revenue growth include:

- Mutual funds – these offer built-in diversification and management by professionals. Customization is possible to enable achieving different investment goals. But there are risks of losing money altogether too.

- Company stocks for employees of a company that is publicly traded, a company fund or stocks can be part of the investment. A higher employer match is also possible with such an approach. You get partial ownership and a share of company profits. Avoid placing all the 401k funds in this instrument is very risky.

- Individual stocks, securities, and bonds are another option.

- Variable annuities include several different funds similar to mutual funds, and these have specific insurance cover.

Comparing To Benchmarks

There are two key reasons for 401k investment being a good concept:

1. You receive tax breaks. The pre-tax money you earn is used for the contribution in contrast to Roth plans. Thus, you also reduce the money that is taxed.

2. You need not pay tax for the money in the plan and any returns you receive over the long term until you withdraw the money.

401K is an effective saving method when compared to individual retirement accounts because the maximum contribution level for 401k is higher than the IRA limit. For instance, $19,500 is the limit for 401k in 2020- 2021, while it is $6,000 for IRA with an additional $1,000 for those aged 50 years and above. Another significant benefit is the matching contribution provided by your employer. And this amount is not taken into account for the contribution limit.

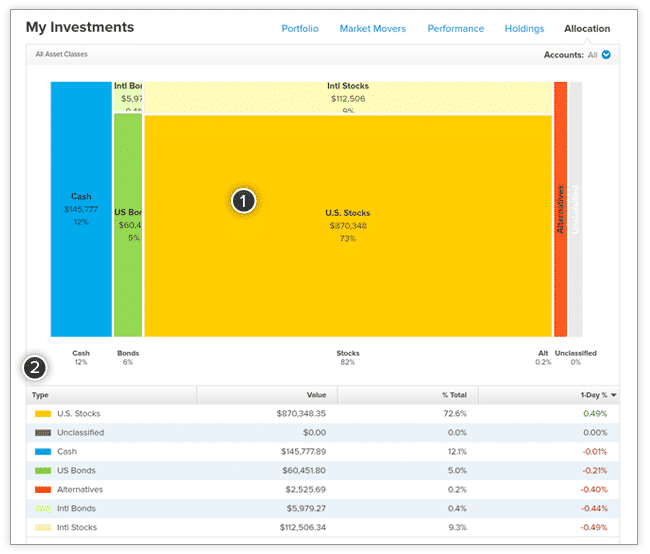

Risk Reward Ratio

As with any investment, the risk is a part of 401k also. This depends on the asset group you are focusing on. For instance, stocks and mutual funds are high-risk assets, while bonds carry a moderate level of risk and cash assets have the least risk.

To calculate your potential risk and reward, you need to consider the two factors:

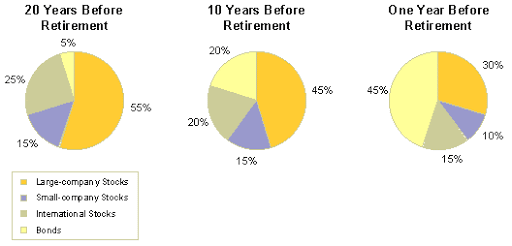

- Your age

- Number of years until your retirement

At a younger age, you are capable of taking higher risks compared to when you are a few years away from retirement with dependents. When you are around 50, a low risk may look appealing, but with the low risk, you get only low returns on a huge part of your investment. This cannot protect you from the reduced purchasing power you will face due to inflation. But with just a couple of years to retirement, it is safer to take a lower risk as you have to safeguard your principal sum.

Thus, the reward and risk potential in a 401k investment fund is identifying the right balance between the risk you can take and the returns you wish to accrue. This will help you create a strategy to handle your investment fund and benefit from the funds.

Conclusion

401k is among the best plans for retirement savings. While you keep contributing, there are times when you see drastic downturns in the wake of the coronavirus pandemic. This can make you worry about the state of your investments. Instead of withdrawing money, ride out the downturn and wait for the upswing.