- PayPal is seeing growing demand for its digital payment services. The company has been a beneficiary of the pandemic. Digital payments uptake has increased as people try to reduce cash handling to avoid contracting or spreading the coronavirus. More people have also turned to shop online, which is fueling demand for PayPal’s digital payment and financial solutions.

- PayPal has decided it will no longer hold itself back from the bitcoin boom. The company has moved to catch up with its fintech rival Square is launching a bitcoin trading service. PayPal is going even more in-depth with a plan to let its users pay with bitcoin and other popular cryptocurrencies. At the same time, PayPal is investing in promising cryptocurrency and blockchain startups.

- PayPal is among the hot tech stocks of all time. That presents a challenge for those looking for a good entry point into PayPal stock. But now, you have a chance to enter PayPal at a discount. Some investors pulled out money from the stock market for the holiday spending, and that has left stocks like PayPal looking fairly-priced right now.

PayPal: the company and its products

PayPal is a technology company headquartered in Palo Alto, California. The company’s business is primarily built around providing digital payment services. It serves both merchant and consumer markets. More than 28 million merchants around the world currently use PayPal services to accept digital payments. Consumers use PayPal services to pay for purchases and send money. The company also sells payment card readers to small businesses through its iZettle subsidiary. It also offers a credit facility to small businesses.

Besides its flagship namesake business, PayPal’s other major products are Venmo, Xoom, and Honey. People use Venmo to pay for purchases and make peer-to-peer money transfer. Xoom provides international money transfer while Honey helps online shoppers discover discount opportunities to save money on purchases.

PayPal started in 1998. It first went public in 2002 but later sold itself to eBay. It separated from eBay and went public again in 2015.

Why invest in PayPal?

PayPal is one of the world’s leading providers of digital payments. People turn to digital payment options in the pandemic to avoid contracting or spreading the coronavirus through cash handling. PayPal has described cash as its greatest competitor, so the shift away from cash should be good for its business. Once people turn their back to cash, it will be hard for them to return to cash as their primary payment method.

Moreover, the pandemic has accelerated eCommerce uptake as people try to avoid crowding at local stores that could expose them to the virus. The shift to online shopping is, in turn, fueling demand for digital payment services. The global digital payments market is on track to reach $8.1 trillion in volume by 2023 from $3.9 trillion in 2019.

PayPal’s Venmo app continues to record strong growth. Venmo transaction volume surged 61% to $44 billion in Q3. PayPal CEO Dan Schulman has described Venmo as the company’s crown jewel. PayPal continues to find new ways to monetize Venmo. PayPal’s Xoom provides a global money remittance service, an industry currently valued at $683 billion and is on track to reach $930 billion by 2026.

PayPal recently launched a cryptocurrency service. The service lets people trade and invests in bitcoin and other cryptocurrencies right within their PayPal account. In the future, PayPal wants to let people use cryptocurrency to pay for purchases at its more than 28 million global merchants.

Additionally, PayPal wants to continue investing in cryptocurrency and blockchain technology. It has invested in TRM Labs, a company that helps financial institutions protect against cryptocurrency fraud and financial crimes. It has also invested in Cambridge Blockchain, a company that provides blockchain-based identity management and compliance software.

PayPal boasts solid fundamentals

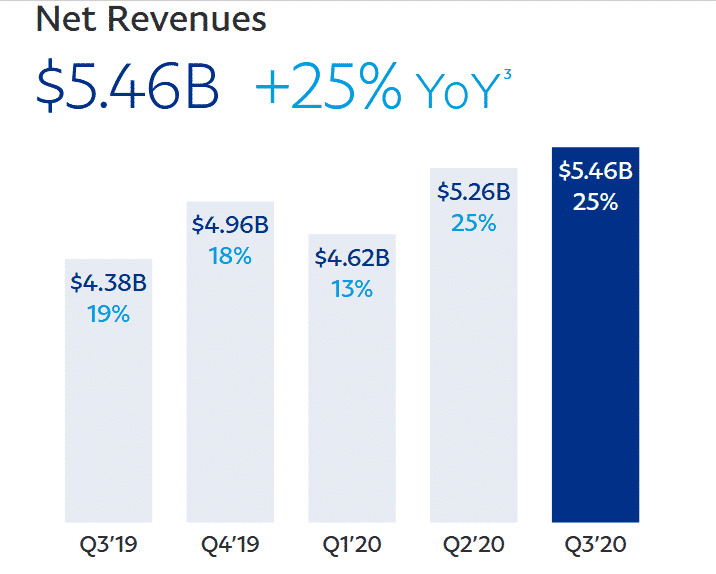

PayPal delivered strong Q3 earnings. Adjusted EPS of $1.07 rose 41% year-over-year and topped consensus estimate at $0.94. Revenue of $5.5 billion jumped 25% YoY and beat consensus estimate at $5.4 billion.

The company expects to continue delivering impressive results. It forecasts Q4 revenue to grow by up to 25% YoY. It expects adjusted EPS to increase by up to 18% in Q4. For full-year 2020, PayPal forecasts revenue growth of up to 21% and adjusted EPS growth of up to 28%.

The second stimulus package that includes $600 direct payment should be a boon for PayPal. It should increase both merchant and consumer use of PayPal services, which would make the company more money.

PayPal also boasts a strong balance sheet. The company finished Q3 with $17.6 billion in cash against total debt of $8.9 billion.

What technicals say about PayPal stock

There is no doubt that PayPal has strong fundamentals. But smart investors look for good entry points into a stock, and technical analysis helps with that. PayPal stock chart tells an interesting story. The stock started 2020 on a strong note. But then the coronavirus outbreak came. The stock crashed from its $125 high in February to $80 lows in March. The selloff subsided as investors started to realize that the pandemic was generating more business for PayPal as merchants and consumers turned to digital payment solutions.

PayPal stock then started rising steadily, hitting $180 in July before topping $200 in August. In September, some investors decided it was time to take the profit. The selling pulled the stock down to about $175. But some investors saw the pullback as a buying opportunity and quickly sent PayPal stock soaring past $210 in October.

A brief selling took place in November that pulled the stock down to the $170 range. The stock has generally been rising since, with some brief profit-taking episodes along the way.

Looking at the key technical indicators, PayPal stock looks richly-priced right now. If you are looking for a good entry point into PayPal stock, you may have to be a little patient for an excellent opening to arise.

Conclusion

Many catalysts could send PayPal stock higher than the current level of $231. We recommend BUY on the pullback.