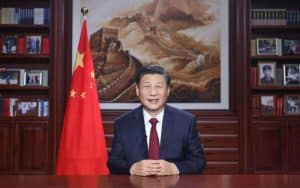

China stocks hitting 5-month lows followed by news of potential no-deal Brexit. Rolls-Royce retained its 2021 guidance. Nio issuing 60 million shares and Disney announcements of Disney+ offerings. What were Friday’s top market news?

Global Insights

China’s blue-chip CSI300 index traded 1.3% lower to 4,875.26 points and could fall further by more than 3.7%, the biggest weekly decline since July. EU commission chief hinted at a no-deal Brexit sending Britain stocks and pound down.

S&P 500 3,639.00 -0.59%

NASDAQ 12,298.00 -0.83%

DJIA 29,880.00 -0.11%

FTSE 6,546.75 -0.80%

DAX 13,104.50 -1.49%

NIKKEI 25,510 -0.66%

HSI 26,505.87 +0.36%

SHANGHAI 3,347.19 -0.77%

VIX 24.10 +6.99%

WTI Oil 46.47 -0.68%

Nat Gas 2.5810 +1.10%

GOLD 1844.20 +0.37%

US Dollar Index 90.99 +0.18%

U.S. 10 Treasury Yield +0.92%

Corporate Stories

Rolls-Royce has maintained its guidance to turn cash flow positive during the second half of 2021 but warned of a challenging outlook.

Nio’s stock fell 5.55% to trade at $42.71 in premarket on Friday after it announced on Thursday evening an offering of 60 million ADSs of Class A ordinary shares.

Disney announced impressive Disney+ offerings and boosted subscriber numbers to between 230 million and 260 million by 2024. The company plans to increase costs of service by $1 to $7.99

Market Sentiment

The market was bearish on Friday. Oil cooled on previous gains to trade lower. Gold strengthened on risk sentiment as VIX gained. The dollar recovered some losses to trade slightly higher.