Waiting Night uses a combination of approaches that includes night scalping for flexible customization and successful results. The FX robot is fully automated and you can make changes to the ATS as per your trading preferences. It works on 12 major currency pairs which can be worked on from a single chart. The ATS is compatible with the MT4 and MT5 terminals.

This FX EA cost $319. A free demo is part of the pricing package. The author does not provide further details on the features you get with the product. According to the author, a 20% discount is present until June 12, 2022, after which the price will be $449 and the final price will be $2000. No money-back guarantee is present for the product making us doubt its reliability. Further, when compared to the market average, we find the pricing is expensive.

Waiting Night trading strategy

According to the author, the FX EA is a night scalper that uses a combination of a proprietary indicator, a unique position tracking system, and price action for identifying accurate trades. The author mentions that the risk levels can be adjusted or customized to a specific broker. A total of 5 settings covers all possible optimizations you can do to the parameters. The author provides general trading settings and settings for the risk and the currency limits on the MQL5 site.

Waiting Night features

Some of the main features of the FX robot that make it competitive are:

- The FX EA uses pending orders to reduce the slippage.

- It does not use dangerous strategies such as the Martingale, averaging orders, etc.

- The transactions will be closed in a short span of 3 to 5 hours.

- SL, TP, and a limit on the transaction life are used for every order.

- An integrated volatility filter is present for each currency pair.

- No news filters are present.

- Risk settings can be changed to limit the frequency of transactions.

- The FX robot is compliant with FIFO rules.

- A minimum deposit of $100 with a lot size of 0.01 is recommended for all the pairs.

- The trading tool can work on ECN or RAW accounts with a low ping VPS with Night Standby.

Waiting Night backtesting results

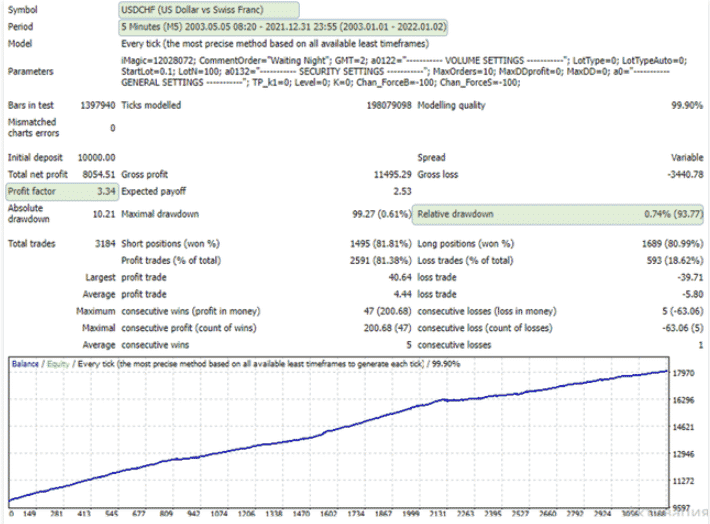

The backtesting result shown above shows the test was done on the USDCHF pair using the M5 timeframe from 2003 to 2021. For an initial deposit of $10,000, the total net profit generated was 8054.51. A total of 3184 trades were completed with profitability of 81.38% and a drawdown of 0.61%. The profit factor was 3.34. From the results, it is clear that the system used a low-risk strategy but the profits were low indicating an average performance.

Waiting Night live trading results

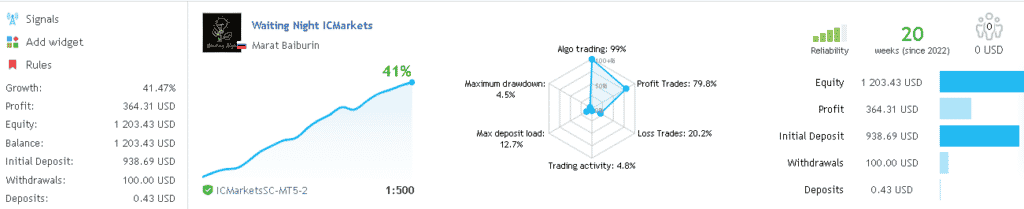

A live signal for the FX EA is present on the MQL5 site. Here is a screenshot of the trading stats:

From the above screenshot, we can see the account was started in January 2022 with an initial deposit of $938.69. A profit of $364 is present showing 41.47% growth with a drawdown of 4.5%. For a total of 183 trades, the profitability is 79.8% and the profit factor is 2.24. Comparing the real trading results with the backtesting, we find the values are lesser in real trading. The comparison indicates that while the profits are low showing a less than average performance, the low drawdown reveals a low-risk approach.

Waiting Night reputation

Marat Baiburin is the author of this FX robot. He is based in Russia and has one year of experience in developing FX trading tools. He has created 3 products and 9 signals. For contact, the author provides an email address, a Skype link, and the messaging option on the MQL5 site. His other products include Lightness and the MT4 version of Waiting Night.

We found 15 reviews for the MT5 version on the MQL5 site with a rating of 4.83. However, we do not consider the reviews as the site promotes the product. Further, we could not find user reviews on reputed third-party sites such as Forexpeacearmy, Trustpilot, etc. to support the user testimonials on the promoter site.

Waiting Night review summary

- Strategy – 4/10

- Functionality & Features – 5/10

- Trading Results – 4/10

- Reliability – 4/10

- Pricing – 4/10

Waiting Night uses a blend of methods for accurate orders and profitable returns. The author provides backtesting results and real trading stats which show a low drawdown indicating a low-risk approach. However, the profits are not high indicating a less than average performance. Other downsides we noticed in the system include the expensive pricing and the absence of a money-back guarantee.