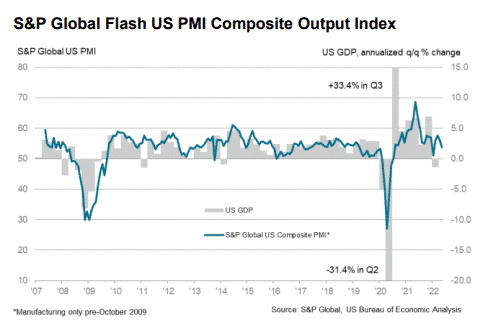

(S&P Global) The Composite Output Index gauging the private sector activity in the US was at 53.8 in May, marking the weakest expansion in four months. The index was April’s 56.0.

The fall in the private sector activity was attributed to weaker demand expansion, inflationary pressures, and elevated lead times. At the reading of 53.8, the index is now below its long-run average of 54.8.

In the service sector, activity hit a 4-month low, with the index at 53.5 in May, from 55.6 in April.

Manufacturing also showed weaknesses, with the output gauge hitting a 3-month low of 55.2, compared to 57.6 in April. The manufacturing PMI was at 57.5, a three-month low, and below 59.2 in April.

Input prices rose in May, with the pace hitting a series high. Output charges increased at the second-fastest in history. Employment gains continued, with the rate of hiring at the fastest rate in thirteen months.

Despite the slowdowns, firms in the US private sector remained upbeat over the coming year. Expectations of sales growth and streamlining of supply chains boosted the confidence.

SPY is down -2.36%, DXY is down -0.27%.