The best time to do anything in a market is when it is most active. This rule applies to the Forex market as well. The most optimal time for it is when the trading spreads are narrow, and liquidity is high. During these times, less money goes into the hands of those who facilitate the trade of currencies, leaving more for those who are actually trading.

In this article, we take a look at which hours are the best for Forex trading, what are the main sessions, and how to leverage them.

Understanding Forex market hours

Many beginners are looking to get in on the action and keep an eye on every economic news, piece of data, and calendar to learn and get ahead, seeing the 24 hours/day and five days/week market as a convenient way of trading throughout the time. But, this can finish off a trader’s reserves in a short time and burn out even the most tenacious traders.

Since Forex runs on the usual business hours of four different corners of the world (and their time zones), one can trade all day and night without having to stay caffeinated and strung out in front of their computer screen. Those traders who can commit the hours of the following four sessions to memory and work out a schedule around them to trade all day and night will have a better chance of making profits.

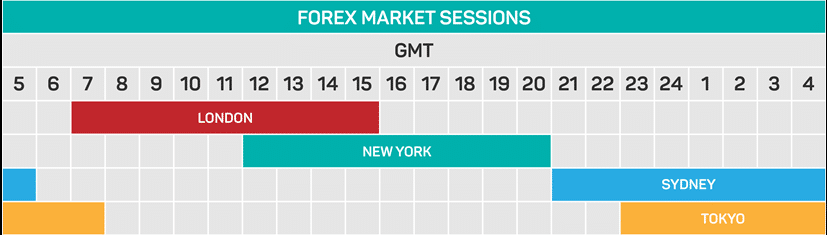

New York

8 a.m. – 5 p.m. This is the second-biggest Forex platform that is watched keenly by investors since USD is involved with almost all the trades (90%). Fluctuations and movements in the New York Stock Exchange (NYSE) will have a sudden and impactful effect on the dollar. Dollar loses and gains value instantly when acquisitions finalize or mergers take place.

London

3 a.m. – noon. The UK is the biggest currency market worldwide, with London being its main hub. Being the trading capital of the world, it makes up about 43% of all trading worldwide. Currency fluctuations are impacted by the Bank of England since it sets the rates and makes up the monetary policy of the GBP. Its headquarters are located in London.

Various Forex trends also find their origins in London, and technical traders should keep an eye on this session. They may be able to use technical data, trends, price movement, and momentum to look for opportunities.

Sydney

5 p.m. – 2 a.m. This is where a trading day usually begins. Even though it is the smallest of the four markets, it does see a lot of action at the start when the markets reopen after Sunday afternoon since financial institutions and traders are looking to get back to trading and winning after a long hiatus after Friday afternoon.

Tokyo

7 p.m. – 4 a.m. This is where the first trading center opens, and it is the hub for most of the Asian trading. The currency pairs that see the most trade during these times are USD/JPY, GBP/CHF, and GBP/JPY. When only the Tokyo session is open, the USD/JPY pair is a good one to keep an eye on since the Bank of Japan has some influence over the market.

Overlaps in Forex trading hours

When two exchanges are open at the same time, and there is an overlap in the trading hours, the number of traders and the buying/selling of currencies increase significantly. The spreads in one exchange will have an impact on all others that are open, thereby limiting spreads and boosting volatility. This is definitely the case in the following overlaps:

- When both London and New York sessions are open (8 a.m. to noon).

- When both Tokyo and Sydney sessions are open (7 p.m. to 2 a.m.).

- When both the Tokyo and London sessions are open (3 a.m. to 4 a.m.).

Risky Forex market hours

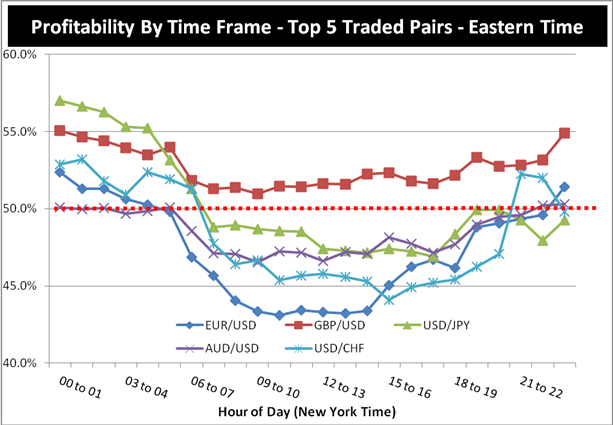

The worst time to trade is in the morning when the prices and volumes fluctuate because of the news releases. Even though a veteran may be able to recognize the patterns and make quick profits, most may end up suffering huge losses. That is why if you’re a beginner, you would want to avoid trading during the first few hours of the morning because of the volatility that the market goes through.

Best Forex trading hours

The best time for traders is from 8 am to noon when there is an overlap between London and New York sessions. Since these two sessions account for more than half of all the trading volume, it is no surprise that this is the ideal time for someone to trade to get the shortest spreads.

It must be kept in mind that busy trading hours don’t necessarily equate to profits. This is because trades often involve huge leverage rates of 1000 to 1. Even though the opportunities to make a profit can be extremely lucrative, there is a significant risk of losing your entire investment if you’re not careful on a single trade.

The Bottom Line

Market overlaps can provide huge opportunities for traders to cash in on the high volatility of the market and the exchange of major currency pairs. Those looking to get in on the action and get a piece of the Forex pie should look to trade during the periods that are considered more volatile than the rest while keeping track of the news releases.

Even though it may be risky for amateurs to do so and find themselves in the midst of increasing fluctuations, veterans shouldn’t have much of a problem figuring out the patterns. Traders who want to trade throughout the day and way into the night for the full five days of the week should memorize the different trading session hours to make the most of the time and opportunities they have.